Renewal Form - Pend Oreille County

ADVERTISEMENT

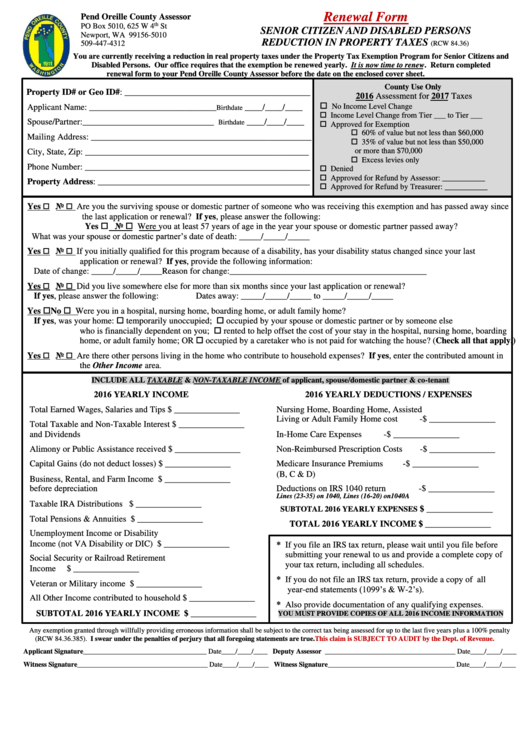

Renewal Form

Pend Oreille County Assessor

th

PO Box 5010, 625 W 4

St

SENIOR CITIZEN AND DISABLED PERSONS

Newport, WA 99156-5010

REDUCTION IN PROPERTY TAXES

509-447-4312

(RCW 84.36)

You are currently receiving a reduction in real property taxes under the Property Tax Exemption Program for Senior Citizens and

Disabled Persons. Our office requires that the exemption be renewed yearly. It is now time to renew. Return completed

renewal form to your Pend Oreille County Assessor before the date on the enclosed cover sheet.

County Use Only

Property ID# or Geo ID#: __________________________________________

2016 Assessment for 2017 Taxes

No Income Level Change

Applicant Name: _____________________________

____/____/____

Birthdate

Income Level Change from Tier ___ to Tier ___

Spouse/Partner:______________________________

____/____/____

Approved for Exemption

Birthdate

60% of value but not less than $60,000

Mailing Address: __________________________________________________

35% of value but not less than $50,000

or more than $70,000

City, State, Zip: ___________________________________________________

Excess levies only

Phone Number: ___________________________________________________

Denied

Approved for Refund by Assessor: ___________

Property Address: ________________________________________________

Approved for Refund by Treasurer: ___________

Yes

No

Are you the surviving spouse or domestic partner of someone who was receiving this exemption and has passed away since

the last application or renewal? If yes, please answer the following:

Yes No Were you at least 57 years of age in the year your spouse or domestic partner passed away?

What was your spouse or domestic partner’s date of death: _____/_____/_____

Yes

No

If you initially qualified for this program because of a disability, has your disability status changed since your last

application or renewal? If yes, provide the following information:

Date of change: _____/_____/_____ Reason for change:_____________________________________________

Yes

No

Did you live somewhere else for more than six months since your last application or renewal?

If yes, please answer the following:

Dates away: _____/_____/_____ to _____/_____/_____

Yes No Were you in a hospital, nursing home, boarding home, or adult family home?

If yes, was your home: temporarily unoccupied; occupied by your spouse or domestic partner or by someone else

who is financially dependent on you; rented to help offset the cost of your stay in the hospital, nursing home, boarding

home, or adult family home; OR occupied by a caretaker who is not paid for watching the house? (Check all that apply.)

Yes

No

Are there other persons living in the home who contribute to household expenses? If yes, enter the contributed amount in

the Other Income area

.

INCLUDE ALL TAXABLE & NON-TAXABLE INCOME of applicant, spouse/domestic partner & co-tenant

2016 YEARLY INCOME

2016 YEARLY DEDUCTIONS / EXPENSES

Total Earned Wages, Salaries and Tips

$ _______________

Nursing Home, Boarding Home, Assisted

Living or Adult Family Home cost

-$ _______________

Total Taxable and Non-Taxable Interest

$ _______________

and Dividends

In-Home Care Expenses

-$ _______________

Alimony or Public Assistance received

$ _______________

Non-Reimbursed Prescription Costs

-$ _______________

Capital Gains (do not deduct losses)

$ _______________

Medicare Insurance Premiums

-$ _______________

(B, C & D)

Business, Rental, and Farm Income

$ _______________

before depreciation

Deductions on IRS 1040 return

-$ _______________

Lines (23-35) on 1040, Lines (16-20) on 1040A

Taxable IRA Distributions

$ _______________

$ _______________

SUBTOTAL 2016 YEARLY EXPENSES

Total Pensions & Annuities

$ _______________

TOTAL 2016 YEARLY INCOME $ _______________

Unemployment Income or Disability

Income (not VA Disability or DIC)

$ _______________

* If you file an IRS tax return, please wait until you file before

submitting your renewal to us and provide a complete copy of

Social Security or Railroad Retirement

your tax return, including all schedules.

Income

$ _______________

* If you do not file an IRS tax return, provide a copy of all

Veteran or Military income

$ _______________

year-end statements (1099’s & W-2’s).

All Other Income contributed to household $ _______________

* Also provide documentation of any qualifying expenses.

SUBTOTAL 2016 YEARLY INCOME $ _______________

YOU MUST PROVIDE COPIES OF ALL 2016 INCOME INFORMATION

Any exemption granted through willfully providing erroneous information shall be subject to the correct tax being assessed for up to the last five years plus a 100% penalty

(RCW 84.36.385). I swear under the penalties of perjury that all foregoing statements are true.

This claim is SUBJECT TO AUDIT by the Dept. of Revenue.

Applicant Signature___________________________________ Date____/____/____ Deputy Assessor _____________________________________ Date____/____/____

Witness Signature_____________________________________ Date____/____/____ Witness Signature____________________________________ Date____/____/____

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2