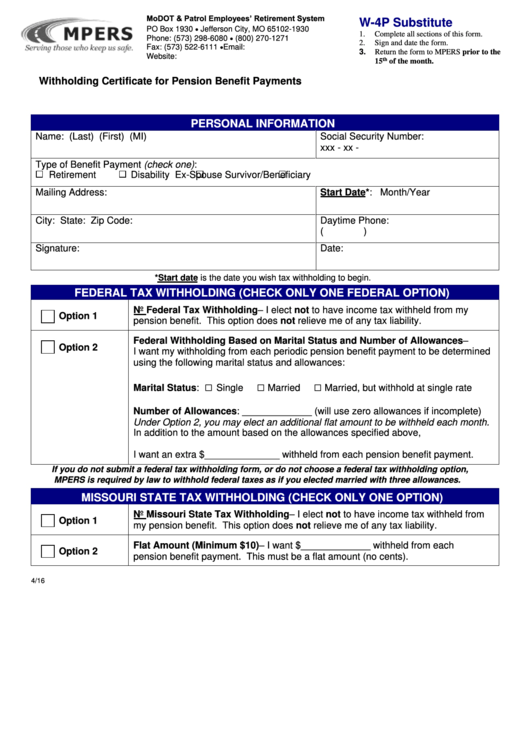

MoDOT & Patrol Employees’ Retirement System

W-4P Substitute

PO Box 1930

Jefferson City, MO 65102-1930

1.

Complete all sections of this form.

Phone: (573) 298-6080

(800) 270-1271

2.

Sign and date the form.

Fax: (573) 522-6111

Email:

3.

Return the form to MPERS prior to the

Website:

th

15

of the month.

Withholding Certificate for Pension Benefit Payments

PERSONAL INFORMATION

Name:

(Last)

(First)

(MI)

Social Security Number:

xxx - xx -

Type of Benefit Payment (check one):

Retirement

Disability

Ex-Spouse

Survivor/Beneficiary

Mailing Address:

Start Date*: Month/Year

City:

State:

Zip Code:

Daytime Phone:

(

)

Signature:

Date:

*Start date is the date you wish tax withholding to begin.

FEDERAL TAX WITHHOLDING (CHECK ONLY ONE FEDERAL OPTION)

No Federal Tax Withholding – I elect not to have income tax withheld from my

Option 1

pension benefit. This option does not relieve me of any tax liability.

Federal Withholding Based on Marital Status and Number of Allowances –

Option 2

I want my withholding from each periodic pension benefit payment to be determined

using the following marital status and allowances:

□

□

□

Marital Status:

Single

Married

Married, but withhold at single rate

Number of Allowances: _____________ (will use zero allowances if incomplete)

Under Option 2, you may elect an additional flat amount to be withheld each month.

In addition to the amount based on the allowances specified above,

I want an extra $______________ withheld from each pension benefit payment.

If you do not submit a federal tax withholding form, or do not choose a federal tax withholding option,

MPERS is required by law to withhold federal taxes as if you elected married with three allowances.

MISSOURI STATE TAX WITHHOLDING (CHECK ONLY ONE OPTION)

No Missouri State Tax Withholding – I elect not to have income tax withheld from

Option 1

my pension benefit. This option does not relieve me of any tax liability.

Flat Amount (Minimum $10) – I want $_____________ withheld from each

Option 2

pension benefit payment. This must be a flat amount (no cents).

4/16

1

1