Print

Clear

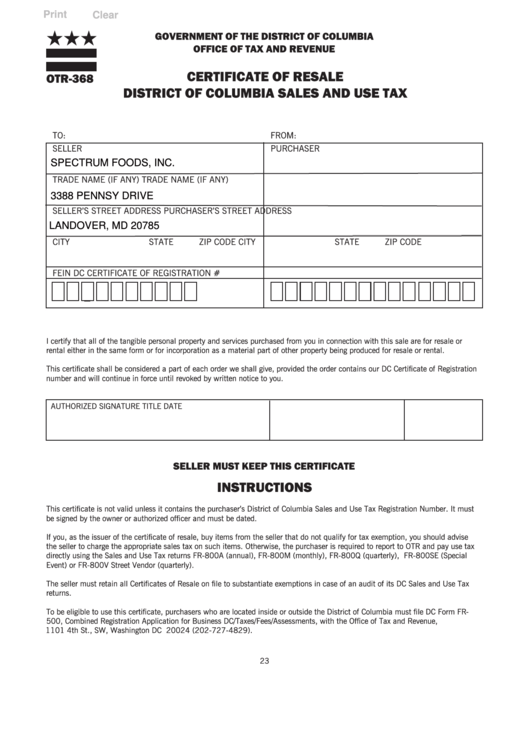

★★★

GOVERNMENT OF THE DISTRICT OF COLUMBIA

OFFICE OF TAX AND REVENUE

CERTIFICATE OF RESALE

OTR-368

DISTRICT OF COLUMBIA SALES AND USE TAX

TO:

FROM:

SELLER

PURCHASER

SPECTRUM FOODS, INC.

TRADE NAME (IF ANY)

TRADE NAME (IF ANY)

3388 PENNSY DRIVE

SELLER’S STREET ADDRESS

PURCHASER’S STREET ADDRESS

LANDOVER, MD 20785

CITY

STATE

ZIP CODE

CITY

STATE

ZIP CODE

FEIN

DC CERTIFICATE OF REGISTRATION #

–

I certify that all of the tangible personal property and services purchased from you in connection with this sale are for resale or

rental either in the same form or for incorporation as a material part of other property being produced for resale or rental.

This certificate shall be considered a part of each order we shall give, provided the order contains our DC Certificate of Registration

number and will continue in force until revoked by written notice to you.

AUTHORIZED SIGNATURE

TITLE

DATE

SELLER MUST KEEP THIS CERTIFICATE

INSTRUCTIONS

This certificate is not valid unless it contains the purchaser’s District of Columbia Sales and Use Tax Registration Number. It must

be signed by the owner or authorized officer and must be dated.

If you, as the issuer of the certificate of resale, buy items from the seller that do not qualify for tax exemption, you should advise

the seller to charge the appropriate sales tax on such items. Otherwise, the purchaser is required to report to OTR and pay use tax

directly using the Sales and Use Tax returns FR-800A (annual), FR-800M (monthly), FR-800Q (quarterly), FR-800SE (Special

Event) or FR-800V Street Vendor (quarterly).

The seller must retain all Certificates of Resale on file to substantiate exemptions in case of an audit of its DC Sales and Use Tax

returns.

To be eligible to use this certificate, purchasers who are located inside or outside the District of Columbia must file DC Form FR-

500, Combined Registration Application for Business DC/Taxes/Fees/Assessments, with the Office of Tax and Revenue,

1101 4th St., SW, Washington DC 20024 (202-727-4829).

23

1

1