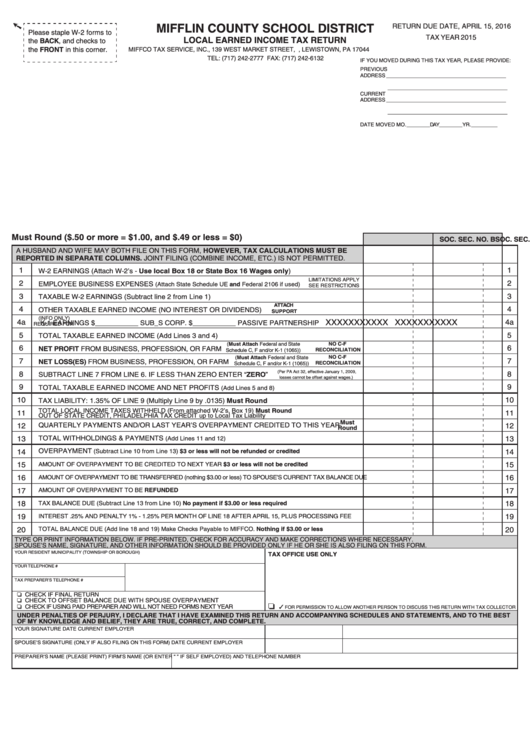

Local Earned Income Tax Return - Mifflin County School District - 2015

ADVERTISEMENT

MIFFLIN COUNTY SCHOOL DISTRICT

RETURN DUE DATE, APRIL 15, 2016

Please staple W-2 forms to

TAX YEAR 2015

LOCAL EARNED INCOME TAX RETURN

the BACK, and checks to

the FRONT in this corner.

MIFFCO TAX SERVICE, INC., 139 WEST MARKET STREET, P.O. BOX 746, LEWISTOWN, PA 17044

TEL: (717) 242-2777 FAX: (717) 242-6132

IF YOU MOVED DURING THIS TAX YEAR, PLEASE PROVIDE:

PREVIOUS

ADDRESS _________________________________________

_________________________________________

CURRENT

ADDRESS _________________________________________

_________________________________________

DATE MOVED

MO. ________ DAY ________YR. _________

Must Round ($.50 or more = $1.00, and $.49 or less = $0)

SOC. SEC. NO. A

SOC. SEC. NO. B

A HUSBAND AND WIFE MAY BOTH FILE ON THIS FORM, HOWEVER, TAX CALCULATIONS MUST BE

REPORTED IN SEPARATE COLUMNS. JOINT FILING (COMBINE INCOME, ETC.) IS NOT PERMITTED.

_________________________________________________________________________________________________________

1

1

W-2 EARNINGS (Attach W-2’s - Use local Box 18 or State Box 16 Wages only)

_________________________________________________________________________________________________________

LIMITATIONS APPLY

2

2

EMPLOYEE BUSINESS EXPENSES

_________________________________________________________________________________________________________

(Attach State Schedule UE and Federal 2106 if used)

SEE RESTRICTIONS

3

3

TAXABLE W-2 EARNINGS (Subtract line 2 from Line 1)

_________________________________________________________________________________________________________

ATTACH

4

4

OTHER TAXABLE EARNED INCOME (NO INTEREST OR DIVIDENDS)

_________________________________________________________________________________________________________

SUPPORT

(INFO ONLY)

XXXXXXXXXXX XXXXXXXXXXX

4a

4a

K-1 EARNINGS $___________ SUB_S CORP. $___________ PASSIVE PARTNERSHIP

_________________________________________________________________________________________________________

REQUIRED FOR

5

5

TOTAL TAXABLE EARNED INCOME (Add Lines 3 and 4)

_________________________________________________________________________________________________________

(Must Attach Federal and State

NO C-F

6

6

NET PROFIT FROM BUSINESS, PROFESSION, OR FARM

_________________________________________________________________________________________________________

RECONCILIATION

Schedule C, F and/or K-1 (1065))

NO C-F

(Must Attach Federal and State

7

7

NET LOSS(ES) FROM BUSINESS, PROFESSION, OR FARM

_________________________________________________________________________________________________________

RECONCILIATION

Schedule C, F and/or K-1 (1065))

(Per PA Act 32, effective January 1, 2009,

8

8

SUBTRACT LINE 7 FROM LINE 6. IF LESS THAN ZERO ENTER “ZERO”

_________________________________________________________________________________________________________

losses cannot be offset against wages.)

9

9

TOTAL TAXABLE EARNED INCOME AND NET PROFITS

_________________________________________________________________________________________________________

(Add Lines 5 and 8)

10

10

TAX LIABILITY: 1.35% OF LINE 9 (Multiply Line 9 by .0135) Must Round

_________________________________________________________________________________________________________

TOTAL LOCAL INCOME TAXES WITHHELD (From attached W-2’s, Box 19) Must Round

11

11

_________________________________________________________________________________________________________

OUT OF STATE CREDIT, PHILADELPHIA TAX CREDIT up to Local Tax Liability

Must

QUARTERLY PAYMENTS AND/OR LAST YEAR’S OVERPAYMENT CREDITED TO THIS YEAR

12

12

_________________________________________________________________________________________________________

Round

TOTAL WITHHOLDINGS & PAYMENTS

13

(Add Lines 11 and 12)

13

_________________________________________________________________________________________________________

14

OVERPAYMENT

14

(Subtract Line 10 from Line 13) $3 or less will not be refunded or credited

_________________________________________________________________________________________________________

15

15

AMOUNT OF OVERPAYMENT TO BE CREDITED TO NEXT YEAR $3 or less will not be credited

_________________________________________________________________________________________________________

16

16

AMOUNT OF OVERPAYMENT TO BE TRANSFERRED (nothing $3.00 or less) TO SPOUSE’S CURRENT TAX BALANCE DUE

_________________________________________________________________________________________________________

17

AMOUNT OF OVERPAYMENT TO BE REFUNDED

17

_________________________________________________________________________________________________________

18

TAX BALANCE DUE (Subtract Line 13 from Line 10) No payment if $3.00 or less required

18

_________________________________________________________________________________________________________

19

19

INTEREST .25% AND PENALTY 1% - 1.25% PER MONTH OF LINE 18 AFTER APRIL 15, PLUS PROCESSING FEE

_________________________________________________________________________________________________________

20

TOTAL BALANCE DUE (Add line 18 and 19) Make Checks Payable to MIFFCO. Nothing if $3.00 or less

20

_________________________________________________________________________________________________________

TYPE OR PRINT INFORMATION BELOW. IF PRE-PRINTED, CHECK FOR ACCURACY AND MAKE CORRECTIONS WHERE NECESSARY.

_________________________________________________________________________________________________________

SPOUSE’S NAME, SIGNATURE, AND OTHER INFORMATION SHOULD BE PROVIDED ONLY IF HE OR SHE IS ALSO FILING ON THIS FORM.

YOUR RESIDENT MUNICIPALITY (TOWNSHIP OR BOROUGH)

TAX OFFICE USE ONLY

YOUR TELEPHONE #

TAX PREPARER’S TELEPHONE #

❏ CHECK IF FINAL RETURN

❏ CHECK TO OFFSET BALANCE DUE WITH SPOUSE OVERPAYMENT

❏

❏ CHECK IF USING PAID PREPARER AND WILL NOT NEED FORMS NEXT YEAR

✓ FOR PERMISSION TO ALLOW ANOTHER PERSON TO DISCUSS THIS RETURN WITH TAX COLLECTOR

UNDER PENALTIES OF PERJURY, I DECLARE THAT I HAVE EXAMINED THIS RETURN AND ACCOMPANYING SCHEDULES AND STATEMENTS, AND TO THE BEST

OF MY KNOWLEDGE AND BELIEF, THEY ARE TRUE, CORRECT, AND COMPLETE.

YOUR SIGNATURE

DATE

CURRENT EMPLOYER

SPOUSE’S SIGNATURE (ONLY IF ALSO FILING ON THIS FORM)

DATE

CURRENT EMPLOYER

PREPARER’S NAME (PLEASE PRINT)

FIRM’S NAME (OR ENTER “S.E.” IF SELF EMPLOYED) AND TELEPHONE NUMBER

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2