Dol-Owcp Forms - Postal Reporter

Download a blank fillable Dol-Owcp Forms - Postal Reporter in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Dol-Owcp Forms - Postal Reporter with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

Reset

Print

U.S. Department of Labor

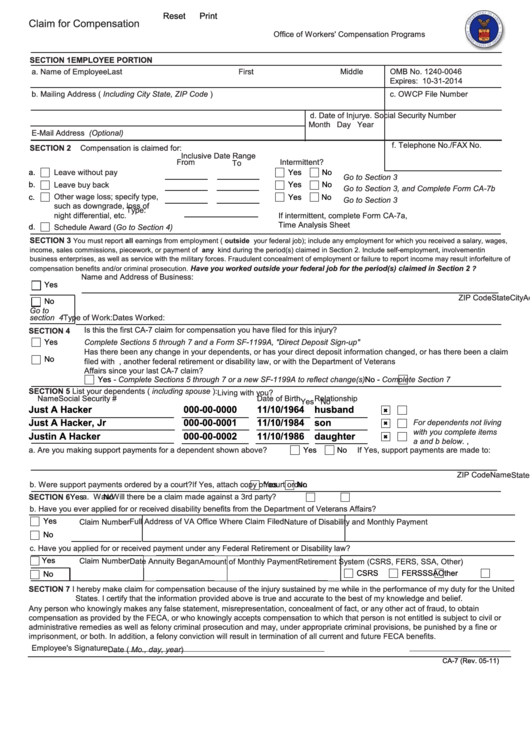

Claim for Compensation

Office of Workers' Compensation Programs

SECTION 1

EMPLOYEE PORTION

a. Name of Employee

Last

First

Middle

OMB No. 1240-0046

Expires: 10-31-2014

b. Mailing Address ( Including City State, ZIP Code )

c. OWCP File Number

d. Date of Injury

e. Social Security Number

Month Day Year

E-Mail Address (Optional)

f. Telephone No./FAX No.

SECTION 2

Compensation is claimed for:

Inclusive Date Range

From

Intermittent?

To

a.

Leave without pay

Yes

No

Go to Section 3

b.

Leave buy back

Yes

No

Go to Section 3, and Complete Form CA-7b

c.

Other wage loss; specify type,

Yes

No

Go to Section 3

such as downgrade, loss of

Type:

night differential, etc.

If intermittent, complete Form CA-7a,

Time Analysis Sheet

d.

Schedule Award (Go to Section 4)

SECTION 3

You must report all earnings from employment ( outside your federal job); include any employment for which you received a salary, wages,

income, sales commissions, piecework, or payment of any kind during the period(s) claimed in Section 2. Include self-employment, involvement in

business enterprises, as well as service with the military forces. Fraudulent concealment of employment or failure to report income may result in forfeiture of

Have you worked outside your federal job for the period(s) claimed in Section 2

compensation benefits and/or criminal prosecution.

?

Name and Address of Business:

Yes

Name

Address

City

State

ZIP Code

No

Go to

section 4

Dates Worked:

Type of Work:

Is this the first CA-7 claim for compensation you have filed for this injury?

SECTION 4

Yes

Complete Sections 5 through 7 and a Form SF-1199A, "Direct Deposit Sign-up"

Has there been any change in your dependents, or has your direct deposit information changed, or has there been a claim

No

filed with U.S. Civil Service Retirement, another federal retirement or disability law, or with the Department of Veterans

Affairs since your last CA-7 claim?

Yes

- Complete Sections 5 through 7 or a new SF-1199A to reflect change(s)

No -

Complete Section 7

SECTION 5 List your dependents ( including spouse ):

Living with you?

Name

Social Security #

Date of Birth

Relationship

Yes No

Just A Hacker

000-00-0000

11/10/1964

husband

Just A Hacker, Jr

000-00-0001

11/10/1984

son

For dependents not living

with you complete items

Justin A Hacker

000-00-0002

11/10/1986

daughter

a and b below. ,

a. Are you making support payments for a dependent shown above?

Yes

No

If Yes, support payments are made to:

Name

ZIP Code

Address

City

State

b. Were support payments ordered by a court?

Yes

No

If Yes, attach copy of court order.

a. Was/Will there be a claim made against a 3rd party?

Yes

No

SECTION 6

b. Have you ever applied for or received disability benefits from the Department of Veterans Affairs?

Yes

Full Address of VA Office Where Claim Filed

Nature of Disability and Monthly Payment

Claim Number

No

c. Have you applied for or received payment under any Federal Retirement or Disability law?

Yes

Claim Number

Date Annuity Began

Amount of Monthly Payment

Retirement System (CSRS, FERS, SSA, Other)

CSRS

FERS

SSA

Other

No

SECTION 7 I hereby make claim for compensation because of the injury sustained by me while in the performance of my duty for the United

States. I certify that the information provided above is true and accurate to the best of my knowledge and belief.

Any person who knowingly makes any false statement, misrepresentation, concealment of fact, or any other act of fraud, to obtain

compensation as provided by the FECA, or who knowingly accepts compensation to which that person is not entitled is subject to civil or

administrative remedies as well as felony criminal prosecution and may, under appropriate criminal provisions, be punished by a fine or

imprisonment, or both. In addition, a felony conviction will result in termination of all current and future FECA benefits.

Employee's Signature

Date ( Mo., day, year)

CA-7 (Rev. 05-11)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4