Reasonable Tangible Net Benefit

ADVERTISEMENT

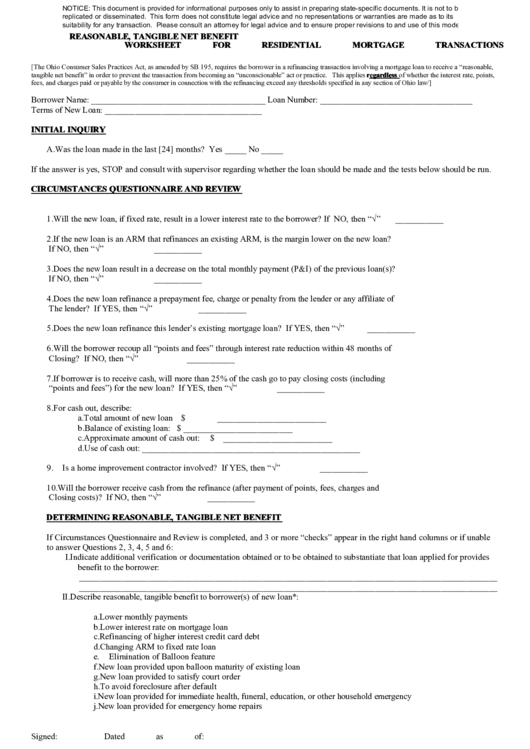

NOTICE: This document is provided for informational purposes only to assist in preparing state-specific documents. It is not to be

replicated or disseminated. This form does not constitute legal advice and no representations or warranties are made as to its

suitability for any transaction. Please consult an attorney for legal advice and to ensure proper revisions to and use of this model.

REASONABLE, TANGIBLE NET BENEFIT

WORKSHEET FOR RESIDENTIAL MORTGAGE TRANSACTIONS

[The Ohio Consumer Sales Practices Act, as amended by SB 195, requires the borrower in a refinancing transaction involving a mortgage loan to receive a “reasonable,

tangible net benefit” in order to prevent the transaction from becoming an “unconscionable” act or practice. This applies regardless of whether the interest rate, points,

fees, and charges paid or payable by the consumer in connection with the refinancing exceed any thresholds specified in any section of Ohio law/]

Borrower Name: ________________________________________

Loan Number: ___________________________________

Terms of New Loan: ____________________________________

INITIAL INQUIRY

A. Was the loan made in the last [24] months? Yes _____ No _____

If the answer is yes, STOP and consult with supervisor regarding whether the loan should be made and the tests below should be run.

CIRCUMSTANCES QUESTIONNAIRE AND REVIEW

1. Will the new loan, if fixed rate, result in a lower interest rate to the borrower? If NO, then “√”

___________

2. If the new loan is an ARM that refinances an existing ARM, is the margin lower on the new loan?

If NO, then “√”

___________

3. Does the new loan result in a decrease on the total monthly payment (P&I) of the previous loan(s)?

If NO, then “√”

___________

4. Does the new loan refinance a prepayment fee, charge or penalty from the lender or any affiliate of

The lender? If YES, then “√”

___________

5. Does the new loan refinance this lender’s existing mortgage loan? If YES, then “√”

___________

6. Will the borrower recoup all “points and fees” through interest rate reduction within 48 months of

Closing? If NO, then “√”

___________

7. If borrower is to receive cash, will more than 25% of the cash go to pay closing costs (including

“points and fees”) for the new loan? If YES, then “√”

___________

8. For cash out, describe:

a.

Total amount of new loan

$ _________________________

b. Balance of existing loan:

$ _________________________

c.

Approximate amount of cash out:

$ _________________________

d. Use of cash out: __________________________________________________

9. Is a home improvement contractor involved? If YES, then “√”

___________

10. Will the borrower receive cash from the refinance (after payment of points, fees, charges and

Closing costs)? If NO, then “√”

___________

DETERMINING REASONABLE, TANGIBLE NET BENEFIT

If Circumstances Questionnaire and Review is completed, and 3 or more “checks” appear in the right hand columns or if unable

to answer Questions 2, 3, 4, 5 and 6:

I. Indicate additional verification or documentation obtained or to be obtained to substantiate that loan applied for provides

benefit to the borrower:

________________________________________________________________________________________________

________________________________________________________________________________________________

II. Describe reasonable, tangible benefit to borrower(s) of new loan*:

a.

Lower monthly payments

b. Lower interest rate on mortgage loan

c.

Refinancing of higher interest credit card debt

d. Changing ARM to fixed rate loan

e.

Elimination of Balloon feature

f.

New loan provided upon balloon maturity of existing loan

g. New loan provided to satisfy court order

h. To avoid foreclosure after default

i.

New loan provided for immediate health, funeral, education, or other household emergency

j.

New loan provided for emergency home repairs

Signed:

Dated as of:

_____________________________________________

________________________________________________

[Lender Underwriter]

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1