Instructions

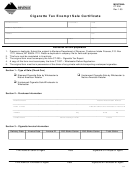

Who May Issue a Resale Certificate. Form 13, Section A, is

their agent, who fraudulently signs a Form 13 may be found guilty

issued by persons or organizations making purchases of property or

of a Class IV misdemeanor.

taxable services that will subsequently be resold in the purchaser’s

Categories of Exemption

normal course of business. The property or services must be resold

1. Governmental agencies identified in

Reg-1-012,

Exemptions;

in the same form or condition as when purchased, or as an ingredient

Reg-1-072, United States Government and Federal

Corporations;

or component part of other property that will be resold.

and

Reg-1-093, Governmental

Units. Governmental units are not

Who May Issue an Exempt Sale Certificate. Form 13,

assigned exemption numbers.

Section B, may only be issued by governmental units and persons or

Sales to the United States government, its agencies, instru-

organizations that are exempt from paying Nebraska sales and use

mentalities, and corporations wholly owned by the U.S.

tax. Nonprofit organizations that are exempt from paying sales and

government are exempt from sales tax. However, sales to

use tax are listed in the

Nebraska Sales Tax Exemption

Chart.

institutions chartered or created under federal authority, but

Enter the appropriate number from the “Categories of Exemption”

which are not directly operated and controlled by the United

in the space provided that properly reflects the basis for your

States government for the benefit of the public, generally are

exemption. If category 2 through 6 is the basis for exemption, you

taxable. For construction projects for federal agencies, see

must complete the information requested in Section B.

Reg-1-017,

Contractors.

For additional information about proper issuance and use of this

Purchases by governmental units that are not exempt from

certificate, please review

Reg-1-013, Sale for Resale – Resale

Nebraska sales and use taxes include, but are not limited to:

Certificate, and

Reg-1-014, Exempt Sale

Certificate.

governmental units of other states; sanitary and improvement

Contractors. To make tax-exempt purchases of building materials

districts; rural water districts; railroad transportation safety

and fixtures, Option 1 or Option 3 contractors must complete

districts; and county historical or agricultural societies.

Form 13, Section C, Part 1.

2. Purchases when the intended use renders it exempt as stated in

To make tax-exempt purchases of building materials and fixtures

paragraph 012.02D of

Reg-1-012,

Exemptions. See

Nebraska

pursuant to a construction project for an exempt governmental unit or

Sales Tax Exemption

Chart. Complete the description of the item

an exempt nonprofit organization, Option 2 contractors must complete

purchased and the intended use on the front of Form 13.

Form 13, Section C, Part 2. The contractor must also attach a copy of

Beginning October 1, 2014, sales of repair and replacement parts

a properly completed

Purchasing Agent Appointment and Delegation

for agricultural machinery and equipment used in commercial

of Authority for Sales and Use Tax, Form

17, to the Form 13, and

agriculture are exempt from sales and use taxes. When claiming

both documents must be given to the supplier when purchasing

this exemption, please enter “commercial agriculture” on the

building materials. See the

contractor information guides

for

Intended Use of Items Purchased line.

additional information.

3. Purchases made by organizations that have been issued a

When and Where to Issue. The Form 13 must be given to the

Nebraska Exempt Organization Certificate of Exemption.

seller at the time of the purchase to document why sales tax does not

Reg-1-090, Nonprofit

Organizations;

Reg-1-091, Religious

apply to the purchase. The Form 13 must be kept with the seller’s

Organizations; and

Reg-1-092, Educational

Institutions, identify

records for audit purposes (see

Reg-1-012,

Exemptions). Do not

these organizations. These organizations are issued a Nebraska

send Forms 13 to the Nebraska Department of Revenue.

state exemption ID number. This exemption number must be

Sales Tax Number. A purchaser who is engaged in business

entered in Section B of Form 13.

as a wholesaler or manufacturer is not required to provide an

Nonprofit health care organizations that hold a certificate of

ID number when completing Section A. Out-of-state purchasers

exemption are exempt for purchases of items for use at their

may provide their home state sales tax number. Section B does not

facility, or portion of the facility, covered by the license issued

require a Nebraska ID number when exemption category 1, 2, or 5

under the Health Care Facility Licensure Act. Only specific types

is indicated.

of health care facilities and activities are exempt. Purchases

Fully Completed Resale or Exempt Sale Certificate.

of items for use at facilities that are not covered under the

For a resale certificate to be fully completed, it must include:

license, or for any other activities that are not specifically exempt,

(1) identification of the purchaser and seller, type of business

are taxable.

engaged in by the purchaser, and reason for the exemption;

4. Purchases of common or contract carrier motor vehicles, trailers,

(2) sales tax permit number; (3) signature of an authorized person; and

and semitrailers; accessories that physically become part of a

(4) the date of issuance.

common or contract carrier vehicle; and repair and replacement

For an exempt sale certificate to be fully completed, it must include:

parts for these vehicles. The exemption number must be entered

(1) identification of purchaser and seller; (2) a statement that the

in Section B of the Form 13.

certificate is for a single purchase or is a blanket certificate covering

5. Purchases of manufacturing machinery and equipment made by a

future sales; (3) a statement of the basis for exemption, including

person engaged in the business of manufacturing, including repair

the type of activity engaged in by the purchaser; (4) signature of an

and replacement parts or accessories, for use in manufacturing.

authorized person; and (5) the date of issuance.

6. Occasional sales of used business or farm machinery or

Penalties. Any purchaser who gives a Form 13 to a seller for any

equipment productively used by the seller as a depreciable

purchase which is other than for resale, lease, or rental in the normal

capital asset for more than one year in his or her business. The

course of the purchaser’s business, or is not otherwise exempted

seller must have previously paid tax on the item being sold. The

from sales and use tax under the Nebraska Revenue Act, is subject to

seller must complete, sign, and give the exemption certificate to

a penalty of $100 or ten times the tax, whichever is greater, for each

the purchaser.

instance of presentation and misuse. In addition, any purchaser, or

1

1 2

2