Tangible Net Benefit Worksheet Template

ADVERTISEMENT

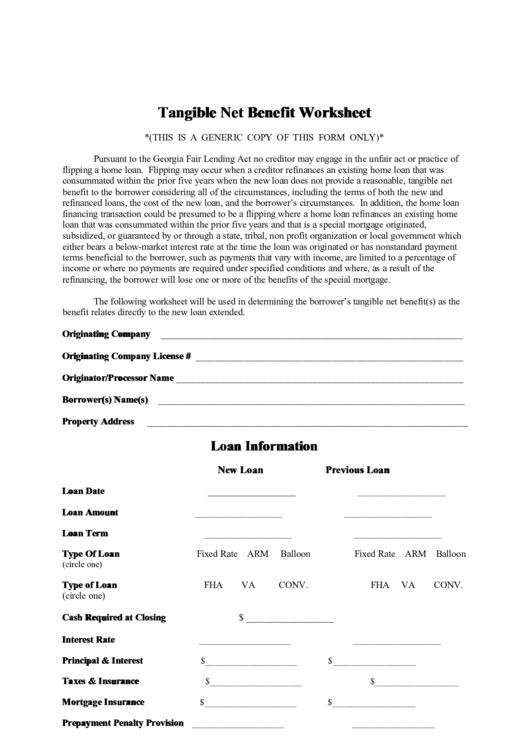

Tangible Net Benefit Worksheet

*(THIS IS A GENERIC COPY OF THIS FORM ONLY)*

Pursuant to the Georgia Fair Lending Act no creditor may engage in the unfair act or practice of

flipping a home loan. Flipping may occur when a creditor refinances an existing home loan that was

consummated within the prior five years when the new loan does not provide a reasonable, tangible net

benefit to the borrower considering all of the circumstances, including the terms of both the new and

refinanced loans, the cost of the new loan, and the borrower’s circumstances. In addition, the home loan

financing transaction could be presumed to be a flipping where a home loan refinances an existing home

loan that was consummated within the prior five years and that is a special mortgage originated,

subsidized, or guaranteed by or through a state, tribal, non profit organization or local government which

either bears a below-market interest rate at the time the loan was originated or has nonstandard payment

terms beneficial to the borrower, such as payments that vary with income, are limited to a percentage of

income or where no payments are required under specified conditions and where, as a result of the

refinancing, the borrower will lose one or more of the benefits of the special mortgage.

The following worksheet will be used in determining the borrower’s tangible net benefit(s) as the

benefit relates directly to the new loan extended.

Originating Company ______________________________________________________________

Originating Company License # _______________________________________________________

Originator/Processor Name ___________________________________________________________

Borrower(s) Name(s) _______________________________________________________________

Property Address

__________________________________________________________________

Loan Information

New Loan

Previous Loan

Loan Date

__________________

____________________

Loan Amount

____________________

____________________

Loan Term

____________________

____________________

Type Of Loan

Fixed Rate ARM

Balloon

Fixed Rate ARM Balloon

(circle one)

Type of Loan

FHA

VA

CONV.

FHA

VA

CONV.

(circle one)

Cash Required at Closing

$ __________________

Interest Rate

_____________________

____________________

Principal & Interest

$_____________________

$___________________

Taxes & Insurance

$_____________________

$___________________

Mortgage Insurance

$_____________________

$___________________

Prepayment Penalty Provision

_____________________

___________________

Special Loan as described above

(circle one)

YES OR NO

Broker/Lender

_______________________

_____________________

Servicer

_____________________

___________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2