Instructions For Completing W-8ben & W-8imy Forms

ADVERTISEMENT

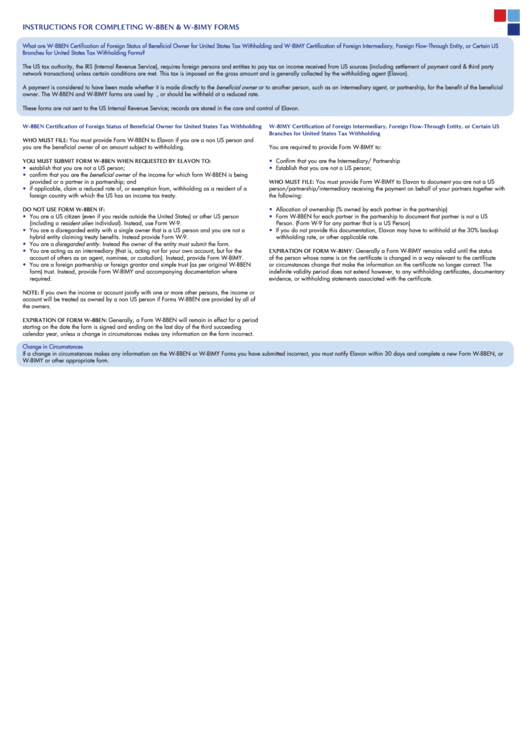

INSTRUCTIONS FOR COMPLETING W-8BEN & W-8IMY FORMS

What are W-8BEN Certification of Foreign Status of Beneficial Owner for United States Tax Withholding and W-8IMY Certification of Foreign Intermediary, Foreign Flow-Through Entity, or Certain US

Branches for United States Tax Withholding Forms?

The US tax authority, the IRS (Internal Revenue Service), requires foreign persons and entities to pay tax on income received from US sources (including settlement of payment card & third party

network transactions) unless certain conditions are met. This tax is imposed on the gross amount and is generally collected by the withholding agent (Elavon).

A payment is considered to have been made whether it is made directly to the beneficial owner or to another person, such as an intermediary agent, or partnership, for the benefit of the beneficial

owner. The W-8BEN and W-8IMY forms are used by non-U.S. persons or entities to establish that taxes should not be withheld, or should be withheld at a reduced rate.

These forms are not sent to the US Internal Revenue Service; records are stored in the care and control of Elavon.

W-8BEN Certification of Foreign Status of Beneficial Owner for United States Tax Withholding

W-8IMY Certification of Foreign Intermediary, Foreign Flow-Through Entity, or Certain US

Branches for United States Tax Withholding

WHO MUST FILE: You must provide Form W-8BEN to Elavon if you are a non US person and

you are the beneficial owner of an amount subject to withholding.

You are required to provide Form W-8IMY to:

•

Confirm that you are the Intermediary/ Partnership

YOU MUST SUBMIT FORM W-8BEN WHEN REQUESTED BY ELAVON TO:

•

establish that you are not a US person;

•

Establish that you are not a US person;

•

confirm that you are the beneficial owner of the income for which form W-8BEN is being

provided or a partner in a partnership; and

WHO MUST FILE: You must provide Form W-8IMY to Elavon to document you are not a US

•

if applicable, claim a reduced rate of, or exemption from, withholding as a resident of a

person/partnership/intermediary receiving the payment on behalf of your partners together with

foreign country with which the US has an income tax treaty.

the following:

•

Allocation of ownership (% owned by each partner in the partnership)

DO NOT USE FORM W-8BEN IF:

•

You are a US citizen (even if you reside outside the United States) or other US person

•

Form W-8BEN for each partner in the partnership to document that partner is not a US

(including a resident alien individual). Instead, use Form W-9.

Person. (Form W-9 for any partner that is a US Person)

•

You are a disregarded entity with a single owner that is a US person and you are not a

•

If you do not provide this documentation, Elavon may have to withhold at the 30% backup

hybrid entity claiming treaty benefits. Instead provide Form W-9.

withholding rate, or other applicable rate.

You are a disregarded entity. Instead the owner of the entity must submit the form.

•

•

You are acting as an intermediary (that is, acting not for your own account, but for the

EXPIRATION OF FORM W-8IMY: Generally a Form W-8IMY remains valid until the status

account of others as an agent, nominee, or custodian). Instead, provide Form W-8IMY.

of the person whose name is on the certificate is changed in a way relevant to the certificate

•

You are a foreign partnership or foreign grantor and simple trust (as per original W-8BEN

or circumstances change that make the information on the certificate no longer correct. The

form) trust. Instead, provide Form W-8IMY and accompanying documentation where

indefinite validity period does not extend however, to any withholding certificates, documentary

required.

evidence, or withholding statements associated with the certificate.

NOTE: If you own the income or account jointly with one or more other persons, the income or

account will be treated as owned by a non US person if Forms W-8BEN are provided by all of

the owners.

EXPIRATION OF FORM W-8BEN: Generally, a Form W-8BEN will remain in effect for a period

starting on the date the form is signed and ending on the last day of the third succeeding

calendar year, unless a change in circumstances makes any information on the form incorrect.

Change in Circumstances

If a change in circumstances makes any information on the W-8BEN or W-8IMY Forms you have submitted incorrect, you must notify Elavon within 30 days and complete a new Form W-8BEN, or

W-8IMY or other appropriate form.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2