Request For Business Tax Or Fee Refund - City And County Of San Francisco

ADVERTISEMENT

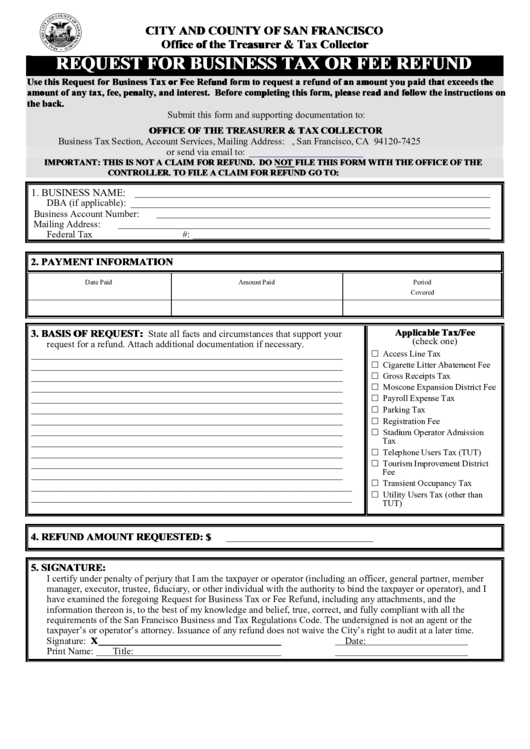

CITY AND COUNTY OF SAN FRANCISCO

Office of the Treasurer & Tax Collector

REQUEST FOR BUSINESS TAX OR FEE REFUND

Use this Request for Business Tax or Fee Refund form to request a refund of an amount you paid that exceeds the

amount of any tax, fee, penalty, and interest. Before completing this form, please read and follow the instructions on

the back.

Submit this form and supporting documentation to:

OFFICE OF THE TREASURER & TAX COLLECTOR

Business Tax Section, Account Services, Mailing Address: P.O. Box 7425, San Francisco, CA 94120-7425

or send via email to:

IMPORTANT: THIS IS NOT A CLAIM FOR REFUND. DO NOT FILE THIS FORM WITH THE OFFICE OF THE

CONTROLLER. TO FILE A CLAIM FOR REFUND GO TO:

1. BUSINESS NAME:

DBA (if applicable):

Business Account Number:

Mailing Address:

Federal Tax I.D. or Social Security #:

2. PAYMENT INFORMATION

Date Paid

Amount Paid

Period

Covered

Applicable Tax/Fee

3. BASIS OF REQUEST:

State all facts and circumstances that support your

(check one)

request for a refund. Attach additional documentation if necessary.

Access Line Tax

Cigarette Litter Abatement Fee

Gross Receipts Tax

Moscone Expansion District Fee

Payroll Expense Tax

Parking Tax

Registration Fee

Stadium Operator Admission

Tax

Telephone Users Tax (TUT)

Tourism Improvement District

Fee

Transient Occupancy Tax

__________________________________________________________________

Utility Users Tax (other than

__________________________________________________________________

TUT)

4. REFUND AMOUNT REQUESTED: $

5. SIGNATURE:

I certify under penalty of perjury that I am the taxpayer or operator (including an officer, general partner, member

manager, executor, trustee, fiduciary, or other individual with the authority to bind the taxpayer or operator), and I

have examined the foregoing Request for Business Tax or Fee Refund, including any attachments, and the

information thereon is, to the best of my knowledge and belief, true, correct, and fully compliant with all the

requirements of the San Francisco Business and Tax Regulations Code. The undersigned is not an agent or the

taxpayer’s or operator’s attorney. Issuance of any refund does not waive the City’s right to audit at a later time.

Signature: X

Date:

Print Name:

Title:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2