Instructions For Completing Form 106 - Colorado

ADVERTISEMENT

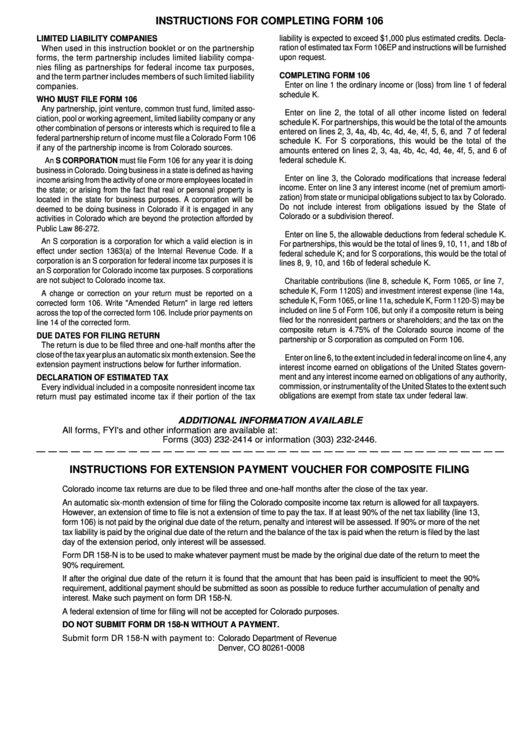

INSTRUCTIONS FOR COMPLETING FORM 106

liability is expected to exceed $1,000 plus estimated credits. Decla-

LIMITED LIABILITY COMPANIES

ration of estimated tax Form 106EP and instructions will be furnished

When used in this instruction booklet or on the partnership

upon request.

forms, the term partnership includes limited liability compa-

nies filing as partnerships for federal income tax purposes,

COMPLETING FORM 106

and the term partner includes members of such limited liability

Enter on line 1 the ordinary income or (loss) from line 1 of federal

companies.

schedule K.

WHO MUST FILE FORM 106

Any partnership, joint venture, common trust fund, limited asso-

Enter on line 2, the total of all other income listed on federal

ciation, pool or working agreement, limited liability company or any

schedule K. For partnerships, this would be the total of the amounts

other combination of persons or interests which is required to file a

entered on lines 2, 3, 4a, 4b, 4c, 4d, 4e, 4f, 5, 6, and 7 of federal

federal partnership return of income must file a Colorado Form 106

schedule K. For S corporations, this would be the total of the

if any of the partnership income is from Colorado sources.

amounts entered on lines 2, 3, 4a, 4b, 4c, 4d, 4e, 4f, 5, and 6 of

federal schedule K.

An S CORPORATION must file Form 106 for any year it is doing

business in Colorado. Doing business in a state is defined as having

Enter on line 3, the Colorado modifications that increase federal

income arising from the activity of one or more employees located in

income. Enter on line 3 any interest income (net of premium amorti-

the state; or arising from the fact that real or personal property is

zation) from state or municipal obligations subject to tax by Colorado.

located in the state for business purposes. A corporation will be

Do not include interest from obligations issued by the State of

deemed to be doing business in Colorado if it is engaged in any

Colorado or a subdivision thereof.

activities in Colorado which are beyond the protection afforded by

Public Law 86-272.

Enter on line 5, the allowable deductions from federal schedule K.

An S corporation is a corporation for which a valid election is in

For partnerships, this would be the total of lines 9, 10, 11, and 18b of

effect under section 1363(a) of the Internal Revenue Code. If a

federal schedule K; and for S corporations, this would be the total of

corporation is an S corporation for federal income tax purposes it is

lines 8, 9, 10, and 16b of federal schedule K.

an S corporation for Colorado income tax purposes. S corporations

are not subject to Colorado income tax.

Charitable contributions (line 8, schedule K, Form 1065, or line 7,

schedule K, Form 1120S) and investment interest expense (line 14a,

A change or correction on your return must be reported on a

schedule K, Form 1065, or line 11a, schedule K, Form 1120-S) may be

corrected form 106. Write "Amended Return" in large red letters

included on line 5 of Form 106, but only if a composite return is being

across the top of the corrected form 106. Include prior payments on

filed for the nonresident partners or shareholders; and the tax on the

line 14 of the corrected form.

composite return is 4.75% of the Colorado source income of the

DUE DATES FOR FILING RETURN

partnership or S corporation as computed on Form 106.

The return is due to be filed three and one-half months after the

close of the tax year plus an automatic six month extension. See the

Enter on line 6, to the extent included in federal income on line 4, any

extension payment instructions below for further information.

interest income earned on obligations of the United States govern-

ment and any interest income earned on obligations of any authority,

DECLARATION OF ESTIMATED TAX

commission, or instrumentality of the United States to the extent such

Every individual included in a composite nonresident income tax

obligations are exempt from state tax under federal law.

return must pay estimated income tax if their portion of the tax

ADDITIONAL INFORMATION AVAILABLE

All forms, FYI's and other information are available at: or you can call for

Forms (303) 232-2414 or information (303) 232-2446.

INSTRUCTIONS FOR EXTENSION PAYMENT VOUCHER FOR COMPOSITE FILING

Colorado income tax returns are due to be filed three and one-half months after the close of the tax year.

An automatic six-month extension of time for filing the Colorado composite income tax return is allowed for all taxpayers.

However, an extension of time to file is not a extension of time to pay the tax. If at least 90% of the net tax liability (line 13,

form 106) is not paid by the original due date of the return, penalty and interest will be assessed. If 90% or more of the net

tax liability is paid by the original due date of the return and the balance of the tax is paid when the return is filed by the last

day of the extension period, only interest will be assessed.

Form DR 158-N is to be used to make whatever payment must be made by the original due date of the return to meet the

90% requirement.

If after the original due date of the return it is found that the amount that has been paid is insufficient to meet the 90%

requirement, additional payment should be submitted as soon as possible to reduce further accumulation of penalty and

interest. Make such payment on form DR 158-N.

A federal extension of time for filing will not be accepted for Colorado purposes.

DO NOT SUBMIT FORM DR 158-N WITHOUT A PAYMENT.

Submit form DR 158-N with payment to: Colorado Department of Revenue

Denver, CO 80261-0008

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1