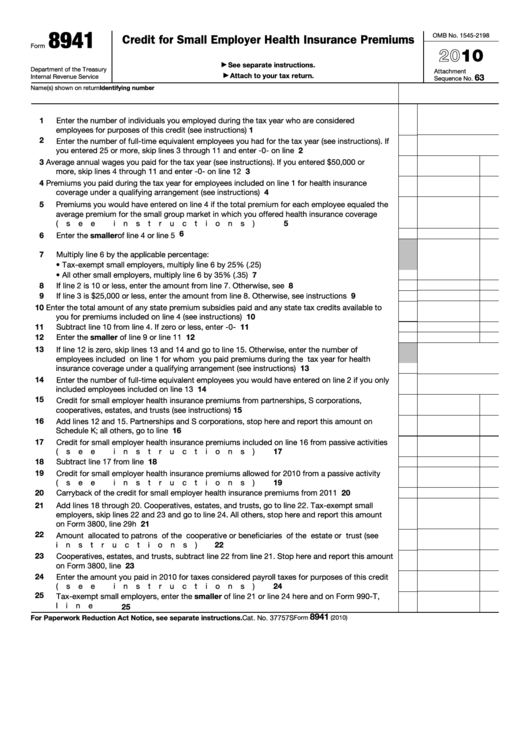

8941

OMB No. 1545-2198

Credit for Small Employer Health Insurance Premiums

Form

2010

See separate instructions.

▶

Department of the Treasury

Attachment

Attach to your tax return.

63

▶

Internal Revenue Service

Sequence No.

Name(s) shown on return

Identifying number

1

Enter the number of individuals you employed during the tax year who are considered

employees for purposes of this credit (see instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

1

2

Enter the number of full-time equivalent employees you had for the tax year (see instructions). If

2

you entered 25 or more, skip lines 3 through 11 and enter -0- on line 12 .

.

.

.

.

.

.

.

3

Average annual wages you paid for the tax year (see instructions). If you entered $50,000 or

more, skip lines 4 through 11 and enter -0- on line 12

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3

4

Premiums you paid during the tax year for employees included on line 1 for health insurance

4

coverage under a qualifying arrangement (see instructions)

.

.

.

.

.

.

.

.

.

.

.

.

5

Premiums you would have entered on line 4 if the total premium for each employee equaled the

average premium for the small group market in which you offered health insurance coverage

5

(see instructions)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6

6

Enter the smaller of line 4 or line 5

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7

Multiply line 6 by the applicable percentage:

• Tax-exempt small employers, multiply line 6 by 25% (.25)

• All other small employers, multiply line 6 by 35% (.35)

.

.

.

.

.

.

.

.

.

.

.

.

.

7

8

8

If line 2 is 10 or less, enter the amount from line 7. Otherwise, see instructions .

.

.

.

.

.

9

9

If line 3 is $25,000 or less, enter the amount from line 8. Otherwise, see instructions .

.

.

.

10

Enter the total amount of any state premium subsidies paid and any state tax credits available to

you for premiums included on line 4 (see instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

10

11

11

Subtract line 10 from line 4. If zero or less, enter -0- .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

12

Enter the smaller of line 9 or line 11 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

12

13

If line 12 is zero, skip lines 13 and 14 and go to line 15. Otherwise, enter the number of

employees included on line 1 for whom you paid premiums during the tax year for health

insurance coverage under a qualifying arrangement (see instructions) .

.

.

.

.

.

.

.

.

13

14

Enter the number of full-time equivalent employees you would have entered on line 2 if you only

14

included employees included on line 13 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

15

Credit for small employer health insurance premiums from partnerships, S corporations,

cooperatives, estates, and trusts (see instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

15

16

Add lines 12 and 15. Partnerships and S corporations, stop here and report this amount on

16

Schedule K; all others, go to line 17 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

17

Credit for small employer health insurance premiums included on line 16 from passive activities

(see instructions)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

17

18

18

Subtract line 17 from line 16 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

19

Credit for small employer health insurance premiums allowed for 2010 from a passive activity

(see instructions)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

19

20

20

Carryback of the credit for small employer health insurance premiums from 2011 .

.

.

.

.

21

Add lines 18 through 20. Cooperatives, estates, and trusts, go to line 22. Tax-exempt small

employers, skip lines 22 and 23 and go to line 24. All others, stop here and report this amount

on Form 3800, line 29h

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

21

22

Amount allocated to patrons of the cooperative or beneficiaries of the estate or trust (see

instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

22

23

Cooperatives, estates, and trusts, subtract line 22 from line 21. Stop here and report this amount

23

on Form 3800, line 29h

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

24

Enter the amount you paid in 2010 for taxes considered payroll taxes for purposes of this credit

(see instructions)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

24

25

Tax-exempt small employers, enter the smaller of line 21 or line 24 here and on Form 990-T,

line 44f .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

25

8941

For Paperwork Reduction Act Notice, see separate instructions.

Cat. No. 37757S

Form

(2010)

1

1