Hardship Withdrawal Form

ADVERTISEMENT

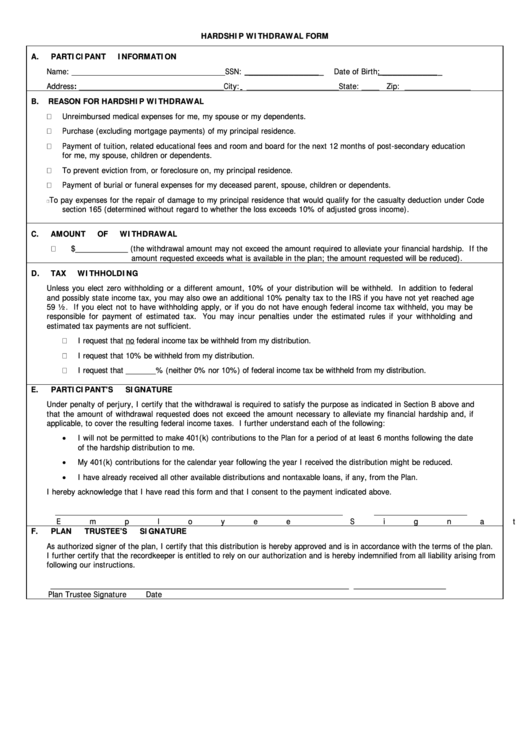

HARDSHIP WITHDRAWAL FORM

A.

PARTICIPANT INFORMATION

Name: ___________________________________SSN: _______________

Date of Birth: ____________

Address: _________________________________City: _____________________State: ____ Zip: _______________

B.

REASON FOR HARDSHIP WITHDRAWAL

Unreimbursed medical expenses for me, my spouse or my dependents.

Purchase (excluding mortgage payments) of my principal residence.

Payment of tuition, related educational fees and room and board for the next 12 months of post-secondary education

for me, my spouse, children or dependents.

To prevent eviction from, or foreclosure on, my principal residence.

Payment of burial or funeral expenses for my deceased parent, spouse, children or dependents.

To pay expenses for the repair of damage to my principal residence that would qualify for the casualty deduction under Code

section 165 (determined without regard to whether the loss exceeds 10% of adjusted gross income).

C.

AMOUNT OF WITHDRAWAL

$____________ (the withdrawal amount may not exceed the amount required to alleviate your financial hardship. If the

amount requested exceeds what is available in the plan; the amount requested will be reduced).

D.

TAX WITHHOLDING

Unless you elect zero withholding or a different amount, 10% of your distribution will be withheld. In addition to federal

and possibly state income tax, you may also owe an additional 10% penalty tax to the IRS if you have not yet reached age

59 ½. If you elect not to have withholding apply, or if you do not have enough federal income tax withheld, you may be

responsible for payment of estimated tax. You may incur penalties under the estimated rules if your withholding and

estimated tax payments are not sufficient.

I request that no federal income tax be withheld from my distribution.

I request that 10% be withheld from my distribution.

I request that _______% (neither 0% nor 10%) of federal income tax be withheld from my distribution.

E.

PARTICIPANT'S SIGNATURE

Under penalty of perjury, I certify that the withdrawal is required to satisfy the purpose as indicated in Section B above and

that the amount of withdrawal requested does not exceed the amount necessary to alleviate my financial hardship and, if

applicable, to cover the resulting federal income taxes. I further understand each of the following:

I will not be permitted to make 401(k) contributions to the Plan for a period of at least 6 months following the date

of the hardship distribution to me.

My 401(k) contributions for the calendar year following the year I received the distribution might be reduced.

I have already received all other available distributions and nontaxable loans, if any, from the Plan.

I hereby acknowledge that I have read this form and that I consent to the payment indicated above.

Employee Signature

Date

F.

PLAN TRUSTEE’S SIGNATURE

As authorized signer of the plan, I certify that this distribution is hereby approved and is in accordance with the terms of the plan.

I further certify that the recordkeeper is entitled to rely on our authorization and is hereby indemnified from all liability arising from

following our instructions.

____________________________________________________________________

_____________________

Plan Trustee Signature

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1