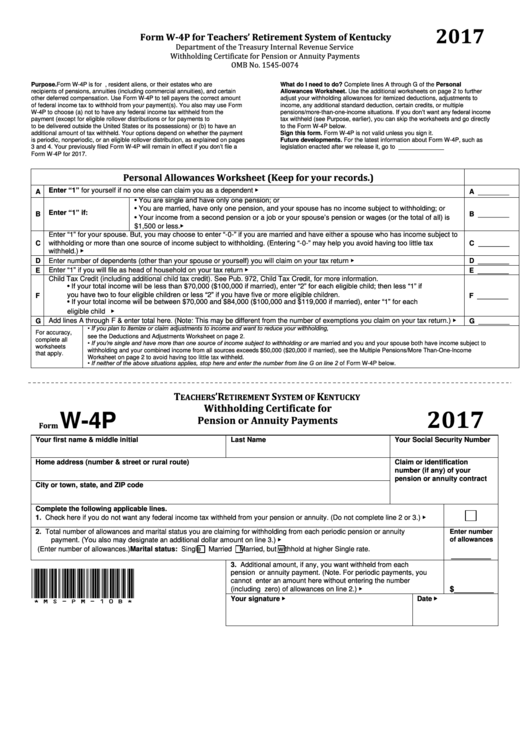

Form W-4p - Withholding Certificate - 2017

ADVERTISEMENT

2017

Form W-4P for Teachers’ Retirement System of Kentucky

Department of the Treasury Internal Revenue Service

Withholding Certificate for Pension or Annuity Payments

OMB No. 1545-0074

Purpose. Form W-4P is for U.S. citizens, resident aliens, or their estates who are

What do I need to do? Complete lines A through G of the Personal

Allowances Worksheet. Use the additional worksheets on page 2 to further

recipients of pensions, annuities (including commercial annuities), and certain

other deferred compensation. Use Form W-4P to tell payers the correct amount

adjust your withholding allowances for itemized deductions, adjustments to

of federal income tax to withhold from your payment(s). You also may use Form

income, any additional standard deduction, certain credits, or multiple

pensions/more-than-one-income situations. If you don’t want any federal income

W-4P to choose (a) not to have any federal income tax withheld from the

payment (except for eligible rollover distributions or for payments to U.S. citizens

tax withheld (see Purpose, earlier), you can skip the worksheets and go directly

to be delivered outside the United States or its possessions) or (b) to have an

to the Form W-4P below.

additional amount of tax withheld. Your options depend on whether the payment

Sign this form. Form W-4P is not valid unless you sign it.

is periodic, nonperiodic, or an eligible rollover distribution, as explained on pages

Future developments. For the latest information about Form W-4P, such as

3 and 4. Your previously filed Form W-4P will remain in effect if you don’t file a

legislation enacted after we release it, go to

Form W-4P for 2017.

Personal Allowances Worksheet (Keep for your records.)

Enter “1” for yourself if no one else can claim you as a dependent ▶

A

A ________

• You are single and have only one pension; or

• You are married, have only one pension, and your spouse has no income subject to withholding; or

Enter “1” if:

B

B ________

• Your income from a second pension or a job or your spouse’s pension or wages (or the total of all) is

$1,500 or less. ▶

Enter “1” for your spouse. But, you may choose to enter “-0-” if you are married and have either a spouse who has income subject to

withholding or more than one source of income subject to withholding. (Entering “-0-” may help you avoid having too little tax

C

C ________

withheld.) ▶

Enter number of dependents (other than your spouse or yourself) you will claim on your tax return ▶

D

D ________

Enter “1” if you will file as head of household on your tax return ▶

E

E ________

Child Tax Credit (including additional child tax credit). See Pub. 972, Child Tax Credit, for more information.

• If your total income will be less than $70,000 ($100,000 if married), enter “2” for each eligible child; then less “1” if

you have two to four eligible children or less “2” if you have five or more eligible children.

F

F ________

• If your total income will be between $70,000 and $84,000 ($100,000 and $119,000 if married), enter “1” for each

eligible child ▶

G Add lines A through F & enter total here. (Note: This may be different from the number of exemptions you claim on your tax return.) ▶

G ________

• If you plan to itemize or claim adjustments to income and want to reduce your withholding,

For accuracy,

see the Deductions and Adjustments Worksheet on page 2.

complete all

• If you’re single and have more than one source of income subject to withholding or are married and you and your spouse both have income subject to

worksheets

withholding and your combined income from all sources exceeds $50,000 ($20,000 if married), see the Multiple Pensions/More Than-One-Income

that apply.

Worksheet on page 2 to avoid having too little tax withheld.

• If neither of the above situations applies, stop here and enter the number from line G on line 2 of Form W-4P below.

T

’ R

S

K

EACHERS

ETIREMENT

YSTEM OF

ENTUCKY

Withholding Certificate for

2017

W-4P

Pension or Annuity Payments

Form

Your first name & middle initial

Last Name

Your Social Security Number

Home address (number & street or rural route)

Claim or identification

number (if any) of your

pension or annuity contract

City or town, state, and ZIP code

Complete the following applicable lines.

Check here if you do not want any federal income tax withheld from your pension or annuity. (Do not complete line 2 or 3.) ▶

1.

2.

Total number of allowances and marital status you are claiming for withholding from each periodic pension or annuity

Enter number

payment. (You also may designate an additional dollar amount on line 3.) ▶

of allowances

(Enter number of allowances.) Marital status:

Single

Married

Married, but withhold at higher Single rate.

_________

3.

Additional amount, if any, you want withheld from each

*MS-PM-10B*

pension or annuity payment. (Note. For periodic payments, you

cannot

enter an amount here without entering the number

zero) of allowances on line 2.) ▶

$_________

(including

Your signature ▶

Date ▶

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2