Inventory And Appraisal - Ohio

Download a blank fillable Inventory And Appraisal - Ohio in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Inventory And Appraisal - Ohio with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

Reset Form

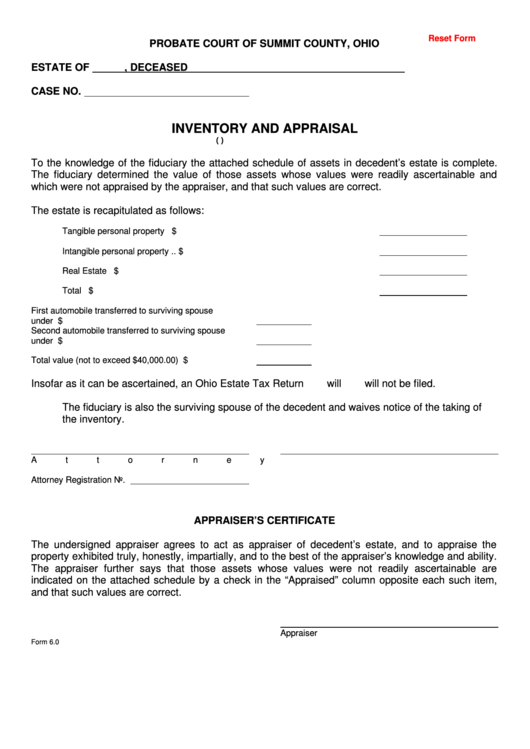

PROBATE COURT OF SUMMIT COUNTY, OHIO

ESTATE OF

, DECEASED

CASE NO.

INVENTORY AND APPRAISAL

(R.C. 2115.02 and 2115.09)

To the knowledge of the fiduciary the attached schedule of assets in decedent’s estate is complete.

The fiduciary determined the value of those assets whose values were readily ascertainable and

which were not appraised by the appraiser, and that such values are correct.

The estate is recapitulated as follows:

Tangible personal property

............................................................................ $

Intangible personal property

............................................................................ $

Real Estate

...................................................................................................... $

Total

................................................................................................................... $

First automobile transferred to surviving spouse

under R.C. 2106.18 ......................................

Value $

Second automobile transferred to surviving spouse

under R.C. 2106.18 .......................................

Value $

Total value (not to exceed $40,000.00) .........

$

Insofar as it can be ascertained, an Ohio Estate Tax Return

will

will not be filed.

The fiduciary is also the surviving spouse of the decedent and waives notice of the taking of

the inventory.

Attorney

Fiduciary

Attorney Registration No.

APPRAISER’S CERTIFICATE

The undersigned appraiser agrees to act as appraiser of decedent’s estate, and to appraise the

property exhibited truly, honestly, impartially, and to the best of the appraiser’s knowledge and ability.

The appraiser further says that those assets whose values were not readily ascertainable are

indicated on the attached schedule by a check in the “Appraised” column opposite each such item,

and that such values are correct.

Appraiser

Form 6.0

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2