Donation Receipt

Download a blank fillable Donation Receipt in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Donation Receipt with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

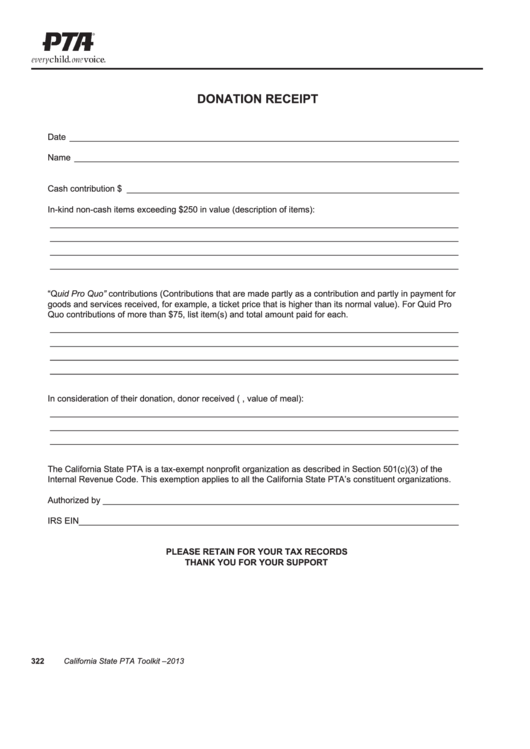

DONATION RECEIPT

Date __________________________________________________________________________________

Name _________________________________________________________________________________

Cash contribution $ ______________________________________________________________________

In-kind non-cash items exceeding $250 in value (description of items):

______________________________________________________________________________________

______________________________________________________________________________________

______________________________________________________________________________________

______________________________________________________________________________________

“Quid Pro Quo” contributions (Contributions that are made partly as a contribution and partly in payment for

goods and services received, for example, a ticket price that is higher than its normal value). For Quid Pro

Quo contributions of more than $75, list item(s) and total amount paid for each.

______________________________________________________________________________________

______________________________________________________________________________________

______________________________________________________________________________________

______________________________________________________________________________________

In consideration of their donation, donor received (e.g., value of meal):

______________________________________________________________________________________

______________________________________________________________________________________

______________________________________________________________________________________

The California State PTA is a tax-exempt nonprofit organization as described in Section 501(c)(3) of the

Internal Revenue Code. This exemption applies to all the California State PTA’s constituent organizations.

Authorized by ___________________________________________________________________________

IRS EIN________________________________________________________________________________

PLEASE RETAIN FOR YOUR TAX RECORDS

THANK YOU FOR YOUR SUPPORT

322

California State PTA Toolkit – 2013

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Letters

1

1