Claim For Home Exemption

Download a blank fillable Claim For Home Exemption in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Claim For Home Exemption with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

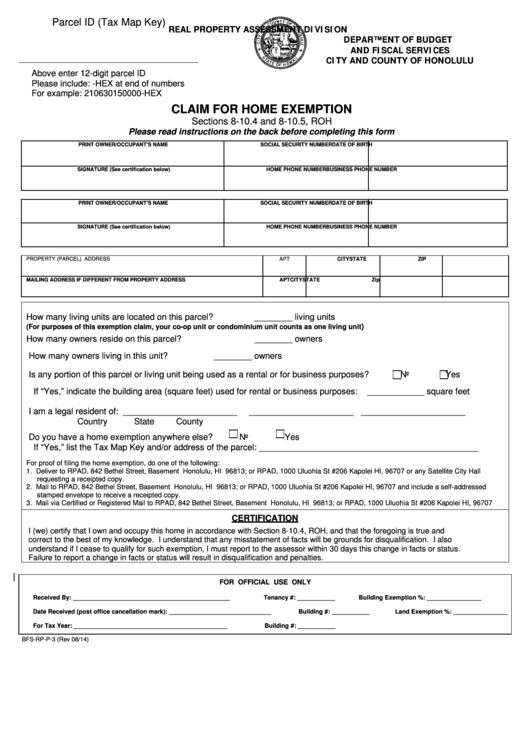

Parcel ID (Tax Map Key)

REAL PROPERTY ASSESSMENT DIVISION

DEPARTMENT OF BUDGET

AND FISCAL SERVICES

CITY AND COUNTY OF HONOLULU

Above enter 12-digit parcel ID

Please include: -HEX at end of numbers

For example: 210630150000-HEX

CLAIM FOR HOME EXEMPTION

Sections 8-10.4 and 8-10.5, ROH

Please read instructions on the back before completing this form

PRINT OWNER/OCCUPANT’S NAME

SOCIAL SECURITY NUMBER

DATE OF BIRTH

SIGNATURE (See certification below)

HOME PHONE NUMBER

BUSINESS PHONE NUMBER

PRINT OWNER/OCCUPANT’S NAME

SOCIAL SECURITY NUMBER

DATE OF BIRTH

SIGNATURE (See certification below)

HOME PHONE NUMBER

BUSINESS PHONE NUMBER

PROPERTY (PARCEL) ADDRESS

APT

CITY

STATE

ZIP

MAILING ADDRESS IF DIFFERENT FROM PROPERTY ADDRESS

APT

CITY

STATE

Zip

How many living units are located on this parcel?

________ living units

)

(For purposes of this exemption claim, your co-op unit or condominium unit counts as one living unit

How many owners reside on this parcel?

________ owners

How many owners living in this unit?

________ owners

Is any portion of this parcel or living unit being used as a rental or for business purposes?

No

Yes

If “Yes,” indicate the building area (square feet) used for rental or business purposes:

____________ square feet

I am a legal resident of: ________________________

______________________

______________________

Country

State

County

Do you have a home exemption anywhere else?

No

Yes

If “Yes,” list the Tax Map Key and/or address of the parcel: ______________________________________________

For proof of filing the home exemption, do one of the following:

1. Deliver to RPAD, 842 Bethel Street, Basement Honolulu, HI 96813; or RPAD, 1000 Uluohia St #206 Kapolei HI, 96707 or any Satellite City Hall

requesting a receipted copy.

2. Mail to RPAD, 842 Bethel Street, Basement Honolulu, HI 96813; or RPAD, 1000 Uluohia St #206 Kapolei HI, 96707 and include a self-addressed

stamped envelope to receive a receipted copy.

3. Mail via Certified or Registered Mail to RPAD, 842 Bethel Street, Basement Honolulu, HI 96813; or RPAD, 1000 Uluohia St #206 Kapolei HI, 96707

CERTIFICATION

I (we) certify that I own and occupy this home in accordance with Section 8-10.4, ROH, and that the foregoing is true and

correct to the best of my knowledge. I understand that any misstatement of facts will be grounds for disqualification. I also

understand if I cease to qualify for such exemption, I must report to the assessor within 30 days this change in facts or status.

Failure to report a change in facts or status will result in disqualification and penalties.

FOR OFFICIAL USE ONLY

Received By: ______________________________________________

Tenancy #: ___________

Building Exemption %: ________________

Date Received (post office cancellation mark): ______________________________

Building #: ___________

Land Exemption %: ________________

For Tax Year: _____________________________________________

Building #: ___________

BFS-RP-P-3 (Rev 08/14)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2