Certificate For The Purpose Of Clause (B) Of Sub-Section (5) Of Section 59b Of The Gujarat Value Added Tax Act, 2003 (Form 701)

ADVERTISEMENT

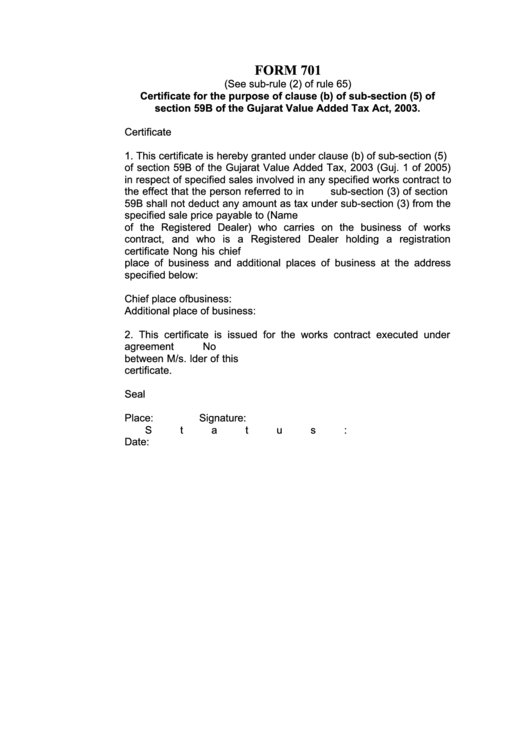

FORM 701

(See sub-rule (2) of rule 65)

Certificate for the purpose of clause (b) of sub-section (5) of

section 59B of the Gujarat Value Added Tax Act, 2003.

Certificate No........................

Dated................

1. This certificate is hereby granted under clause (b) of sub-section (5)

of section 59B of the Gujarat Value Added Tax, 2003 (Guj. 1 of 2005)

in respect of specified sales involved in any specified works contract to

the effect that the person referred to in

sub-section (3) of section

59B shall not deduct any amount as tax under sub-section (3) from the

specified sale price payable to Ms................................................(Name

of the Registered Dealer) who carries on the business of works

contract, and who is a Registered Dealer holding a registration

certificate No................................ dated ..................... having his chief

place of business and additional places of business at the address

specified below:

Chief place of business:................................................

Additional place of business:........................................

2. This certificate is issued for the works contract executed under

agreement

No...............................................dated.........................

between M/s. ............................................................ and holder of this

certificate.

Seal

Place:

Signature:

Status:

Date:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1