Anti Flipping / Tangible Benefit Worksheet

ADVERTISEMENT

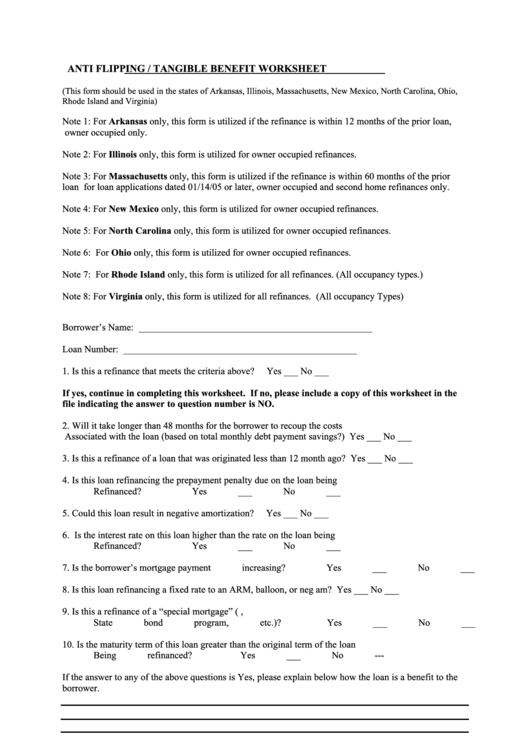

ANTI FLIPPING / TANGIBLE BENEFIT WORKSHEET

(This form should be used in the states of Arkansas, Illinois, Massachusetts, New Mexico, North Carolina, Ohio,

Rhode Island and Virginia)

Note 1: For Arkansas only, this form is utilized if the refinance is within 12 months of the prior loan,

owner occupied only.

Note 2: For Illinois only, this form is utilized for owner occupied refinances.

Note 3: For Massachusetts only, this form is utilized if the refinance is within 60 months of the prior

loan

for loan applications dated 01/14/05 or later, owner occupied and second home refinances only.

Note 4: For New Mexico only, this form is utilized for owner occupied refinances.

Note 5: For North Carolina only, this form is utilized for owner occupied refinances.

Note 6: For Ohio only, this form is utilized for owner occupied refinances.

Note 7: For Rhode Island only, this form is utilized for all refinances. (All occupancy types.)

Note 8: For Virginia only, this form is utilized for all refinances. (All occupancy Types)

Borrower’s Name:

_________________________________________________

Loan Number:

_________________________________________________

1.

Is this a refinance that meets the criteria above?

Yes ___ No ___

If yes, continue in completing this worksheet. If no, please include a copy of this worksheet in the

file indicating the answer to question number is NO.

2.

Will it take longer than 48 months for the borrower to recoup the costs

Associated with the loan (based on total monthly debt payment savings?)

Yes ___ No ___

3.

Is this a refinance of a loan that was originated less than 12 month ago?

Yes ___ No ___

4.

Is this loan refinancing the prepayment penalty due on the loan being

Refinanced?

Yes ___ No ___

5.

Could this loan result in negative amortization?

Yes ___ No ___

6.

Is the interest rate on this loan higher than the rate on the loan being

Refinanced?

Yes ___ No ___

7.

Is the borrower’s mortgage payment increasing?

Yes ___ No ___

8.

Is this loan refinancing a fixed rate to an ARM, balloon, or neg am?

Yes ___ No ___

9.

Is this a refinance of a “special mortgage” (i.e. Habitat for Humanity,

State bond program, etc.)?

Yes ___ No ___

10.

Is the maturity term of this loan greater than the original term of the loan

Being refinanced?

Yes ___ No ---

If the answer to any of the above questions is Yes, please explain below how the loan is a benefit to the

borrower.

Name of person completing this worksheet: ____________________________ Date: ________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1