Print

Reset

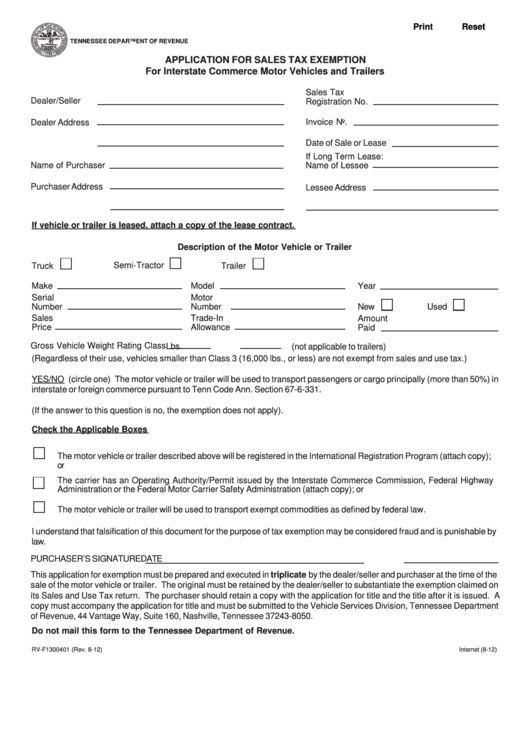

TENNESSEE DEPARTMENT OF REVENUE

APPLICATION FOR SALES TAX EXEMPTION

For Interstate Commerce Motor Vehicles and Trailers

Sales Tax

Dealer/Seller

Registration No.

Invoice No.

Dealer Address

Date of Sale or Lease

If Long Term Lease:

Name of Purchaser

Name of Lessee

Purchaser Address

Lessee Address

If vehicle or trailer is leased, attach a copy of the lease contract.

Description of the Motor Vehicle or Trailer

Semi-Tractor

Truck

Trailer

Make

Model

Year

Serial

Motor

Number

Number

New

Used

Sales

Trade-In

Amount

Price

Allowance

Paid

Gross Vehicle Weight Rating Class

Lbs.

(not applicable to trailers)

(Regardless of their use, vehicles smaller than Class 3 (16,000 lbs., or less) are not exempt from sales and use tax.)

YES/NO (circle one) The motor vehicle or trailer will be used to transport passengers or cargo principally (more than 50%) in

interstate or foreign commerce pursuant to Tenn Code Ann. Section 67-6-331.

(If the answer to this question is no, the exemption does not apply).

Check the Applicable Boxes

The motor vehicle or trailer described above will be registered in the International Registration Program (attach copy);

or

The carrier has an Operating Authority/Permit issued by the Interstate Commerce Commission, Federal Highway

Administration or the Federal Motor Carrier Safety Administration (attach copy); or

The motor vehicle or trailer will be used to transport exempt commodities as defined by federal law.

I understand that falsification of this document for the purpose of tax exemption may be considered fraud and is punishable by

law.

PURCHASER’S SIGNATURE

DATE

This application for exemption must be prepared and executed in triplicate by the dealer/seller and purchaser at the time of the

sale of the motor vehicle or trailer. The original must be retained by the dealer/seller to substantiate the exemption claimed on

its Sales and Use Tax return. The purchaser should retain a copy with the application for title and the title after it is issued. A

copy must accompany the application for title and must be submitted to the Vehicle Services Division, Tennessee Department

of Revenue, 44 Vantage Way, Suite 160, Nashville, Tennessee 37243-8050.

Do not mail this form to the Tennessee Department of Revenue.

RV-F1300401 (Rev. 8-12)

Internet (8-12)

1

1