Teachers' And State Employee'S Retirement System - Enrollment Election

ADVERTISEMENT

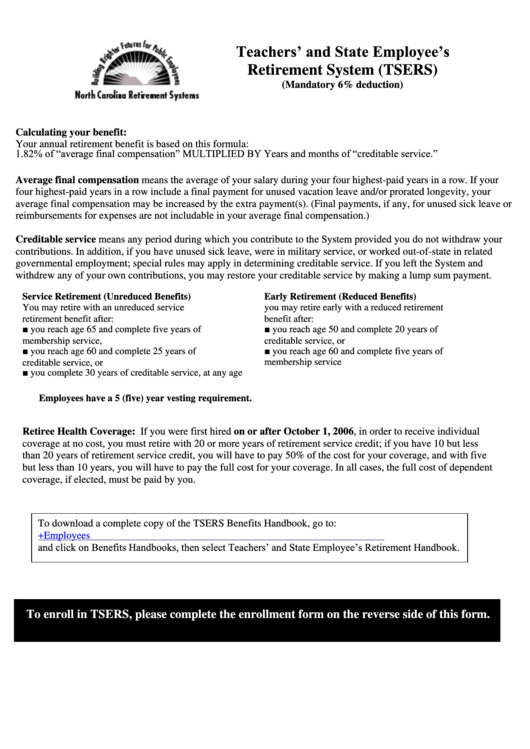

Teachers’ and State Employee’s

Retirement System (TSERS)

(Mandatory 6% deduction)

Calculating your benefit:

Your annual retirement benefit is based on this formula:

1.82% of “average final compensation” MULTIPLIED BY Years and months of “creditable service.”

Average final compensation means the average of your salary during your four highest-paid years in a row. If your

four highest-paid years in a row include a final payment for unused vacation leave and/or prorated longevity, your

average final compensation may be increased by the extra payment(s). (Final payments, if any, for unused sick leave or

reimbursements for expenses are not includable in your average final compensation.)

Creditable service means any period during which you contribute to the System provided you do not withdraw your

contributions. In addition, if you have unused sick leave, were in military service, or worked out-of-state in related

governmental employment; special rules may apply in determining creditable service. If you left the System and

withdrew any of your own contributions, you may restore your creditable service by making a lump sum payment.

Service Retirement (Unreduced Benefits)

Early Retirement (Reduced Benefits)

You may retire with an unreduced service

you may retire early with a reduced retirement

retirement benefit after:

benefit after:

■ you reach age 65 and complete five years of

■ you reach age 50 and complete 20 years of

membership service,

creditable service, or

■ you reach age 60 and complete 25 years of

■ you reach age 60 and complete five years of

creditable service, or

membership service

■ you complete 30 years of creditable service, at any age

Employees have a 5 (five) year vesting requirement.

Retiree Health Coverage: If you were first hired on or after October 1, 2006, in order to receive individual

coverage at no cost, you must retire with 20 or more years of retirement service credit; if you have 10 but less

than 20 years of retirement service credit, you will have to pay 50% of the cost for your coverage, and with five

but less than 10 years, you will have to pay the full cost for your coverage. In all cases, the full cost of dependent

coverage, if elected, must be paid by you.

To download a complete copy of the TSERS Benefits Handbook, go to:

and click on Benefits Handbooks, then select Teachers’ and State Employee’s Retirement Handbook.

To enroll in TSERS, please complete the enrollment form on the reverse side of this form.

10/7/21014

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2