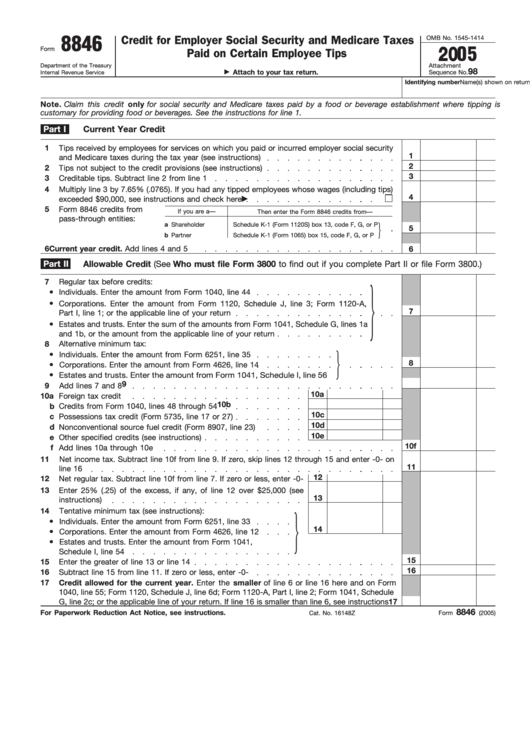

8846

OMB No. 1545-1414

Credit for Employer Social Security and Medicare Taxes

Form

2005

Paid on Certain Employee Tips

Department of the Treasury

Attachment

98

Attach to your tax return.

Internal Revenue Service

Sequence No.

Name(s) shown on return

Identifying number

Note. Claim this credit only for social security and Medicare taxes paid by a food or beverage establishment where tipping is

customary for providing food or beverages. See the instructions for line 1.

Part I

Current Year Credit

1

Tips received by employees for services on which you paid or incurred employer social security

1

and Medicare taxes during the tax year (see instructions)

2

2

Tips not subject to the credit provisions (see instructions)

3

3

Creditable tips. Subtract line 2 from line 1

4

Multiply line 3 by 7.65% (.0765). If you had any tipped employees whose wages (including tips)

4

exceeded $90,000, see instructions and check here

5

Form 8846 credits from

If you are a—

Then enter the Form 8846 credits from—

pass-through entities:

a

Shareholder

Schedule K-1 (Form 1120S) box 13, code F, G, or P

5

Partner

Schedule K-1 (Form 1065) box 15, code F, G, or P

b

6

Current year credit. Add lines 4 and 5

6

Part II

Allowable Credit (See Who must file Form 3800 to find out if you complete Part II or file Form 3800.)

7

Regular tax before credits:

●

Individuals. Enter the amount from Form 1040, line 44

●

Corporations. Enter the amount from Form 1120, Schedule J, line 3; Form 1120-A,

7

Part I, line 1; or the applicable line of your return

●

Estates and trusts. Enter the sum of the amounts from Form 1041, Schedule G, lines 1a

and 1b, or the amount from the applicable line of your return

Alternative minimum tax:

8

●

Individuals. Enter the amount from Form 6251, line 35

8

●

Corporations. Enter the amount from Form 4626, line 14

●

Estates and trusts. Enter the amount from Form 1041, Schedule I, line 56

9

Add lines 7 and 8

9

10a

10a

Foreign tax credit

10b

b

Credits from Form 1040, lines 48 through 54

10c

c

Possessions tax credit (Form 5735, line 17 or 27)

10d

d

Nonconventional source fuel credit (Form 8907, line 23)

10e

e

Other specified credits (see instructions)

10f

f

Add lines 10a through 10e

11

Net income tax. Subtract line 10f from line 9. If zero, skip lines 12 through 15 and enter -0- on

11

line 16

12

12

Net regular tax. Subtract line 10f from line 7. If zero or less, enter -0-

13

Enter 25% (.25) of the excess, if any, of line 12 over $25,000 (see

13

instructions)

14

Tentative minimum tax (see instructions):

●

Individuals. Enter the amount from Form 6251, line 33

14

●

Corporations. Enter the amount from Form 4626, line 12

●

Estates and trusts. Enter the amount from Form 1041,

Schedule I, line 54

15

15

Enter the greater of line 13 or line 14

16

16

Subtract line 15 from line 11. If zero or less, enter -0-

17

Credit allowed for the current year. Enter the smaller of line 6 or line 16 here and on Form

1040, line 55; Form 1120, Schedule J, line 6d; Form 1120-A, Part I, line 2; Form 1041, Schedule

G, line 2c; or the applicable line of your return. If line 16 is smaller than line 6, see instructions

17

8846

For Paperwork Reduction Act Notice, see instructions.

Cat. No. 16148Z

Form

(2005)

1

1 2

2