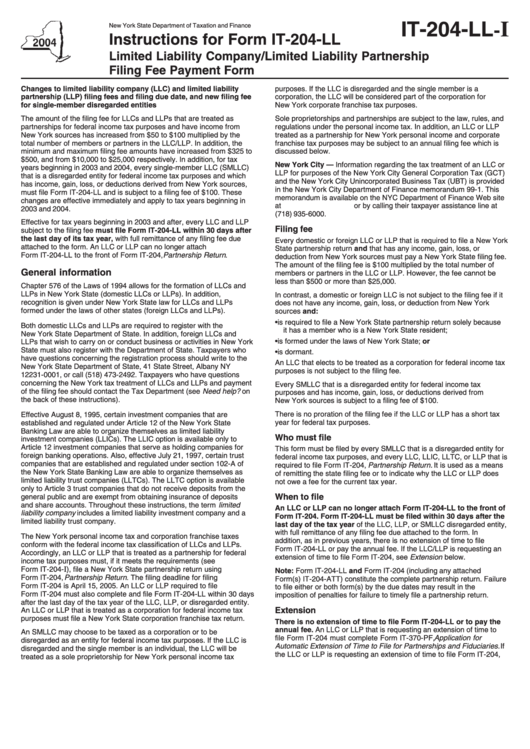

Instructions For Form It-204-Ll - Limited Liability Company/limited Liability Partnership Filing Fee Payment Form

ADVERTISEMENT

IT-204-LL- I

New York State Department of Taxation and Finance

Instructions for Form IT-204-LL

Limited Liability Company/Limited Liability Partnership

Filing Fee Payment Form

Changes to limited liability company (LLC) and limited liability

purposes. If the LLC is disregarded and the single member is a

partnership (LLP) filing fees and filing due date, and new filing fee

corporation, the LLC will be considered part of the corporation for

for single-member disregarded entities

New York corporate franchise tax purposes.

The amount of the filing fee for LLCs and LLPs that are treated as

Sole proprietorships and partnerships are subject to the law, rules, and

partnerships for federal income tax purposes and have income from

regulations under the personal income tax. In addition, an LLC or LLP

New York sources has increased from $50 to $100 multiplied by the

treated as a partnership for New York personal income and corporate

total number of members or partners in the LLC/LLP. In addition, the

franchise tax purposes may be subject to an annual filing fee which is

minimum and maximum filing fee amounts have increased from $325 to

discussed below.

$500, and from $10,000 to $25,000 respectively. In addition, for tax

New York City — Information regarding the tax treatment of an LLC or

years beginning in 2003 and 2004, every single-member LLC (SMLLC)

LLP for purposes of the New York City General Corporation Tax (GCT)

that is a disregarded entity for federal income tax purposes and which

and the New York City Unincorporated Business Tax (UBT) is provided

has income, gain, loss, or deductions derived from New York sources,

in the New York City Department of Finance memorandum 99-1. This

must file Form IT-204-LL and is subject to a filing fee of $100. These

memorandum is available on the NYC Department of Finance Web site

changes are effective immediately and apply to tax years beginning in

at or by calling their taxpayer assistance line at

2003 and 2004.

(718) 935-6000.

Effective for tax years beginning in 2003 and after, every LLC and LLP

Filing fee

subject to the filing fee must file Form IT-204-LL within 30 days after

the last day of its tax year, with full remittance of any filing fee due

Every domestic or foreign LLC or LLP that is required to file a New York

attached to the form. An LLC or LLP can no longer attach

State partnership return and that has any income, gain, loss, or

Form IT-204-LL to the front of Form IT-204, Partnership Return .

deduction from New York sources must pay a New York State filing fee.

The amount of the filing fee is $100 multiplied by the total number of

General information

members or partners in the LLC or LLP. However, the fee cannot be

less than $500 or more than $25,000.

Chapter 576 of the Laws of 1994 allows for the formation of LLCs and

LLPs in New York State (domestic LLCs or LLPs). In addition,

In contrast, a domestic or foreign LLC is not subject to the filing fee if it

recognition is given under New York State law for LLCs and LLPs

does not have any income, gain, loss, or deduction from New York

formed under the laws of other states (foreign LLCs and LLPs).

sources and:

• is required to file a New York State partnership return solely because

Both domestic LLCs and LLPs are required to register with the

it has a member who is a New York State resident;

New York State Department of State. In addition, foreign LLCs and

• is formed under the laws of New York State; or

LLPs that wish to carry on or conduct business or activities in New York

State must also register with the Department of State. Taxpayers who

• is dormant.

have questions concerning the registration process should write to the

An LLC that elects to be treated as a corporation for federal income tax

New York State Department of State, 41 State Street, Albany NY

purposes is not subject to the filing fee.

12231-0001, or call (518) 473-2492. Taxpayers who have questions

concerning the New York tax treatment of LLCs and LLPs and payment

Every SMLLC that is a disregarded entity for federal income tax

of the filing fee should contact the Tax Department (see Need help? on

purposes and has income, gain, loss, or deductions derived from

the back of these instructions).

New York sources is subject to a filing fee of $100.

There is no proration of the filing fee if the LLC or LLP has a short tax

Effective August 8, 1995, certain investment companies that are

year for federal tax purposes.

established and regulated under Article 12 of the New York State

Banking Law are able to organize themselves as limited liability

Who must file

investment companies (LLICs). The LLIC option is available only to

Article 12 investment companies that serve as holding companies for

This form must be filed by every SMLLC that is a disregarded entity for

foreign banking operations. Also, effective July 21, 1997, certain trust

federal income tax purposes, and every LLC, LLIC, LLTC, or LLP that is

companies that are established and regulated under section 102-A of

required to file Form IT-204, Partnership Return. It is used as a means

the New York State Banking Law are able to organize themselves as

of remitting the state filing fee or to indicate why the LLC or LLP does

limited liability trust companies (LLTCs). The LLTC option is available

not owe a fee for the current tax year.

only to Article 3 trust companies that do not receive deposits from the

When to file

general public and are exempt from obtaining insurance of deposits

and share accounts. Throughout these instructions, the term limited

An LLC or LLP can no longer attach Form IT-204-LL to the front of

liability company includes a limited liability investment company and a

Form IT-204. Form IT-204-LL must be filed within 30 days after the

limited liability trust company.

last day of the tax year of the LLC, LLP, or SMLLC disregarded entity,

with full remittance of any filing fee due attached to the form. In

The New York personal income tax and corporation franchise taxes

addition, as in previous years, there is no extension of time to file

conform with the federal income tax classification of LLCs and LLPs.

Form IT-204-LL or pay the annual fee. If the LLC/LLP is requesting an

Accordingly, an LLC or LLP that is treated as a partnership for federal

extension of time to file Form IT-204, see Extension below.

income tax purposes must, if it meets the requirements (see

I

Form IT-204-

), file a New York State partnership return using

Note: Form IT-204-LL and Form IT-204 (including any attached

Form IT-204, Partnership Return . The filing deadline for filing

Form(s) IT-204-ATT) constitute the complete partnership return. Failure

Form IT-204 is April 15, 2005. An LLC or LLP required to file

to file either or both form(s) by the due dates may result in the

Form IT-204 must also complete and file Form IT-204-LL within 30 days

imposition of penalties for failure to timely file a partnership return.

after the last day of the tax year of the LLC, LLP, or disregarded entity.

Extension

An LLC or LLP that is treated as a corporation for federal income tax

purposes must file a New York State corporation franchise tax return.

There is no extension of time to file Form IT-204-LL or to pay the

annual fee. An LLC or LLP that is requesting an extension of time to

An SMLLC may choose to be taxed as a corporation or to be

file Form IT-204 must complete Form IT-370-PF, Application for

disregarded as an entity for federal income tax purposes. If the LLC is

Automatic Extension of Time to File for Partnerships and Fiduciaries. If

disregarded and the single member is an individual, the LLC will be

the LLC or LLP is requesting an extension of time to file Form IT-204,

treated as a sole proprietorship for New York personal income tax

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2