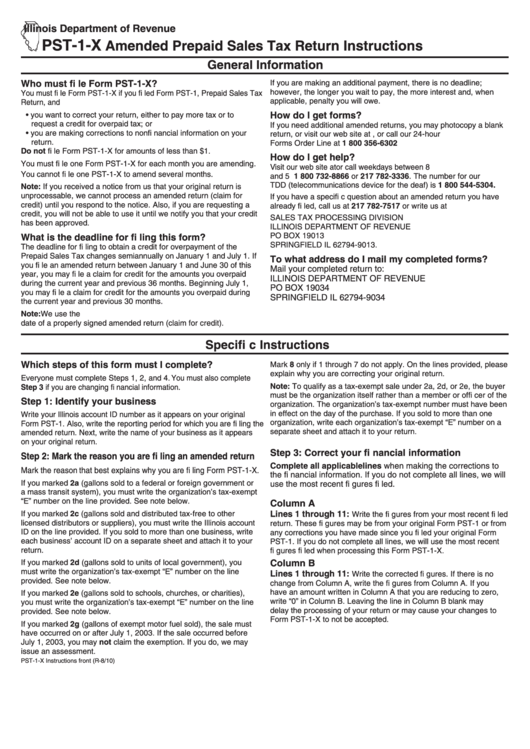

Pst-1-X Amended Prepaid Sales Tax Return Instructions

ADVERTISEMENT

Illinois Department of Revenue

PST-1-X

Amended Prepaid Sales Tax Return Instructions

General Information

Who must fi le Form PST-1-X?

If you are making an additional payment, there is no deadline;

however, the longer you wait to pay, the more interest and, when

You must fi le Form PST-1-X if you fi led Form PST-1, Prepaid Sales Tax

applicable, penalty you will owe.

Return, and

• you want to correct your return, either to pay more tax or to

How do I get forms?

request a credit for overpaid tax; or

If you need additional amended returns, you may photocopy a blank

• you are making corrections to nonfi nancial information on your

return, or visit our web site at tax.illinois.gov, or call our 24-hour

return.

Forms Order Line at 1 800 356-6302

Do not fi le Form PST-1-X for amounts of less than $1.

How do I get help?

You must fi le one Form PST-1-X for each month you are amending.

Visit our web site at tax.illinois.gov or call weekdays between 8 a.m.

You cannot fi le one PST-1-X to amend several months.

and 5 p.m. at 1 800 732-8866 or 217 782-3336. The number for our

TDD (telecommunications device for the deaf) is 1 800 544-5304.

Note: If you received a notice from us that your original return is

unprocessable, we cannot process an amended return (claim for

If you have a specifi c question about an amended return you have

credit) until you respond to the notice. Also, if you are requesting a

already fi led, call us at 217 782-7517 or write us at

credit, you will not be able to use it until we notify you that your credit

SALES TAX PROCESSING DIVISION

has been approved.

ILLINOIS DEPARTMENT OF REVENUE

PO BOX 19013

What is the deadline for fi ling this form?

SPRINGFIELD IL 62794-9013.

The deadline for fi ling to obtain a credit for overpayment of the

Prepaid Sales Tax changes semiannually on January 1 and July 1. If

To what address do I mail my completed forms?

you fi le an amended return between January 1 and June 30 of this

Mail your completed return to:

year, you may fi le a claim for credit for the amounts you overpaid

ILLINOIS DEPARTMENT OF REVENUE

during the current year and previous 36 months. Beginning July 1,

PO BOX 19034

you may fi le a claim for credit for the amounts you overpaid during

SPRINGFIELD IL 62794-9034

the current year and previous 30 months.

Note: We use the U.S. Postal Service postmark date as the fi ling

date of a properly signed amended return (claim for credit).

Specifi c Instructions

Which steps of this form must I complete?

Mark 8 only if 1 through 7 do not apply. On the lines provided, please

explain why you are correcting your original return.

Everyone must complete Steps 1, 2, and 4. You must also complete

Note: To qualify as a tax-exempt sale under 2a, 2d, or 2e, the buyer

Step 3 if you are changing fi nancial information.

must be the organization itself rather than a member or offi cer of the

Step 1: Identify your business

organization. The organization’s tax-exempt number must have been

in effect on the day of the purchase. If you sold to more than one

Write your Illinois account ID number as it appears on your original

organization, write each organization’s tax-exempt “E” number on a

Form PST-1. Also, write the reporting period for which you are fi ling the

separate sheet and attach it to your return.

amended return. Next, write the name of your business as it appears

on your original return.

Step 3: Correct your fi nancial information

Step 2: Mark the reason you are fi ling an amended return

Complete all applicable lines when making the corrections to

Mark the reason that best explains why you are fi ling Form PST-1-X.

the fi nancial information. If you do not complete all lines, we will

If you marked 2a (gallons sold to a federal or foreign government or

use the most recent fi gures fi led.

a mass transit system), you must write the organization’s tax-exempt

“E” number on the line provided. See note below.

Column A

If you marked 2c (gallons sold and distributed tax-free to other

Lines 1 through 11:

Write the fi gures from your most recent fi led

licensed distributors or suppliers), you must write the Illinois account

return. These fi gures may be from your original Form PST-1 or from

ID on the line provided. If you sold to more than one business, write

any corrections you have made since you fi led your original Form

each business’ account ID on a separate sheet and attach it to your

PST-1. If you do not complete all lines, we will use the most recent

return.

fi gures fi led when processing this Form PST-1-X.

If you marked 2d (gallons sold to units of local government), you

Column B

must write the organization’s tax-exempt “E” number on the line

Lines 1 through 11:

Write the corrected fi gures. If there is no

provided. See note below.

change from Column A, write the fi gures from Column A. If you

have an amount written in Column A that you are reducing to zero,

If you marked 2e (gallons sold to schools, churches, or charities),

write “0” in Column B. Leaving the line in Column B blank may

you must write the organization’s tax-exempt “E” number on the line

delay the processing of your return or may cause your changes to

provided. See note below.

Form PST-1-X to not be accepted.

If you marked 2g (gallons of exempt motor fuel sold), the sale must

have occurred on or after July 1, 2003. If the sale occurred before

July 1, 2003, you may not claim the exemption. If you do, we may

issue an assessment.

PST-1-X Instructions front (R-8/10)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2