Form Tc-40 Individual Income Tax Instructions - 2016

ADVERTISEMENT

28

2016 Utah TC-40 Instructions

TC-40W - Utah Withholding Tax Schedule

You must claim Utah withholding tax credits by complet-

Add the amounts of Utah withholding tax from all lines 7 and

ing form TC-40W and attaching it to your return.

enter the total at the bottom of TC-40W, page 1 and on form

TC-40, page 2, line 33.

Do not send copies of your W-2s, 1099s, TC-675Rs, and

Utah Schedule K-1 with your Utah return. Keep all these

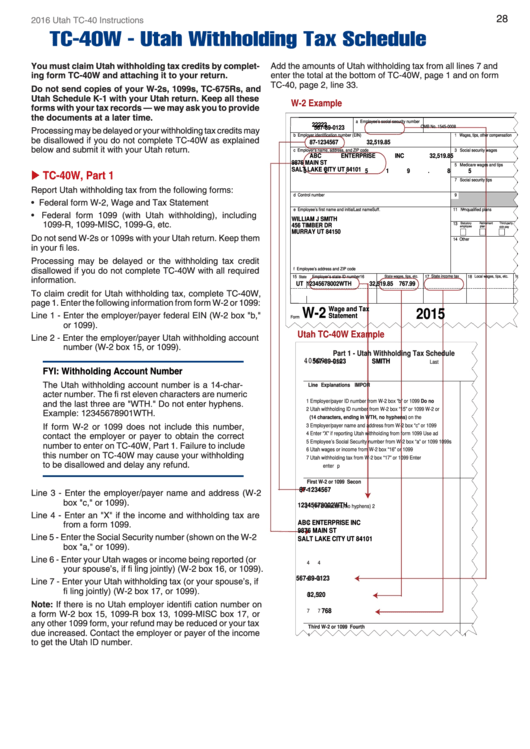

W-2 Example

forms with your tax records — we may ask you to provide

the documents at a later time.

a Employee’s social security number

22222

OMB No. 1545-0008

567-89-0123

Processing may be delayed or your withholding tax credits may

b Employer identification number (EIN)

1 Wages, tips, other compensation

be disallowed if you do not complete TC-40W as explained

87-1234567

32,519.85

below and submit it with your Utah return.

c Employer’s name, address, and ZIP code

3 Social security wages

ABC ENTERPRISE INC

32,519.85

9876 MAIN ST

5 Medicare wages and tips

SALT LAKE CITY UT 84101

32,519.85

TC-40W, Part 1

7 Social security tips

Report Utah withholding tax from the following forms:

d Control number

9

•

Federal form W-2, Wage and Tax Statement

e Employee’s first name and initial

Last name

Suff.

11 Nonqualified plans

•

Federal form 1099 (with Utah withholding), including

WILLIAM J SMITH

1099-R, 1099-MISC, 1099-G, etc.

13

Statutory

Retirement

Third-party

456 TIMBER DR

employee

plan

sick pay

MURRAY UT 84150

Do not send W-2s or 1099s with your Utah return. Keep them

14 Other

in your fi les.

Processing may be delayed or the withholding tax credit

disallowed if you do not complete TC-40W with all required

f Employee’s address and ZIP code

15

State

Employer’s state ID number

16

State wages, tips, etc.

17 State income tax

18

Local wages, tips, etc.

19

information.

UT

12345678002WTH

32,519.85

767.99

To claim credit for Utah withholding tax, complete TC-40W,

page 1. Enter the following information from form W-2 or 1099:

Wage and Tax

W-2

2015

Line 1 - Enter the employer/payer federal EIN (W-2 box "b,"

Statement

Form

or 1099).

Utah TC-40W Example

Line 2 - Enter the employer/payer Utah withholding account

number (W-2 box 15, or 1099).

Part 1 - Utah Withholding Tax Schedule

40509

567-89-0123

SMITH

SSN

Last name

FYI: Withholding Account Number

USTC ORIGINAL FORM

The Utah withholding account number is a 14-char-

Line Explanations

IMPOR

acter number. The fi rst eleven characters are numeric

1 Employer/payer ID number from W-2 box “b” or 1099

Do no

and the last three are "WTH." Do not enter hyphens.

2 Utah withholding ID number from W-2 box “15” or 1099

W-2 or

Example: 12345678901WTH.

(14 characters, ending in WTH, no hyphens)

on the

3 Employer/payer name and address from W-2 box “c” or 1099

If form W-2 or 1099 does not include this number,

4 Enter “X” if reporting Utah withholding from form 1099

Use ad

contact the employer or payer to obtain the correct

5 Employee’s Social Security number from W-2 box “a” or 1099

1099s

number to enter on TC-40W, Part 1. Failure to include

6 Utah wages or income from W-2 box “16” or 1099

this number on TC-40W may cause your withholding

7 Utah withholding tax from W-2 box “17” or 1099

Enter

to be disallowed and delay any refund.

enter p

First W-2 or 1099

Secon

87-1234567

1

1

Line 3 - Enter the employer/payer name and address (W-2

box "c," or 1099).

12345678002WTH

2

(14 characters, no hyphens)

2

Line 4 - Enter an "X" if the income and withholding tax are

ABC ENTERPRISE INC

3

3

from a form 1099.

9876 MAIN ST

Line 5 - Enter the Social Security number (shown on the W-2

SALT LAKE CITY UT 84101

box "a," or 1099).

Line 6 - Enter your Utah wages or income being reported (or

4

4

your spouse’s, if fi ling jointly) (W-2 box 16, or 1099).

567-89-0123

5

5

Line 7 - Enter your Utah withholding tax (or your spouse’s, if

fi ling jointly) (W-2 box 17, or 1099).

32,520

6

6

Note: If there is no Utah employer identifi cation number on

768

7

7

a form W-2 box 15, 1099-R box 13, 1099-MISC box 17, or

any other 1099 form, your refund may be reduced or your tax

Third W-2 or 1099

Fourth

due increased. Contact the employer or payer of the income

1

1

to get the Utah ID number.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2