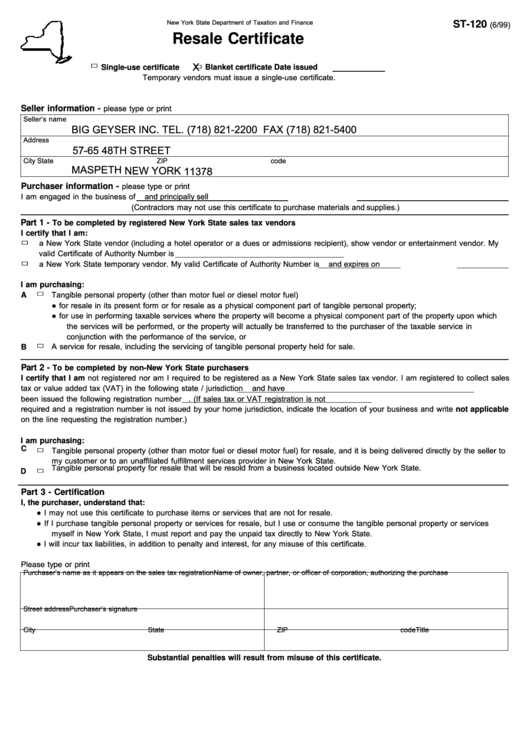

Resale Certificate

ADVERTISEMENT

New York State Department of Taxation and Finance

ST-120

(6/99)

Resale Certificate

□ Single-use certificate

X

□ Blanket certificate

Date issued

Temporary vendors must issue a single-use certificate.

please type or print

Seller information -

Seller’s name

BIG GEYSER INC.

TEL. (718) 821-2200 FAX (718) 821-5400

Address

57-65 48TH STREET

City

State

ZIP code

MASPETH

NEW YORK

11378

please type or print

Purchaser information -

I am engaged in the business of

and principally sell

(Contractors may not use this certificate to purchase materials and supplies.)

Part 1 -

To be completed by registered New York State sales tax vendors

I certify that I am:

□

a New York State vendor (including a hotel operator or a dues or admissions recipient), show vendor or entertainment vendor. My

valid Certificate of Authority Number is

□

a New York State temporary vendor. My valid Certificate of Authority Number is

and expires on

I am purchasing:

□ Tangible personal property (other than motor fuel or diesel motor fuel)

A

●

for resale in its present form or for resale as a physical component part of tangible personal property;

●

for use in performing taxable services where the property will become a physical component part of the property upon which

the services will be performed, or the property will actually be transferred to the purchaser of the taxable service in

conjunction with the performance of the service, or

□ A service for resale, including the servicing of tangible personal property held for sale.

B

Part 2 -

To be completed by non-New York State purchasers

I certify that I am not registered nor am I required to be registered as a New York State sales tax vendor. I am registered to collect sales

tax or value added tax (VAT) in the following state / jurisdiction

and have

been issued the following registration number

. (If sales tax or VAT registration is not

required and a registration number is not issued by your home jurisdiction, indicate the location of your business and write not applicable

on the line requesting the registration number.)

I am purchasing:

□ Tangible personal property (other than motor fuel or diesel motor fuel) for resale, and it is being delivered directly by the seller to

C

my customer or to an unaffiliated fulfillment services provider in New York State.

□

Tangible personal property for resale that will be resold from a business located outside New York State.

D

Part 3 - Certification

I, the purchaser, understand that:

●

I may not use this certificate to purchase items or services that are not for resale.

●

If I purchase tangible personal property or services for resale, but I use or consume the tangible personal property or services

myself in New York State, I must report and pay the unpaid tax directly to New York State.

●

I will incur tax liabilities, in addition to penalty and interest, for any misuse of this certificate.

Please type or print

Purchaser’s name as it appears on the sales tax registration

Name of owner, partner, or officer of corporation, authorizing the purchase

Street address

Purchaser’s signature

City

State

ZIP code

Title

Substantial penalties will result from misuse of this certificate.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2