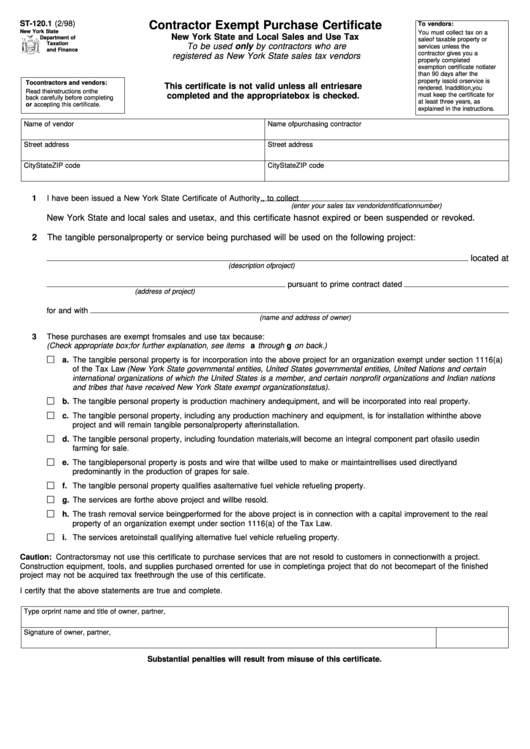

Contractor Exempt Purchase Certificate

ADVERTISEMENT

ST-120.1 (2/98)

Contractor Exempt Purchase Certificate

To vendors:

New York State

You must collect tax on a

New York State and Local Sales and Use Tax

Department of

sale of taxable property or

Taxation

To be used only by contractors who are

services unless the

and Finance

contractor gives you a

registered as New York State sales tax vendors

properly completed

exemption certificate not later

than 90 days after the

property is sold or service is

To contractors and vendors:

This certificate is not valid unless all entries are

rendered. In addition, you

Read the instructions on the

completed and the appropriate box is checked.

must keep the certificate for

back carefully before completing

at least three years, as

or accepting this certificate.

explained in the instructions.

Name of vendor

Name of purchasing contractor

Street address

Street address

City

State

ZIP code

City

State

ZIP code

1

I have been issued a New York State Certificate of Authority,

, to collect

(enter your sales tax vendor identification number)

New York State and local sales and use tax, and this certificate has not expired or been suspended or revoked.

2

The tangible personal property or service being purchased will be used on the following project:

located at

(description of project)

pursuant to prime contract dated

(address of project)

for and with

(name and address of owner)

3

These purchases are exempt from sales and use tax because:

(Check appropriate box; for further explanation, see items a through g on back.)

a. The tangible personal property is for incorporation into the above project for an organization exempt under section 1116(a)

of the Tax Law (New York State governmental entities, United States governmental entities, United Nations and certain

international organizations of which the United States is a member, and certain nonprofit organizations and Indian nations

and tribes that have received New York State exempt organization status).

b. The tangible personal property is production machinery and equipment, and will be incorporated into real property.

c. The tangible personal property, including any production machinery and equipment, is for installation within the above

project and will remain tangible personal property after installation.

d. The tangible personal property, including foundation materials, will become an integral component part of a silo used in

farming for sale.

e. The tangible personal property is posts and wire that will be used to make or maintain trellises used directly and

predominantly in the production of grapes for sale.

f. The tangible personal property qualifies as alternative fuel vehicle refueling property.

g. The services are for the above project and will be resold.

h. The trash removal service being performed for the above project is in connection with a capital improvement to the real

property of an organization exempt under section 1116(a) of the Tax Law.

i. The services are to install qualifying alternative fuel vehicle refueling property.

Caution: Contractors may not use this certificate to purchase services that are not resold to customers in connection with a project.

Construction equipment, tools, and supplies purchased or rented for use in completing a project that do not become part of the finished

project may not be acquired tax free through the use of this certificate.

I certify that the above statements are true and complete.

Type or print name and title of owner, partner, etc. of purchasing contractor

Signature of owner, partner, etc.

Date prepared

Substantial penalties will result from misuse of this certificate.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2