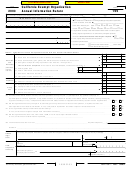

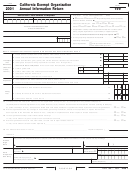

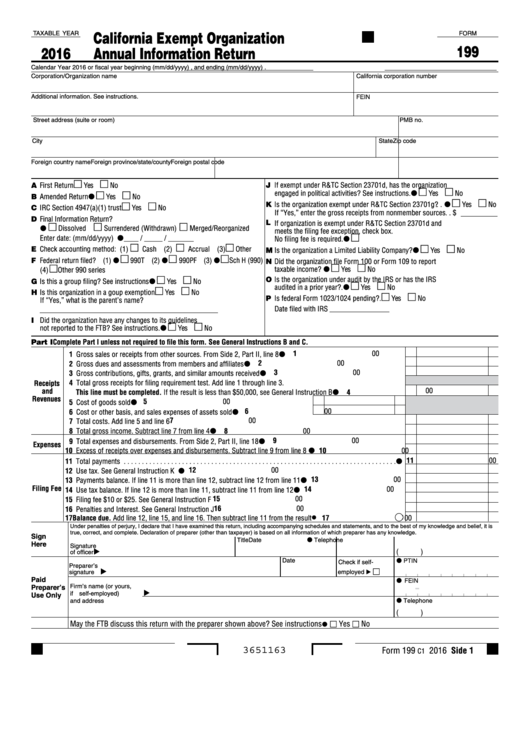

California Exempt Organization

TAXABLE YEAR

FORM

199

2016

Annual Information Return

Calendar Year 2016 or fiscal year beginning (mm/dd/yyyy)

, and ending (mm/dd/yyyy)

.

Corporation/Organization name

California corporation number

Additional information. See instructions.

FEIN

Street address (suite or room)

PMB no.

City

State

Zip code

Foreign country name

Foreign province/state/county

Foreign postal code

J If exempt under R&TC Section 23701d, has the organization

A First Return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

engaged in political activities? See instructions. . . . . . . . . .

Yes

No

B Amended Return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

K Is the organization exempt under R&TC Section 23701g? . .

Yes

No

C IRC Section 4947(a)(1) trust . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

If “Yes,” enter the gross receipts from nonmember sources . . $

D Final Information Return?

L If organization is exempt under R&TC Section 23701d and

Dissolved

Surrendered (Withdrawn)

Merged/Reorganized

meets the filing fee exception, check box.

Enter date: (mm/dd/yyyy)

____ / _____ / _______

No filing fee is required. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

E Check accounting method: (1)

Cash (2)

Accrual (3)

Other

M Is the organization a Limited Liability Company? . . . . . . . . .

Yes

No

F Federal return filed? (1)

990T (2)

990PF (3)

Sch H (990)

N Did the organization file Form 100 or Form 109 to report

taxable income? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

(4)

Other 990 series

O Is the organization under audit by the IRS or has the IRS

G Is this a group filing? See instructions . . . . . . . . . . . . . . . . .

Yes

No

audited in a prior year?. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

H Is this organization in a goup exemption . . . . . . . . . . . . . . . . .

Yes

No

P Is federal Form 1023/1024 pending?. . . . . . . . . . . . . . . . . . . .

Yes

No

If “Yes,” what is the parent’s name?

Date filed with IRS

I Did the organization have any changes to its guidelines

not reported to the FTB? See instructions. . . . . . . . . . . . . . .

Yes

No

Part I Complete Part I unless not required to file this form. See General Instructions B and C.

1

00

1 Gross sales or receipts from other sources. From Side 2, Part II, line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

00

2 Gross dues and assessments from members and affiliates . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

00

3 Gross contributions, gifts, grants, and similar amounts received . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4 Total gross receipts for filing requirement test. Add line 1 through line 3.

Receipts

00

and

This line must be completed. If the result is less than $50,000, see General Instruction B. . . . . . . . . . . . . . . . .

4

Revenues

5

00

5 Cost of goods sold . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

00

6 Cost or other basis, and sales expenses of assets sold . . . . . . . . . . . . . . . . . . .

7

00

7 Total costs. Add line 5 and line 6. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8 Total gross income. Subtract line 7 from line 4. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

00

9

00

9 Total expenses and disbursements. From Side 2, Part II, line 18 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Expenses

10 Excess of receipts over expenses and disbursements. Subtract line 9 from line 8 . . . . . . . . . . . . . . . . . . . . . . . .

10

00

11

00

11 Total payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

00

12 Use tax. See General Instruction K . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

00

13 Payments balance. If line 11 is more than line 12, subtract line 12 from line 11 . . . . . . . . . . . . . . . . . . . . . . . . .

Filing Fee

14

00

14 Use tax balance. If line 12 is more than line 11, subtract line 11 from line 12 . . . . . . . . . . . . . . . . . . . . . . . . . . .

15 Filing fee $10 or $25. See General Instruction F . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

00

16 Penalties and Interest. See General Instruction J . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

00

17 Balance due. Add line 12, line 15, and line 16. Then subtract line 11 from the result . . . . . . . . . . . . . . . . . . . .

17

00

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is

true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Sign

Title

Date

Telephone

Here

Signature

(

)

of officer

Date

PTIN

Check if self-

Preparer’s

signature

employed

Paid

FEIN

-

Firm’s name (or yours,

Preparer’s

if self-employed)

Use Only

Telephone

and address

(

)

May the FTB discuss this return with the preparer shown above? See instructions . . . . . . . . . . . . . . . . . . .

Yes

No

3651163

Form 199

2016 Side 1

C1

1

1 2

2