Instructions For Form 199

ADVERTISEMENT

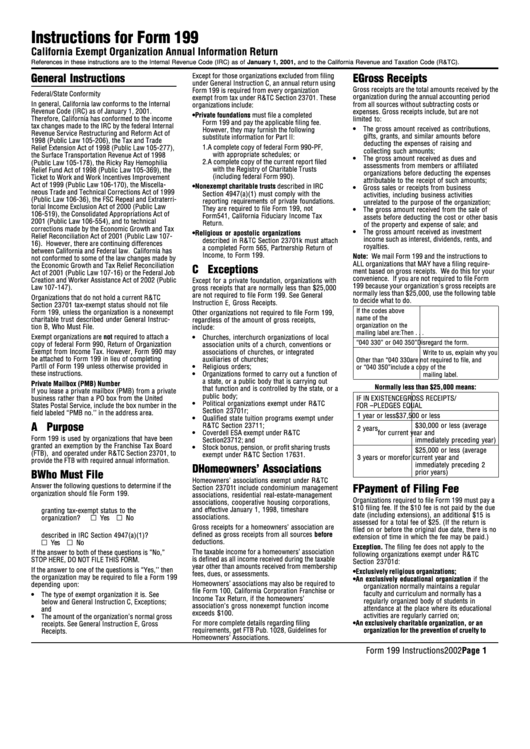

Instructions for Form 199

California Exempt Organization Annual Information Return

References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2001, and to the California Revenue and Taxation Code (R&TC).

Except for those organizations excluded from filing

General Instructions

E Gross Receipts

under General Instruction C, an annual return using

Gross receipts are the total amounts received by the

Form 199 is required from every organization

Federal/State Conformity

organization during the annual accounting period

exempt from tax under R&TC Section 23701. These

In general, California law conforms to the Internal

from all sources without subtracting costs or

organizations include:

Revenue Code (IRC) as of January 1, 2001.

expenses. Gross receipts include, but are not

•

Private foundations must file a completed

Therefore, California has conformed to the income

limited to:

Form 199 and pay the applicable filing fee.

tax changes made to the IRC by the federal Internal

•

The gross amount received as contributions,

However, they may furnish the following

Revenue Service Restructuring and Reform Act of

gifts, grants, and similar amounts before

substitute information for Part II:

1998 (Public Law 105-206), the Tax and Trade

deducting the expenses of raising and

1. A complete copy of federal Form 990-PF,

Relief Extension Act of 1998 (Public Law 105-277),

collecting such amounts;

with appropriate schedules; or

the Surface Transportation Revenue Act of 1998

•

The gross amount received as dues and

2. A complete copy of the current report filed

(Public Law 105-178), the Ricky Ray Hemophilia

assessments from members or affiliated

with the Registry of Charitable Trusts

Relief Fund Act of 1998 (Public Law 105-369), the

organizations before deducting the expenses

(including federal Form 990).

Ticket to Work and Work Incentives Improvement

attributable to the receipt of such amounts;

Act of 1999 (Public Law 106-170), the Miscella-

•

Nonexempt charitable trusts described in IRC

•

Gross sales or receipts from business

neous Trade and Technical Corrections Act of 1999

Section 4947(a)(1) must comply with the

activities, including business activities

(Public Law 106-36), the FSC Repeal and Extraterri-

reporting requirements of private foundations.

unrelated to the purpose of the organization;

torial Income Exclusion Act of 2000 (Public Law

They are required to file Form 199, not

•

The gross amount received from the sale of

106-519), the Consolidated Appropriations Act of

Form 541, California Fiduciary Income Tax

assets before deducting the cost or other basis

2001 (Public Law 106-554), and to technical

Return.

of the property and expense of sale; and

corrections made by the Economic Growth and Tax

•

The gross amount received as investment

•

Religious or apostolic organizations

Relief Reconciliation Act of 2001 (Public Law 107-

income such as interest, dividends, rents, and

described in R&TC Section 23701k must attach

16). However, there are continuing differences

royalties.

a completed Form 565, Partnership Return of

between California and Federal law. California has

Income, to Form 199.

Note: We mail Form 199 and the instructions to

not conformed to some of the law changes made by

ALL organizations that MAY have a filing require-

the Economic Growth and Tax Relief Reconciliation

C Exceptions

ment based on gross receipts. We do this for your

Act of 2001 (Public Law 107-16) or the Federal Job

convenience. If you are not required to file Form

Creation and Worker Assistance Act of 2002 (Public

Except for a private foundation, organizations with

199 because your organization's gross receipts are

Law 107-147).

gross receipts that are normally less than $25,000

normally less than $25,000, use the following table

are not required to file Form 199. See General

Organizations that do not hold a current R&TC

to decide what to do.

Instruction E, Gross Receipts.

Section 23701 tax-exempt status should not file

If the codes above

Form 199, unless the organization is a nonexempt

Other organizations not required to file Form 199,

name of the

charitable trust described under General Instruc-

regardless of the amount of gross receipts,

organization on the

tion B, Who Must File.

include:

mailing label are:

Then . . .

Exempt organizations are not required to attach a

•

Churches, interchurch organizations of local

“040 330” or 040 350” Disregard the form.

copy of federal Form 990, Return of Organization

association units of a church, conventions or

Exempt from Income Tax. However, Form 990 may

associations of churches, or integrated

Write to us, explain why you

be attached to Form 199 in lieu of completing

auxiliaries of churches;

Other than “040 330

are not required to file, and

Part II of Form 199 unless otherwise provided in

•

Religious orders;

or “040 350”

include a copy of the

these instructions.

•

Organizations formed to carry out a function of

mailing label.

a state, or a public body that is carrying out

Private Mailbox (PMB) Number

Normally less than $25,000 means:

that function and is controlled by the state, or a

If you lease a private mailbox (PMB) from a private

public body;

business rather than a PO box from the United

IF IN EXISTENCE

GROSS RECEIPTS/

•

Political organizations exempt under R&TC

States Postal Service, include the box number in the

FOR –

PLEDGES EQUAL

Section 23701r;

field labeled “PMB no.’’ in the address area.

1 year or less

$37,500 or less

•

Qualified state tuition programs exempt under

A Purpose

R&TC Section 23711;

$30,000 or less (average

2 years

•

Coverdell ESA exempt under R&TC

for current year and

Form 199 is used by organizations that have been

Section 23712; and

immediately preceding year)

granted an exemption by the Franchise Tax Board

•

Stock bonus, pension, or profit sharing trusts

$25,000 or less (average

(FTB), and operated under R&TC Section 23701, to

exempt under R&TC Section 17631.

3 years or more

for current year and

provide the FTB with required annual information.

immediately preceding 2

D Homeowners’ Associations

prior years)

B Who Must File

Homeowners’ associations exempt under R&TC

Answer the following questions to determine if the

F Payment of Filing Fee

Section 23701t include condominium management

organization should file Form 199.

associations, residential real-estate-management

Organizations required to file Form 199 must pay a

associations, cooperative housing corporations,

1. Have you received a letter from the FTB

$10 filing fee. If the $10 fee is not paid by the due

and effective January 1, 1998, timeshare

granting tax-exempt status to the

date (including extensions), an additional $15 is

associations.

organization?

Yes

No

assessed for a total fee of $25. (If the return is

Gross receipts for a homeowners’ association are

2. Are you a nonexempt charitable trust as

filed on or before the original due date, there is no

defined as gross receipts from all sources before

described in IRC Section 4947(a)(1)?

extension of time in which the fee may be paid.)

deductions.

Yes

No

Exception. The filing fee does not apply to the

The taxable income for a homeowners’ association

If the answer to both of these questions is “No,”

following organizations exempt under R&TC

is defined as all income received during the taxable

STOP HERE, DO NOT FILE THIS FORM.

Section 23701d:

year other than amounts received from membership

If the answer to one of the questions is “Yes,’’ then

•

Exclusively religious organizations;

fees, dues, or assessments.

the organization may be required to file a Form 199

•

An exclusively educational organization if the

Homeowners’ associations may also be required to

depending upon:

organization normally maintains a regular

file Form 100, California Corporation Franchise or

faculty and curriculum and normally has a

•

The type of exempt organization it is. See

Income Tax Return, if the homeowners’

regularly organized body of students in

below and General Instruction C, Exceptions;

association’s gross nonexempt function income

attendance at the place where its educational

and

exceeds $100.

activities are regularly carried on;

•

The amount of the organization’s normal gross

For more complete details regarding filing

•

An exclusively charitable organization, or an

receipts. See General Instruction E, Gross

requirements, get FTB Pub. 1028, Guidelines for

organization for the prevention of cruelty to

Receipts.

Homeowners’ Associations.

Form 199 Instructions 2002 Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4