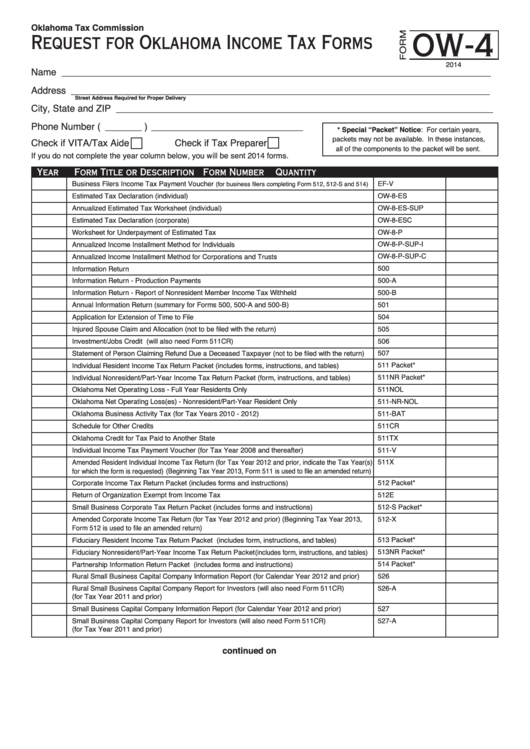

Request For Oklahoma Income Tax Forms

ADVERTISEMENT

Oklahoma Tax Commission

OW-4

Request for Oklahoma Income Tax Forms

2014

Name __________________________________________________________________________________

Address ________________________________________________________________________________

Street Address Required for Proper Delivery

City, State and ZIP ________________________________________________________________________

Phone Number

( _______ ) _____________________________

* Special “Packet” Notice: For certain years,

packets may not be available. In these instances,

Check if VITA/Tax Aide

Check if Tax Preparer

all of the components to the packet will be sent.

If you do not complete the year column below, you will be sent 2014 forms.

Year

Form Title or Description

Form Number

Quantity

Business Filers Income Tax Payment Voucher

EF-V

(for business filers completing Form 512, 512-S and 514)

OW-8-ES

Estimated Tax Declaration (individual)

Annualized Estimated Tax Worksheet (individual)

OW-8-ES-SUP

Estimated Tax Declaration (corporate)

OW-8-ESC

OW-8-P

Worksheet for Underpayment of Estimated Tax

Annualized Income Installment Method for Individuals

OW-8-P-SUP-I

Annualized Income Installment Method for Corporations and Trusts

OW-8-P-SUP-C

Information Return

500

Information Return - Production Payments

500-A

500-B

Information Return - Report of Nonresident Member Income Tax Withheld

Annual Information Return (summary for Forms 500, 500-A and 500-B)

501

Application for Extension of Time to File

504

505

Injured Spouse Claim and Allocation (not to be filed with the return)

Investment/Jobs Credit (will also need Form 511CR)

506

Statement of Person Claiming Refund Due a Deceased Taxpayer (not to be filed with the return)

507

Individual Resident Income Tax Return Packet (includes forms, instructions, and tables)

511 Packet*

Individual Nonresident/Part-Year Income Tax Return Packet (form, instructions, and tables)

511NR Packet*

511NOL

Oklahoma Net Operating Loss - Full Year Residents Only

Oklahoma Net Operating Loss(es) - Nonresident/Part-Year Resident Only

511-NR-NOL

Oklahoma Business Activity Tax (for Tax Years 2010 - 2012)

511-BAT

511CR

Schedule for Other Credits

Oklahoma Credit for Tax Paid to Another State

511TX

511-V

Individual Income Tax Payment Voucher (for Tax Year 2008 and thereafter)

Amended Resident Individual Income Tax Return (for Tax Year 2012 and prior, indicate the Tax Year(s)

511X

for which the form is requested) (Beginning Tax Year 2013, Form 511 is used to file an amended return)

Corporate Income Tax Return Packet (includes forms and instructions)

512 Packet*

512E

Return of Organization Exempt from Income Tax

Small Business Corporate Tax Return Packet (includes forms and instructions)

512-S Packet*

512-X

Amended Corporate Income Tax Return (for Tax Year 2012 and prior) (Beginning Tax Year 2013,

Form 512 is used to file an amended return)

Fiduciary Resident Income Tax Return Packet (includes form, instructions, and tables)

513 Packet*

Fiduciary Nonresident/Part-Year Income Tax Return Packet (includes form, instructions, and tables)

513NR Packet*

514 Packet*

Partnership Information Return Packet (includes forms and instructions)

Rural Small Business Capital Company Information Report (for Calendar Year 2012 and prior)

526

526-A

Rural Small Business Capital Company Report for Investors (will also need Form 511CR)

(for Tax Year 2011 and prior)

527

Small Business Capital Company Information Report (for Calendar Year 2012 and prior)

Small Business Capital Company Report for Investors (will also need Form 511CR)

527-A

(for Tax Year 2011 and prior)

continued on back...

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2