Fafsa Worksheet

ADVERTISEMENT

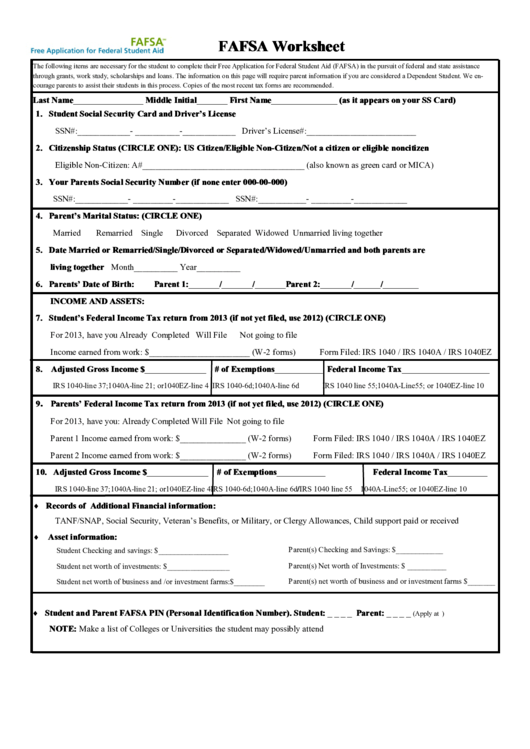

FAFSA Worksheet

The following items are necessary for the student to complete their Free Application for Federal Student Aid (FAFSA) in the pursuit of federal and state assistance

through grants, work study, scholarships and loans. The information on this page will require parent information if you are considered a Dependent Student. We en-

courage parents to assist their students in this process. Copies of the most recent tax forms are recommended.

Last Name________________ Middle Initial_______ First Name_______________ (as it appears on your SS Card)

1. Student Social Security Card and Driver’s License

SSN#:____________- __________-____________

Driver’s License#:_________________________

2. Citizenship Status (CIRCLE ONE): US Citizen/Eligible Non-Citizen/Not a citizen or eligible noncitizen

Eligible Non-Citizen: A#_____________________________________ (also known as green card or MICA)

3. Your Parents Social Security Number (if none enter 000-00-000)

SSN#:____________- _________-____________

SSN#:___________- _________-____________

4. Parent’s Marital Status: (CIRCLE ONE)

Married

Remarried

Single

Divorced

Separated

Widowed

Unmarried living together

5. Date Married or Remarried/Single/Divorced or Separated/Widowed/Unmarried and both parents are

living together Month__________ Year__________

6. Parents’ Date of Birth:

Parent 1:_______/_______/_______

Parent 2:_______/______/________

INCOME AND ASSETS:

7. Student’s Federal Income Tax return from 2013 (if not yet filed, use 2012) (CIRCLE ONE)

For 2013, have you Already Completed

Will File

Not going to file

Income earned from work: $_______________________ (W-2 forms)

Form Filed: IRS 1040 / IRS 1040A / IRS 1040EZ

8. Adjusted Gross Income $______________ # of Exemptions___________ Federal Income Tax____________________

IRS 1040-line 37;1040A-line 21; or1040EZ-line 4 IRS 1040-6d;1040A-line 6d

IRS 1040 line 55;1040A-Line55; or 1040EZ-line 10

.

9

Parents’ Federal Income Tax return from 2013 (if not yet filed, use 2012) (CIRCLE ONE)

For 2013, have you: Already Completed

Will File

Not going to file

Parent 1 Income earned from work: $_______________ (W-2 forms)

Form Filed: IRS 1040 / IRS 1040A / IRS 1040EZ

Parent 2 Income earned from work: $_______________ (W-2 forms)

Form Filed: IRS 1040 / IRS 1040A / IRS 1040EZ

10. Adjusted Gross Income $______________ # of Exemptions___________

Federal Income Tax_________

IRS 1040-line 37;1040A-line 21; or1040EZ-line 4 IRS 1040-6d;1040A-line 6d/IRS 1040 line 55 1040A-Line55; or 1040EZ-line 10

Records of Additional Financial information:

TANF/SNAP, Social Security, Veteran’s Benefits, or Military, or Clergy Allowances, Child support paid or received

Asset information:

Parent(s) Checking and Savings: $____________

Student Checking and savings: $__________________

Parent(s) Net worth of Investments: $ __________

Student net worth of investments: $________________

Parent(s) net worth of business and or investment farms $_______

Student net worth of business and /or investment farms:$________

Student and Parent FAFSA PIN (Personal Identification Number). Student: _ _ _ _ Parent: _ _ _ _

(Apply at )

NOTE: Make a list of Colleges or Universities the student may possibly attend

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2