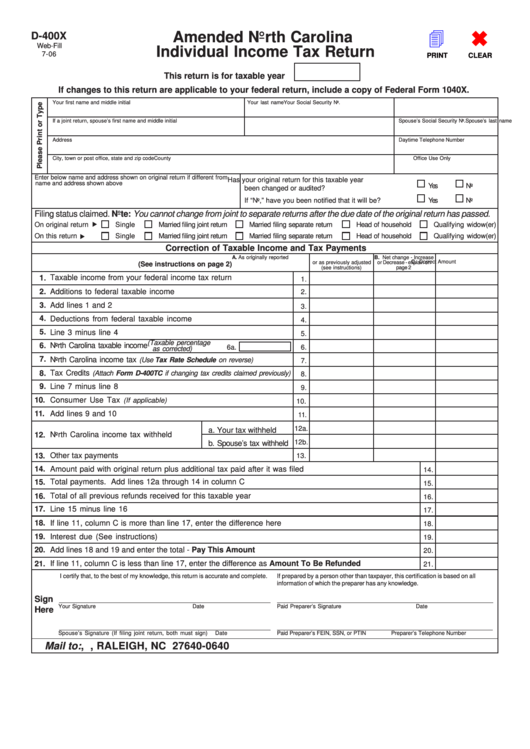

D-400x - Amended North Carolina Individual Income Tax Return

ADVERTISEMENT

4

Amended North Carolina

D-400X

Web-Fill

Individual Income Tax Return

7-06

PRINT

CLEAR

This return is for taxable year

If changes to this return are applicable to your federal return, include a copy of Federal Form 1040X.

Your first name and middle initial

Your last name

Your Social Security No.

If a joint return, spouse’s first name and middle initial

Spouse’s last name

Spouse’s Social Security No.

Address

Daytime Telephone Number

City, town or post office, state and zip code

County

Office Use Only

Enter below name and address shown on original return if different from

Has your original return for this taxable year

name and address shown above

Yes

No

been changed or audited?

If “No,” have you been notified that it will be?

Yes

No

Filing status claimed. Note: You cannot change from joint to separate returns after the due date of the original return has passed.

On original return

Single

Married filing joint return

Married filing separate return

Head of household

Qualifying widow(er)

On this return

Single

Married filing joint return

Married filing separate return

Head of household

Qualifying widow(er)

Correction of Taxable Income and Tax Payments

A. As originally reported

B. Net change - Increase

C. Correct Amount

or as previously adjusted

or Decrease - explain on

(See instructions on page 2)

(see instructions)

page 2

1.

Taxable income from your federal income tax return

1.

2.

Additions to federal taxable income

2.

3.

Add lines 1 and 2

3.

4.

Deductions from federal taxable income

4.

5.

Line 3 minus line 4

5.

(Taxable percentage

6.

North Carolina taxable income

6a.

6.

as corrected)

7.

North Carolina income tax

(Use Tax Rate Schedule on reverse)

7.

Tax Credits

8.

(Attach Form D-400TC if changing tax credits claimed previously)

8.

9.

Line 7 minus line 8

9.

10.

Consumer Use Tax

(If applicable)

10.

11.

Add lines 9 and 10

11.

12a.

a. Your tax withheld

12.

North Carolina income tax withheld

12b.

b. Spouse’s tax withheld

13.

Other tax payments

13.

14.

Amount paid with original return plus additional tax paid after it was filed

14.

15.

Total payments. Add lines 12a through 14 in column C

15.

Total of all previous refunds received for this taxable year

16.

16.

17.

Line 15 minus line 16

17.

18.

If line 11, column C is more than line 17, enter the difference here

18.

19.

Interest due (See instructions)

19.

20.

Add lines 18 and 19 and enter the total - Pay This Amount

20.

21.

If line 11, column C is less than line 17, enter the difference as Amount To Be Refunded

21.

I certify that, to the best of my knowledge, this return is accurate and complete.

If prepared by a person other than taxpayer, this certification is based on all

information of which the preparer has any knowledge.

Sign

Your Signature

Date

Paid Preparer’s Signature

Date

Here

Spouse’s Signature (If filing joint return, both must sign)

Date

Paid Preparer’s FEIN, SSN, or PTIN

Preparer’s Telephone Number

N.C. DEPT. OF REVENUE, P.O. BOX 25000, RALEIGH, NC 27640-0640

Mail to:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2