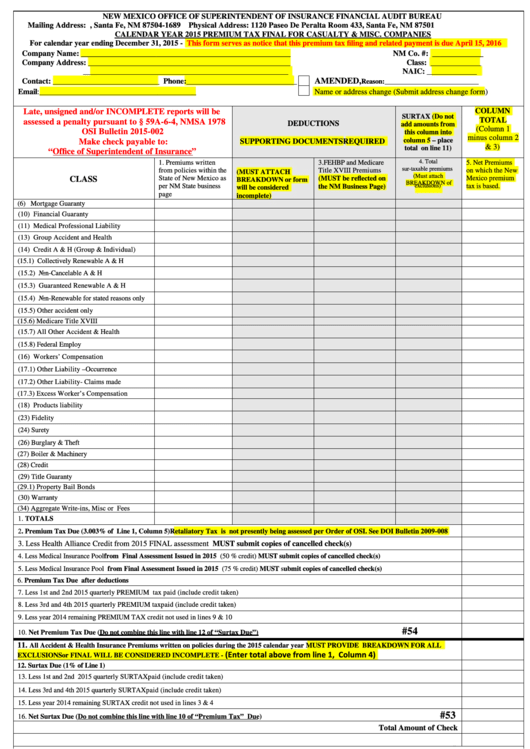

NEW MEXICO OFFICE OF SUPERINTENDENT OF INSURANCE FINANCIAL AUDIT BUREAU

Mailing Address: P.O. Box 1689 Room 433, Santa Fe, NM 87504-1689 Physical Address: 1120 Paseo De Peralta Room 433, Santa Fe, NM 87501

CALENDAR YEAR 2015 PREMIUM TAX FINAL FOR CASUALTY & MISC. COMPANIES

For calendar year ending December 31, 2015 -

This form serves as notice that this premium tax filing and related payment is due April 15, 2016

Company Name: ______________________________________________________

NM Co. #: _____________

Company Address: ____________________________________________________

Class: _____________

____________________________________________________

NAIC: _____________

AMENDED,

Contact: ___________________________ Phone:____________________________

Reason:___________________________

Email:________________________________________

Name or address change (Submit address change form)

Late, unsigned and/or INCOMPLETE reports will be

COLUMN

SURTAX (Do not

TOTAL

assessed a penalty pursuant to § 59A-6-4, NMSA 1978

DEDUCTIONS

add amounts from

(Column 1

OSI Bulletin 2015-002

this column into

minus column 2

column 5 – place

Make check payable to:

SUPPORTING DOCUMENTS REQUIRED

& 3)

total on line 11)

“Office of Superintendent of Insurance”

1. Premiums written

3.FEHBP and Medicare

4. Total

5. Net Premiums

2.Political Subdivisions

sur-taxable premiums

from policies within the

Title XVIII Premiums

on which the New

(MUST ATTACH

(Must attach

CLASS

State of New Mexico as

(MUST be reflected on

Mexico premium

BREAKDOWN or form

BREAKDOWN of

per NM State business

the NM Business Page)

tax is based.

will be considered

exclusions)

page

incomplete)

(6) Mortgage Guaranty

(10) Financial Guaranty

(11) Medical Professional Liability

(13) Group Accident and Health

(14) Credit A & H (Group & Individual)

(15.1) Collectively Renewable A & H

(15.2) Non-Cancelable A & H

(15.3) Guaranteed Renewable A & H

(15.4) Non-Renewable for stated reasons only

(15.5) Other accident only

(15.6) Medicare Title XVIII

(15.7) All Other Accident & Health

(15.8) Federal Employ

(16) Workers’ Compensation

(17.1) Other Liability –Occurrence

(17.2) Other Liability- Claims made

(17.3) Excess Worker’s Compensation

(18) Products liability

(23) Fidelity

(24) Surety

(26) Burglary & Theft

(27) Boiler & Machinery

(28) Credit

(29) Title Guaranty

(29.1) Property Bail Bonds

(30) Warranty

(34) Aggregate Write-ins, Misc or Fees

1. TOTALS

2. Premium Tax Due (3.003% of Line 1, Column 5) Retaliatory Tax is not presently being assessed per Order of OSI. See DOI Bulletin 2009-008

3. Less Health Alliance Credit from 2015 FINAL assessment MUST submit copies of cancelled check(s)

4. Less Medical Insurance Pool from Final Assessment Issued in 2015 (50 % credit) MUST submit copies of cancelled check(s)

5. Less Medical Insurance Pool from Final Assessment Issued in 2015 (75 % credit) MUST submit copies of cancelled check(s)

6. Premium Tax Due after deductions

7. Less 1st and 2nd 2015 quarterly PREMIUM tax paid (include credit taken)

8. Less 3rd and 4th 2015 quarterly PREMIUM tax paid (include credit taken)

9. Less year 2014 remaining PREMIUM TAX credit not used in lines 9 & 10

#54

10. Net Premium Tax Due (Do not combine this line with line 12 of “Surtax Due”)

11.

All Accident & Health Insurance Premiums written on policies during the 2015 calendar year MUST PROVIDE BREAKDOWN FOR ALL

(Enter total above from line 1, Column 4)

EXCLUSIONS or FINAL WILL BE CONSIDERED INCOMPLETE -

12. Surtax Due (1% of Line 1)

13. Less 1st and 2nd 2015 quarterly SURTAX paid (include credit taken)

14. Less 3rd and 4th 2015 quarterly SURTAX paid (include credit taken)

15. Less year 2014 remaining SURTAX credit not used in lines 3 & 4

#53

16. Net Surtax Due (Do not combine this line with line 10 of “Premium Tax” Due)

Total Amount of Check

Check #

I declare under penalty of perjury as representative(s) of the insurance company named above I have examined this return and accompanying schedules and statements

and to the best of knowledge and belief they are true and correct and complete.

____________________________________

Notary Seal

Secretary/Treasurer Authorized Signature

Notary Signature _________________________________

____________________________________

My Commission Expires ___________________________

President Authorized Signature

Subscribed and sworn before me this _____day of ____________, 20_____

NOTE: If this report is not signed by the officers of the company specifically named by title above, a signed and notarized jurat must be attached.

Form 301: 2015 Casualty Final Updated March 1, 2016

Postmarked _______Initials ________

1

1