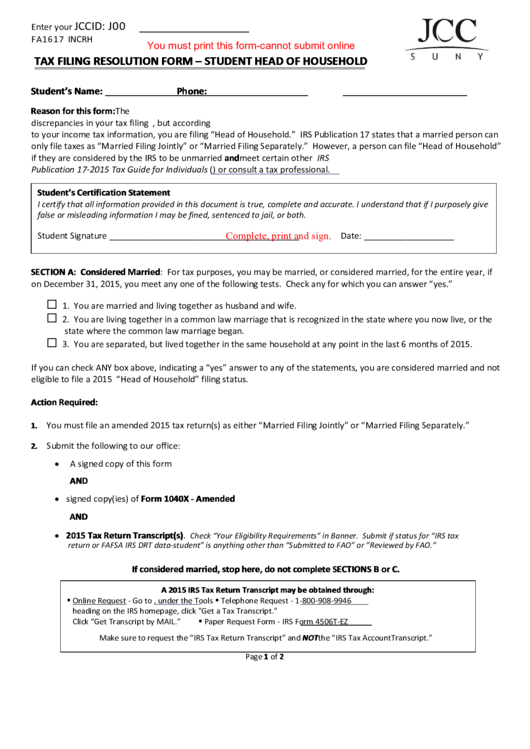

JCC ID: J00

Enter your

FA 1617 INCRH

You must print this form-cannot submit online

TAX FILING RESOLUTION FORM – STUDENT HEAD OF HOUSEHOLD

Student’s Name:

Phone:

Reason for this form: The U.S. Department of Education requires financial aid administrators to review and resolve

discrepancies in your tax filing status. Your FAFSA or other documentation indicates that you are married, but according

to your income tax information, you are filing “Head of Household.” IRS Publication 17 states that a married person can

only file taxes as “Married Filing Jointly” or “Married Filing Separately.” However, a person can file “Head of Household”

if they are considered by the IRS to be unmarried and meet certain other criteria. For more information refer to IRS

Publication 17-2015 Tax Guide for Individuals ( ) or consult a tax professional.

Student’s Certification Statement

I certify that all information provided in this document is true, complete and accurate. I understand that if I purposely give

false or misleading information I may be fined, sentenced to jail, or both.

Student Signature ________________________________________

Complete, print and sign.

Date: ___________________

SECTION A: Considered Married: For tax purposes, you may be married, or considered married, for the entire year, if

on December 31, 2015, you meet any one of the following tests. Check any for which you can answer “yes.”

1. You are married and living together as husband and wife.

2. You are living together in a common law marriage that is recognized in the state where you now live, or the

state where the common law marriage began.

3. You are separated, but lived together in the same household at any point in the last 6 months of 2015.

If you can check ANY box above, indicating a “yes” answer to any of the statements, you are considered married and not

eligible to file a 2015 U.S. Income Tax Return with the “Head of Household” filing status.

Action Required:

You must file an amended 2015 tax return(s) as either “Married Filing Jointly” or “Married Filing Separately.”

1.

Submit the following to our office:

2.

A signed copy of this form

AND

signed copy(ies) of Form 1040X - Amended U.S. Individual Income Tax Return

AND

2015 Tax Return Transcript(s).

Check “Your Eligibility Requirements” in Banner. Submit if status for “IRS tax

return or FAFSA IRS DRT data-student” is anything other than “Submitted to FAO” or ”Reviewed by FAO.”

If considered married, stop here, do not complete SECTIONS B or C.

A 2015 IRS Tax Return Transcript may be obtained through:

Online Request - Go to , under the Tools

Telephone Request - 1-800-908-9946

heading on the IRS homepage, click "Get a Tax Transcript."

Paper Request Form - IRS Form 4506T-EZ

Click “Get Transcript by MAIL.”

Make sure to request the “IRS Tax Return Transcript” and NOT the “IRS Tax Account Transcript.”

Page 1 of 2

1

1 2

2