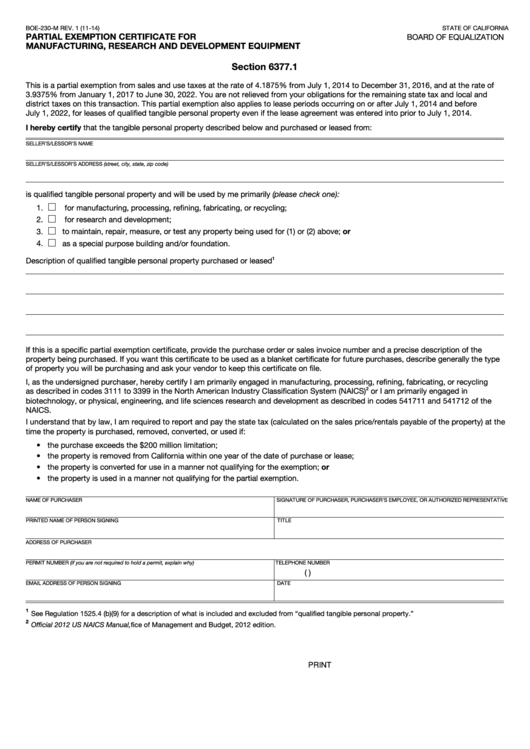

BOE-230-M REV. 1 (11-14)

STATE OF CALIFORNIA

PARTIAL EXEMPTION CERTIFICATE FOR

BOARD OF EQUALIZATION

MANUFACTURING, RESEARCH AND DEVELOPMENT EQUIPMENT

Section 6377.1

This is a partial exemption from sales and use taxes at the rate of 4.1875% from July 1, 2014 to December 31, 2016, and at the rate of

3.9375% from January 1, 2017 to June 30, 2022. You are not relieved from your obligations for the remaining state tax and local and

district taxes on this transaction. This partial exemption also applies to lease periods occurring on or after July 1, 2014 and before

July 1, 2022, for leases of qualified tangible personal property even if the lease agreement was entered into prior to July 1, 2014.

I hereby certify that the tangible personal property described below and purchased or leased from:

SELLER’S/LESSOR’S NAME

SELLER’S/LESSOR’S ADDRESS (street, city, state, zip code)

is qualified tangible personal property and will be used by me primarily (please check one):

1.

for manufacturing, processing, refining, fabricating, or recycling;

2.

for research and development;

3.

to maintain, repair, measure, or test any property being used for (1) or (2) above; or

4.

as a special purpose building and/or foundation.

Description of qualified tangible personal property purchased or leased

1

If this is a specific partial exemption certificate, provide the purchase order or sales invoice number and a precise description of the

property being purchased. If you want this certificate to be used as a blanket certificate for future purchases, describe generally the type

of property you will be purchasing and ask your vendor to keep this certificate on file.

I, as the undersigned purchaser, hereby certify I am primarily engaged in manufacturing, processing, refining, fabricating, or recycling

2

as described in codes 3111 to 3399 in the North American Industry Classification System (NAICS)

or I am primarily engaged in

biotechnology, or physical, engineering, and life sciences research and development as described in codes 541711 and 541712 of the

NAICS.

I understand that by law, I am required to report and pay the state tax (calculated on the sales price/rentals payable of the property) at the

time the property is purchased, removed, converted, or used if:

• the purchase exceeds the $200 million limitation;

• the property is removed from California within one year of the date of purchase or lease;

• the property is converted for use in a manner not qualifying for the exemption; or

• the property is used in a manner not qualifying for the partial exemption.

NAME OF PURCHASER

SIGNATURE OF PURCHASER, PURCHASER’S EMPLOYEE, OR AUTHORIZED REPRESENTATIVE

PRINTED NAME OF PERSON SIGNING

TITLE

ADDRESS OF PURCHASER

PERMIT NUMBER (if you are not required to hold a permit, explain why)

TELEPHONE NUMBER

(

)

EMAIL ADDRESS OF PERSON SIGNING

DATE

1

See Regulation 1525.4 (b)(9) for a description of what is included and excluded from “qualified tangible personal property.”

2

Official 2012 US NAICS Manual, U.S. Office of Management and Budget, 2012 edition.

CLEAR

PRINT

1

1