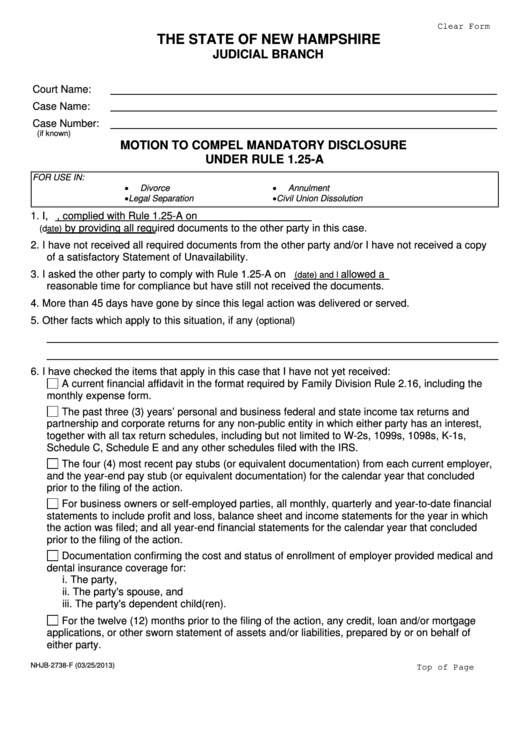

Clear Form

THE STATE OF NEW HAMPSHIRE

JUDICIAL BRANCH

Court Name:

Case Name:

Case Number:

(if known)

MOTION TO COMPEL MANDATORY DISCLOSURE

UNDER RULE 1.25-A

FOR USE IN:

Divorce

Annulment

Legal Separation

Civil Union Dissolution

1. I,

, complied with Rule 1.25-A on

by providing all required documents to the other party in this case.

(date)

2. I have not received all required documents from the other party and/or I have not received a copy

of a satisfactory Statement of Unavailability.

3. I asked the other party to comply with Rule 1.25-A on

allowed a

(date) and I

reasonable time for compliance but have still not received the documents.

4. More than 45 days have gone by since this legal action was delivered or served.

5. Other facts which apply to this situation, if any

(optional)

6. I have checked the items that apply in this case that I have not yet received:

A current financial affidavit in the format required by Family Division Rule 2.16, including the

monthly expense form.

The past three (3) years’ personal and business federal and state income tax returns and

partnership and corporate returns for any non-public entity in which either party has an interest,

together with all tax return schedules, including but not limited to W-2s, 1099s, 1098s, K-1s,

Schedule C, Schedule E and any other schedules filed with the IRS.

The four (4) most recent pay stubs (or equivalent documentation) from each current employer,

and the year-end pay stub (or equivalent documentation) for the calendar year that concluded

prior to the filing of the action.

For business owners or self-employed parties, all monthly, quarterly and year-to-date financial

statements to include profit and loss, balance sheet and income statements for the year in which

the action was filed; and all year-end financial statements for the calendar year that concluded

prior to the filing of the action.

Documentation confirming the cost and status of enrollment of employer provided medical and

dental insurance coverage for:

i. The party,

ii. The party's spouse, and

iii. The party's dependent child(ren).

For the twelve (12) months prior to the filing of the action, any credit, loan and/or mortgage

applications, or other sworn statement of assets and/or liabilities, prepared by or on behalf of

either party.

NHJB-2738-F (03/25/2013)

Top of Page

1

1 2

2