Healthcare Fsa Claim Form - Altogether Great - 2017

ADVERTISEMENT

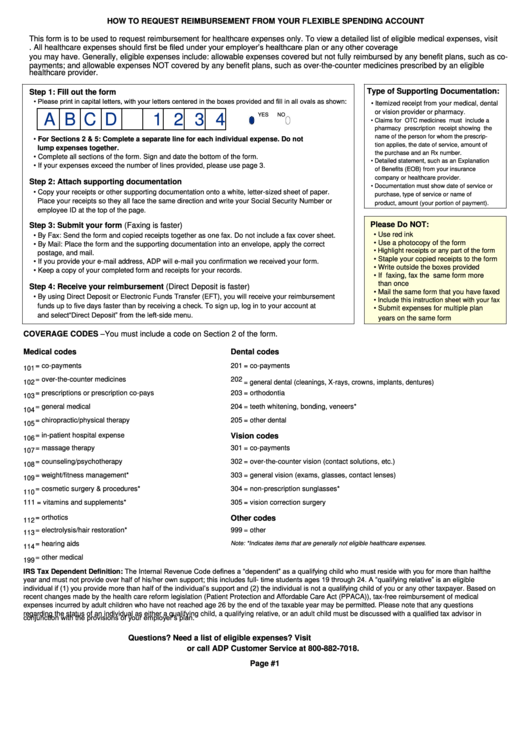

HOW TO REQUEST REIMBURSEMENT FROM YOUR FLEXIBLE SPENDING ACCOUNT

This form is to be used to request reimbursement for healthcare expenses only. To view a detailed list of eligible medical expenses, visit

. All healthcare expenses should first be filed under your employer’s healthcare plan or any other coverage

you may have. Generally, eligible expenses include: allowable expenses covered but not fully reimbursed by any benefit plans, such as co-

payments; and allowable expenses NOT covered by any benefit plans, such as over-the-counter medicines prescribed by an eligible

healthcare provider.

Step 1: Fill out the form

Type of Supporting Documentation:

• Please print in capital letters, with your letters centered in the boxes provided and fill in all ovals as shown:

• Itemized receipt from your medical, dental

or vision provider or pharmacy.

A B C D

1 2 3 4

• Claims for OTC medicines must include a

YES

NO

pharmacy prescription receipt showing the

name of the person for whom the prescrip-

• For Sections 2 & 5: Complete a separate line for each individual expense. Do not

tion applies, the date of service, amount of

lump expenses together.

the purchase and an Rx number.

• Complete all sections of the form. Sign and date the bottom of the form.

• Detailed statement, such as an Explanation

• If your expenses exceed the number of lines provided, please use page 3.

of Benefits (EOB) from your insurance

company or healthcare provider.

Step 2: Attach supporting documentation

• Documentation must show date of service or

• Copy your receipts or other supporting documentation onto a white, letter-sized sheet of paper.

purchase, type of service or name of

Place your receipts so they all face the same direction and write your Social Security Number or

product, amount (your portion of payment).

employee ID at the top of the page.

Please Do NOT:

Step 3: Submit your form (Faxing is faster)

• Use red ink

• By Fax: Send the form and copied receipts together as one fax. Do not include a fax cover sheet.

• Use a photocopy of the form

• By Mail: Place the form and the supporting documentation into an envelope, apply the correct

• Highlight receipts or any part of the form

postage, and mail.

• Staple your copied receipts to the form

• If you provide your e-mail address, ADP will e-mail you confirmation we received your form.

• Write outside the boxes provided

• Keep a copy of your completed form and receipts for your records.

• If faxing, fax the same form more

than once

Step 4: Receive your reimbursement (Direct Deposit is faster)

• Mail the same form that you have faxed

• By using Direct Deposit or Electronic Funds Transfer (EFT), you will receive your reimbursement

• Include this instruction sheet with your fax

funds up to five days faster than by receiving a check. To sign up, log in to your account at

• Submit expenses for multiple plan

and select “Direct Deposit” from the left-side menu.

years on the same form

COVERAGE CODES – You must include a code on Section 2 of the form.

Medical codes

Dental codes

101 = co-payments

201 = co-payments

102 = over-the-counter medicines

202 = general dental (cleanings, X-rays, crowns, implants, dentures)

103 = prescriptions or prescription co-pays

203 = orthodontia

104 = general medical

204 = teeth whitening, bonding, veneers*

105 = chiropractic/physical therapy

205 = other dental

Vision codes

106 = in-patient hospital expense

107 = massage therapy

301 = co-payments

108 = counseling/psychotherapy

302 = over-the-counter vision (contact solutions, etc.)

109 = weight/fitness management*

303 = general vision (exams, glasses, contact lenses)

110 = cosmetic surgery & procedures*

304 = non-prescription sunglasses*

111 = vitamins and supplements*

305 = vision correction surgery

Other codes

112 = orthotics

113 = electrolysis/hair restoration*

999 = other

114 = hearing aids

Note: *Indicates items that are generally not eligible healthcare expenses.

199 = other medical

IRS Tax Dependent Definition: The Internal Revenue Code defines a “dependent” as a qualifying child who must reside with you for more than half the

year and must not provide over half of his/her own support; this includes full- time students ages 19 through 24. A “qualifying relative” is an eligible

individual if (1) you provide more than half of the individual’s support and (2) the individual is not a qualifying child of you or any other taxpayer. Based on

recent changes made by the health care reform legislation (Patient Protection and Affordable Care Act (PPACA)), tax-free reimbursement of medical

expenses incurred by adult children who have not reached age 26 by the end of the taxable year may be permitted. Please note that any questions

regarding the status of an individual as either a qualifying child, a qualifying relative, or an adult child must be discussed with a qualified tax advisor in

conjunction with the provisions of your employer’s plan.

Questions? Need a list of eligible expenses? Visit

or call ADP Customer Service at 800-882-7018.

Page #1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3