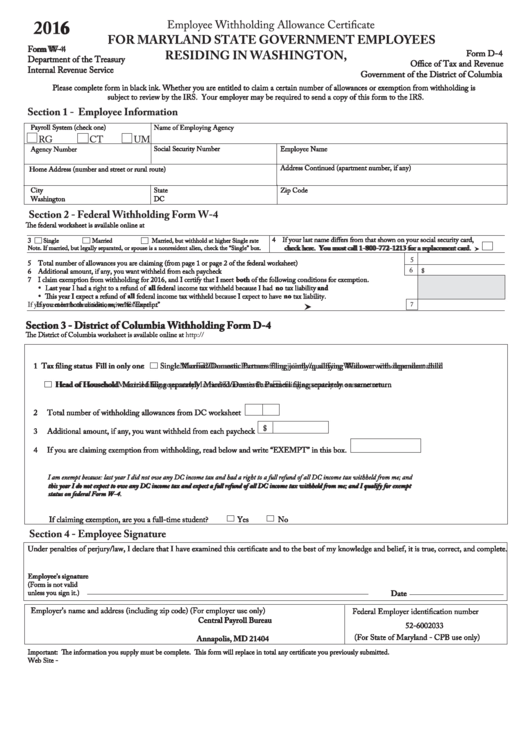

Employee Withholding Allowance Certificate

2016 6

FOR MARYLAND STATE GOVERNMENT EMPLOYEES

Form W-4

Form W-4

Form D-4

Form D-4

RESIDING IN WASHINGTON, D.C.

Department of the Treasury

Department of the Treasury

Office of Tax and Revenue

Office of Tax and Revenue

Internal Revenue Service

Internal Revenue Service

Government of the District of Columbia

Government of the District of Columbia

Please complete form in black ink. Whether you are entitled to claim a certain number of allowances or exemption from withholding is

Please complete form in black ink. Whether you are entitled to claim a certain number of allowances or exemption from withholding is

subject to review by the IRS. Your employer may be required to send a copy of this form to the IRS.

subject to review by the IRS. Your employer may be required to send a copy of this form to the IRS.

Section 1 - Employee Information

Payroll System (check one)

Payroll System (check one)

Name of Employing Agency

Name of Employing Agency

RG

CT

UM

Social Security Number

Social Security Number

Employee Name

Employee Name

Agency Number

Agency Number

Address Continued (apartment number, if any)

Address Continued (apartment number, if any)

Home Address (number and street or rural route)

Home Address (number and street or rural route)

City

City

State

State

Zip Code

Zip Code

Washington

Washington

DC

DC

Section 2 - Federal Withholding Form W-4

The federal worksheet is available online at

The federal worksheet is available online at

4 If your last name differs from that shown on your social security card,

4 If your last name differs from that shown on your social security card,

3 3

Single

Single

Married

Married

Married, but withhold at higher Single rate

Married, but withhold at higher Single rate

check here. You must call 1-800-772-1213 for a replacement card.

check here. You must call 1-800-772-1213 for a replacement card.

Note. If married, but legally separated, or spouse is a nonresident alien, check the “Single” box.

Note. If married, but legally separated, or spouse is a nonresident alien, check the “Single” box.

5

5 Total number of allowances you are claiming (from page 1 or page 2 of the federal worksheet)

5 Total number of allowances you are claiming (from page 1 or page 2 of the federal worksheet)

6

$

6 Additional amount, if any, you want withheld from each paycheck ......................................................................................................

6 Additional amount, if any, you want withheld from each paycheck ......................................................................................................

7 I claim exemption from withholding for 2016, and I certify that I meet

7 I claim exemption from withholding for 2016, and I certify that I meet both

both of the following conditions for exemption.

of the following conditions for exemption.

• • Last year I had a right to a refund of

Last year I had a right to a refund of all all federal income tax withheld because I had

federal income tax withheld because I had no

no tax liability

tax liability and

and

• This year I expect a refund of

This year I expect a refund of all all federal income tax withheld because I expect to have

federal income tax withheld because I expect to have no

no tax liability.

tax liability.

If you meet both conditions, write “Exempt” here...........................................................................

If you meet both conditions, write “Exempt” here...........................................................................

7

Section 3 - District of Columbia Withholding Form D-4

Section 3 - District of Columbia Withholding Form D-4

The District of Columbia worksheet is available online at

The District of Columbia worksheet is available online at

1 1 Tax filing status Fill in only one

Tax filing status Fill in only one:

:

Single

Single

Married/Domestic Partners filing jointly/qualifying Widower with dependent child

Married/Domestic Partners filing jointly/qualifying Widower with dependent child

Head of Household

Head of Household

Married filing separately

Married filing separately

Married/Domestic Partners filing separately on same return

Married/Domestic Partners filing separately on same return

2

2

Total number of withholding allowances from DC worksheet

Total number of withholding allowances from DC worksheet

$

3

3

Additional amount, if any, you want withheld from each paycheck

Additional amount, if any, you want withheld from each paycheck

4

4

If you are claiming exemption from withholding, read below and write “EXEMPT” in this box.

If you are claiming exemption from withholding, read below and write “EXEMPT” in this box.

I am exempt because: last year I did not owe any DC income tax and had a right to a full refund of all DC income tax withheld from me; and

I am exempt because: last year I did not owe any DC income tax and had a right to a full refund of all DC income tax withheld from me; and

this year I do not expect to owe any DC income tax and expect a full refund of all DC income tax withheld from me; and I qualify for exempt

this year I do not expect to owe any DC income tax and expect a full refund of all DC income tax withheld from me; and I qualify for exempt

status on federal Form W-4.

status on federal Form W-4.

If claiming exemption, are you a full-time student?

If claiming exemption, are you a full-time student?

Yes

Yes

No

No

Section 4 - Employee Signature

Under penalties of perjury/law, I declare that I have examined this certificate and to the best of my knowledge and belief, it is true, correct, and complete.

Under penalties of perjury/law, I declare that I have examined this certificate and to the best of my knowledge and belief, it is true, correct, and complete.

Employee’s signature

Employee’s signature

(Form is not valid

(Form is not valid

Date

Date

unless you sign it.)

unless you sign it.)

Employer’s name and address (including zip code) (For employer use only)

Employer’s name and address (including zip code) (For employer use only)

Federal Employer identification number

Federal Employer identification number

Central Payroll Bureau

Central Payroll Bureau

52-6002033

52-6002033

P.O. Box 2396

P.O. Box 2396

Annapolis, MD 21404

Annapolis, MD 21404

(For State of Maryland - CPB use only)

(For State of Maryland - CPB use only)

Important: The information you supply must be complete. This form will replace in total any certificate you previously submitted.

Important: The information you supply must be complete. This form will replace in total any certificate you previously submitted.

Web Site -

Web Site -

1

1