Extension Of Time To File Income Tax Return

ADVERTISEMENT

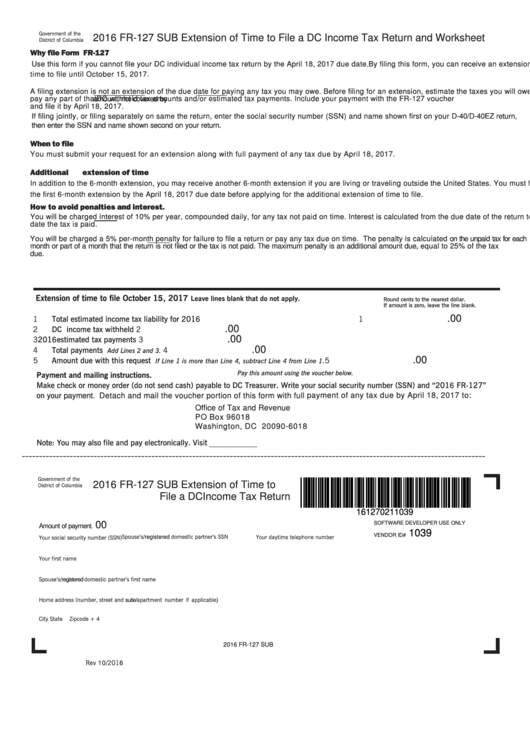

Government of the

2016 FR-127 SUB Extension of Time to File a DC Income Tax Return and Worksheet

District of Columbia

Why file Form FR-127

Use this form if you cannot file your DC individual income tax return by the April 18, 2017 due date. By filing this form, you can receive an extension of

time to file until October 15, 2017.

A filing extension is not an extension of the due date for paying any tax you may owe. Before filing for an extension, estimate the taxes you will owe and

pay any part of that

amount, not covered by

DC withheld tax amounts and/or estimated tax payments. Include your payment with the FR-127 voucher

and file it by April

18, 2017.

If filing jointly, or filing separately on same the return, enter the social security number (SSN) and name shown first on your D-40/D-40EZ return,

then enter the SSN and name shown second on your return.

When to file

You must submit your request for an extension along with full payment of any tax due by April 18, 2017.

Additional extension of time

In addition to the 6-month extension, you may receive another 6-month extension if you are living or traveling outside the United States. You must file for

the first 6-month extension by the April 18, 2017 due date before applying for the additional extension of time to file.

How to avoid penalties and interest.

You will be charged interest of 10% per year, compounded daily, for any tax not paid on time. Interest is calculated from the due date of the return to the

date the tax is paid.

You will be charged a 5% per-month penalty for failure to file a return or pay any tax due on time. The penalty is calculated on the unpaid tax for each

month or part of a month that the return is not filed or the tax is not paid. The maximum penalty is an additional amount due, equal to 25% of the tax

due.

Extension of time to file October 15, 2017

Leave lines blank that do not apply.

Round cents to the nearest dollar.

If amount is zero, leave the line blank.

.00

1

Total estimated income tax liability for 2016

1

.00

2

DC income tax withheld

2

.00

3

2016 estimated tax payments

3

.00

4

Total payments

4

Add Lines 2 and 3.

.00

5

Amount due with this request

5

If Line 1 is more than Line 4, subtract Line 4 from Line 1.

Pay this amount using the voucher below.

Payment and mailing instructions.

Make check or money order (do not send cash) payable to DC Treasurer. Write your social security number (SSN) and “2016 FR-127”

on your payment. Detach and mail the voucher portion of this form with full payment of any tax due by April 18, 2017 to:

Office of Tax and Revenue

PO Box 96018

Washington, DC 20090-6018

Note: You may also file and pay electronically. Visit MyTax.DC.gov.

----------------------------------------------------------------------------------------------------------------------------------------

Government of the

2016 FR-127 SUB Extension of Time to

District of Columbia

File a DC Income Tax Return

161270211039

SOFTWARE DEVELOPER USE ONLY

00

Amount of payment

.

1039

VENDOR ID#

Spouse’s/registered domestic partner’s SSN

Your daytime telephone number

Your social security number (SSN)

Your first name

M.I.

Last name

Spouse’s/registered domestic partner’s first name

M.I.

Last name

Home address (number, street and suite/apartment number if applicable)

City

State

Zipcode + 4

2016 FR-127 SUB

Rev 10/2016

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1