11410 SW 68th Parkway, Tigard OR 97223

Mailing Address – PO Box 23700, Tigard OR 97281-3700

Toll free – 888-320-7377 fax – 503-598-0561

Website –

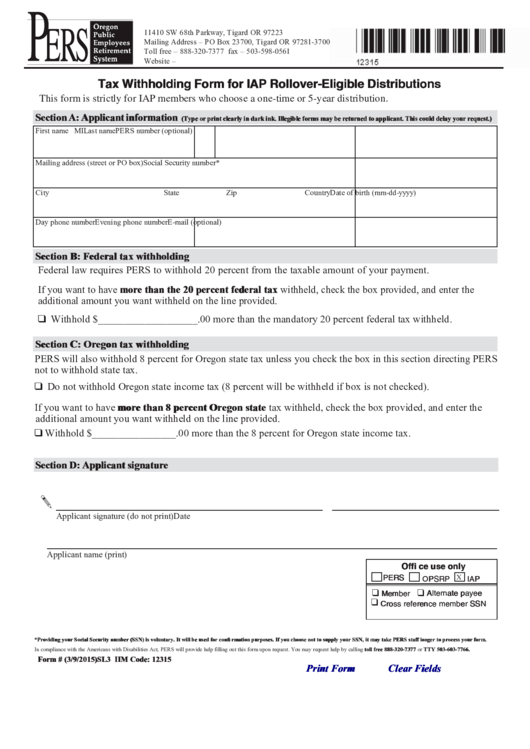

Tax Withholding Form for IAP Rollover-Eligible Distributions

This form is strictly for IAP members who choose a one-time or 5-year distribution.

Section A: Applicant information

(Type or print clearly in dark ink. Illegible forms may be returned to applicant. This could delay your request.)

First name

MI Last name

PERS number (optional)

Mailing address (street or PO box)

Social Security number*

City

State

Zip

Country

Date of birth (mm-dd-yyyy)

Day phone number

Evening phone number

E-mail (optional)

Section B: Federal tax withholding

Federal law requires PERS to withhold 20 percent from the taxable amount of your payment.

If you want to have more than the 20 percent federal tax withheld, check the box provided, and enter the

additional amount you want withheld on the line provided.

❑ Withhold $___________________.00 more than the mandatory 20 percent federal tax withheld.

Section C: Oregon tax withholding

PERS will also withhold 8 percent for Oregon state tax unless you check the box in this section directing PERS

not to withhold state tax.

❑ Do not withhold Oregon state income tax (8 percent will be withheld if box is not checked).

If you want to have more than 8 percent Oregon state tax withheld, check the box provided, and enter the

additional amount you want withheld on the line provided.

❑ Withhold $________________.00 more than the 8 percent for Oregon state income tax.

Section D: Applicant signature

Applicant signature (do not print)

Date

Applicant name (print)

Offi ce use only

X

PERS

OPSRP

IAP

❑

❑

Member

Alternate payee

❑

Cross reference member SSN

*Providing your Social Security number (SSN) is voluntary. It will be used for confi rmation purposes. If you choose not to supply your SSN, it may take PERS staff longer to process your form.

In compliance with the Americans with Disabilities Act, PERS will provide help filling out this form upon request. You may request help by calling toll free 888-320-7377 or TTY 503-603-7766.

Form #459-549w.pdf (3/9/2015) SL3 IIM Code: 12315

Print Form

Clear Fields

1

1