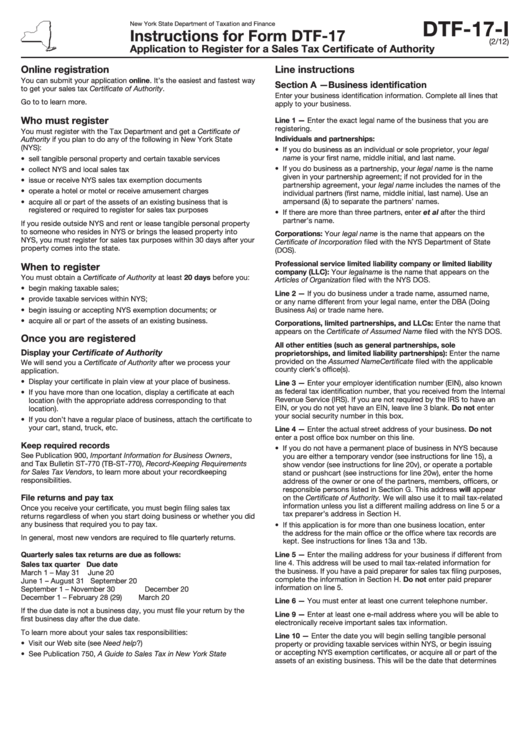

Instructions For Form Dtf-17-I Application To Register For A Sales Tax Certificate Of Authority

ADVERTISEMENT

DTF-17-I

New York State Department of Taxation and Finance

Instructions for Form DTF-17

(2/12)

Application to Register for a Sales Tax Certificate of Authority

Online registration

Line instructions

You can submit your application online. It’s the easiest and fastest way

Section A —Business identification

to get your sales tax Certificate of Authority.

Enter your business identification information. Complete all lines that

Go to to learn more.

apply to your business.

Who must register

Line 1 — Enter the exact legal name of the business that you are

registering.

You must register with the Tax Department and get a Certificate of

Individuals and partnerships:

Authority if you plan to do any of the following in New York State

(NYS):

• If you do business as an individual or sole proprietor, your legal

name is your first name, middle initial, and last name.

• sell tangible personal property and certain taxable services

• If you do business as a partnership, your legal name is the name

• collect NYS and local sales tax

given in your partnership agreement; if not provided for in the

• issue or receive NYS sales tax exemption documents

partnership agreement, your legal name includes the names of the

• operate a hotel or motel or receive amusement charges

individual partners (first name, middle initial, last name). Use an

ampersand (&) to separate the partners’ names.

• acquire all or part of the assets of an existing business that is

registered or required to register for sales tax purposes

• If there are more than three partners, enter et al after the third

partner’s name.

If you reside outside NYS and rent or lease tangible personal property

to someone who resides in NYS or brings the leased property into

Corporations: Your legal name is the name that appears on the

NYS, you must register for sales tax purposes within 30 days after your

Certificate of Incorporation filed with the NYS Department of State

property comes into the state.

(DOS).

Professional service limited liability company or limited liability

When to register

company (LLC): Your legal name is the name that appears on the

You must obtain a Certificate of Authority at least 20 days before you:

Articles of Organization filed with the NYS DOS.

• begin making taxable sales;

Line 2 — If you do business under a trade name, assumed name,

• provide taxable services within NYS;

or any name different from your legal name, enter the DBA (Doing

• begin issuing or accepting NYS exemption documents; or

Business As) or trade name here.

• acquire all or part of the assets of an existing business.

Corporations, limited partnerships, and LLCs: Enter the name that

appears on the Certificate of Assumed Name filed with the NYS DOS.

Once you are registered

All other entities (such as general partnerships, sole

Display your Certificate of Authority

proprietorships, and limited liability partnerships): Enter the name

provided on the Assumed Name Certificate filed with the applicable

We will send you a Certificate of Authority after we process your

county clerk’s office(s).

application.

• Display your certificate in plain view at your place of business.

Line 3 — Enter your employer identification number (EIN), also known

as federal tax identification number, that you received from the Internal

• If you have more than one location, display a certificate at each

Revenue Service (IRS). If you are not required by the IRS to have an

location (with the appropriate address corresponding to that

EIN, or you do not yet have an EIN, leave line 3 blank. Do not enter

location).

your social security number in this box.

• If you don’t have a regular place of business, attach the certificate to

your cart, stand, truck, etc.

Line 4 — Enter the actual street address of your business. Do not

enter a post office box number on this line.

Keep required records

• If you do not have a permanent place of business in NYS because

See Publication 900, Important Information for Business Owners,

you are either a temporary vendor (see instructions for line 15), a

and Tax Bulletin ST-770 (TB-ST-770), Record-Keeping Requirements

show vendor (see instructions for line 20v), or operate a portable

for Sales Tax Vendors, to learn more about your recordkeeping

stand or pushcart (see instructions for line 20w), enter the home

responsibilities.

address of the owner or one of the partners, members, officers, or

responsible persons listed in Section G. This address will appear

File returns and pay tax

on the Certificate of Authority. We will also use it to mail tax-related

information unless you list a different mailing address on line 5 or a

Once you receive your certificate, you must begin filing sales tax

tax preparer’s address in Section H.

returns regardless of when you start doing business or whether you did

any business that required you to pay tax.

• If this application is for more than one business location, enter

the address for the main office or the office where tax records are

In general, most new vendors are required to file quarterly returns.

kept. See instructions for lines 13a and 13b.

Quarterly sales tax returns are due as follows:

Line 5 — Enter the mailing address for your business if different from

line 4. This address will be used to mail tax-related information for

Sales tax quarter

Due date

the business. If you have a paid preparer for sales tax filing purposes,

March 1 – May 31

June 20

complete the information in Section H. Do not enter paid preparer

June 1 – August 31

September 20

information on line 5.

September 1 – November 30

December 20

December 1 – February 28 (29)

March 20

Line 6 — You must enter at least one current telephone number.

If the due date is not a business day, you must file your return by the

Line 9 — Enter at least one e-mail address where you will be able to

first business day after the due date.

electronically receive important sales tax information.

To learn more about your sales tax responsibilities:

Line 10 — Enter the date you will begin selling tangible personal

• Visit our Web site (see Need help?)

property or providing taxable services within NYS, or begin issuing

or accepting NYS exemption certificates, or acquire all or part of the

• See Publication 750, A Guide to Sales Tax in New York State

assets of an existing business. This will be the date that determines

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3