Instructions For Form Dtf-17-I, New York

ADVERTISEMENT

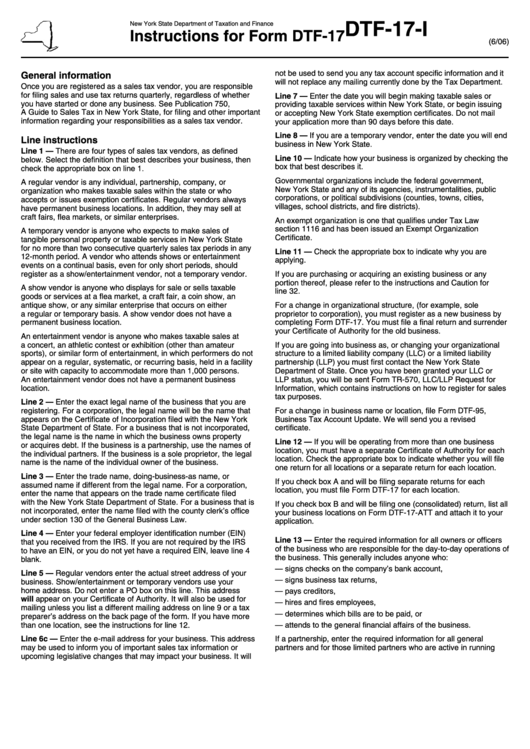

DTF-17-I

New York State Department of Taxation and Finance

Instructions for Form DTF-17

(6/06)

not be used to send you any tax account specific information and it

General information

will not replace any mailing currently done by the Tax Department.

Once you are registered as a sales tax vendor, you are responsible

for filing sales and use tax returns quarterly, regardless of whether

Line 7 — Enter the date you will begin making taxable sales or

you have started or done any business. See Publication 750,

providing taxable services within New York State, or begin issuing

A Guide to Sales Tax in New York State, for filing and other important

or accepting New York State exemption certificates. Do not mail

information regarding your responsibilities as a sales tax vendor.

your application more than 90 days before this date.

Line 8 — If you are a temporary vendor, enter the date you will end

Line instructions

business in New York State.

Line 1 — There are four types of sales tax vendors, as defined

Line 10 — Indicate how your business is organized by checking the

below. Select the definition that best describes your business, then

box that best describes it.

check the appropriate box on line 1.

Governmental organizations include the federal government,

A regular vendor is any individual, partnership, company, or

New York State and any of its agencies, instrumentalities, public

organization who makes taxable sales within the state or who

corporations, or political subdivisions (counties, towns, cities,

accepts or issues exemption certificates. Regular vendors always

villages, school districts, and fire districts).

have permanent business locations. In addition, they may sell at

craft fairs, flea markets, or similar enterprises.

An exempt organization is one that qualifies under Tax Law

section 1116 and has been issued an Exempt Organization

A temporary vendor is anyone who expects to make sales of

Certificate.

tangible personal property or taxable services in New York State

for no more than two consecutive quarterly sales tax periods in any

Line 11 — Check the appropriate box to indicate why you are

12-month period. A vendor who attends shows or entertainment

applying.

events on a continual basis, even for only short periods, should

register as a show/entertainment vendor, not a temporary vendor.

If you are purchasing or acquiring an existing business or any

portion thereof, please refer to the instructions and Caution for

A show vendor is anyone who displays for sale or sells taxable

line 32.

goods or services at a flea market, a craft fair, a coin show, an

antique show, or any similar enterprise that occurs on either

For a change in organizational structure, (for example, sole

a regular or temporary basis. A show vendor does not have a

proprietor to corporation), you must register as a new business by

permanent business location.

completing Form DTF-17. You must file a final return and surrender

your Certificate of Authority for the old business.

An entertainment vendor is anyone who makes taxable sales at

a concert, an athletic contest or exhibition (other than amateur

If you are going into business as, or changing your organizational

sports), or similar form of entertainment, in which performers do not

structure to a limited liability company (LLC) or a limited liability

appear on a regular, systematic, or recurring basis, held in a facility

partnership (LLP) you must first contact the New York State

or site with capacity to accommodate more than 1,000 persons.

Department of State. Once you have been granted your LLC or

An entertainment vendor does not have a permanent business

LLP status, you will be sent Form TR-570, LLC/LLP Request for

location.

Information, which contains instructions on how to register for sales

tax purposes.

Line 2 — Enter the exact legal name of the business that you are

registering. For a corporation, the legal name will be the name that

For a change in business name or location, file Form DTF-95,

appears on the Certificate of Incorporation filed with the New York

Business Tax Account Update. We will send you a revised

State Department of State. For a business that is not incorporated,

certificate.

the legal name is the name in which the business owns property

Line 12 — If you will be operating from more than one business

or acquires debt. If the business is a partnership, use the names of

location, you must have a separate Certificate of Authority for each

the individual partners. If the business is a sole proprietor, the legal

location. Check the appropriate box to indicate whether you will file

name is the name of the individual owner of the business.

one return for all locations or a separate return for each location.

Line 3 — Enter the trade name, doing-business-as name, or

If you check box A and will be filing separate returns for each

assumed name if different from the legal name. For a corporation,

location, you must file Form DTF-17 for each location.

enter the name that appears on the trade name certificate filed

with the New York State Department of State. For a business that is

If you check box B and will be filing one (consolidated) return, list all

not incorporated, enter the name filed with the county clerk’s office

your business locations on Form DTF-17-ATT and attach it to your

under section 130 of the General Business Law.

application.

Line 4 — Enter your federal employer identification number (EIN)

Line 13 — Enter the required information for all owners or officers

that you received from the IRS. If you are not required by the IRS

of the business who are responsible for the day-to-day operations of

to have an EIN, or you do not yet have a required EIN, leave line 4

the business. This generally includes anyone who:

blank.

— signs checks on the company’s bank account,

Line 5 — Regular vendors enter the actual street address of your

— signs business tax returns,

business. Show/entertainment or temporary vendors use your

home address. Do not enter a PO box on this line. This address

— pays creditors,

will appear on your Certificate of Authority. It will also be used for

— hires and fires employees,

mailing unless you list a different mailing address on line 9 or a tax

— determines which bills are to be paid, or

preparer’s address on the back page of the form. If you have more

than one location, see the instructions for line 12.

— attends to the general financial affairs of the business.

Line 6c — Enter the e-mail address for your business. This address

If a partnership, enter the required information for all general

may be used to inform you of important sales tax information or

partners and for those limited partners who are active in running

upcoming legislative changes that may impact your business. It will

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2