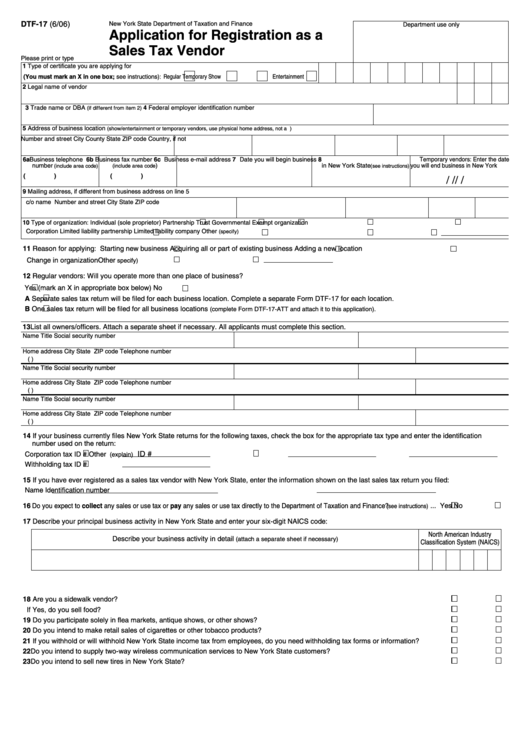

DTF-17 (6/06)

New York State Department of Taxation and Finance

Department use only

Application for Registration as a

Sales Tax Vendor

Please print or type

1 Type of certificate you are applying for

(You must mark an X in one box; see instructions): Regular

Temporary

Show

Entertainment

2 Legal name of vendor

3 Trade name or DBA

4 Federal employer identification number

(if different from item 2)

5 Address of business location

(show/entertainment or temporary vendors, use physical home address, not a P.O. box)

Number and street

City

County

State

ZIP code

Country, if not U.S.

6a Business telephone

6b Business fax number

6c Business e-mail address

7 Date you will begin business

8 Temporary vendors: Enter the date

number

)

in New York State

you will end business in New York

(include area code)

(include area code

(see instructions)

(

)

(

)

/

/

/

/

9 Mailing address, if different from business address on line 5

c/o name

Number and street

City

State

ZIP code

10 Type of organization:

Individual (sole proprietor)

Partnership

Trust

Governmental

Exempt organization

Corporation

Limited liability partnership

Limited liability company

Other

(specify)

11 Reason for applying: Starting new business

Acquiring all or part of existing business

Adding a new location

Change in organization

Other

specify)

12 Regular vendors: Will you operate more than one place of business?

Ye

(mark an X in appropriate box below)

No

s

A Separate sales tax return will be filed for each business location. Complete a separate Form DTF-17 for each location.

B One sales tax return will be filed for all business locations

(complete Form DTF-17-ATT and attach it to this application).

13 List all owners/officers. Attach a separate sheet if necessary. All applicants must complete this section.

Name

Title

Social security number

Home address

City

State

ZIP code

Telephone number

(

)

Name

Title

Social security number

Home address

City

State

ZIP code

Telephone number

(

)

Name

Title

Social security number

Home address

City

State

ZIP code

Telephone number

(

)

14 If your business currently files New York State returns for the following taxes, check the box for the appropriate tax type and enter the identification

number used on the return:

ID #

Corporation tax

ID #

Other

(explain)

Withholding tax

ID #

15 If you have ever registered as a sales tax vendor with New York State, enter the information shown on the last sales tax return you filed:

Name

Identification number

16 Do you expect to collect any sales or use tax or pay any sales or use tax directly to the Department of Taxation and Finance?

... Yes

No

(see instructions)

17 Describe your principal business activity in New York State and enter your six-digit NAICS code:

North American Industry

Describe your business activity in detail

(attach a separate sheet if necessary)

Classification System (NAICS)

18 Are you a sidewalk vendor? .................................................................................................................................................................... Yes

No

If Yes, do you sell food? ....................................................................................................................................................................... Yes

No

19 Do you participate solely in flea markets, antique shows, or other shows? ............................................................................................ Yes

No

20 Do you intend to make retail sales of cigarettes or other tobacco products? ......................................................................................... Yes

No

21 If you withhold or will withhold New York State income tax from employees, do you need withholding tax forms or information? ......... Yes

No

22 Do you intend to supply two-way wireless communication services to New York State customers? ...................................................... Yes

No

23 Do you intend to sell new tires in New York State? ................................................................................................................................. Yes

No

1

1 2

2