Form 72a007 - Affidavit Of Nonhighway Use

ADVERTISEMENT

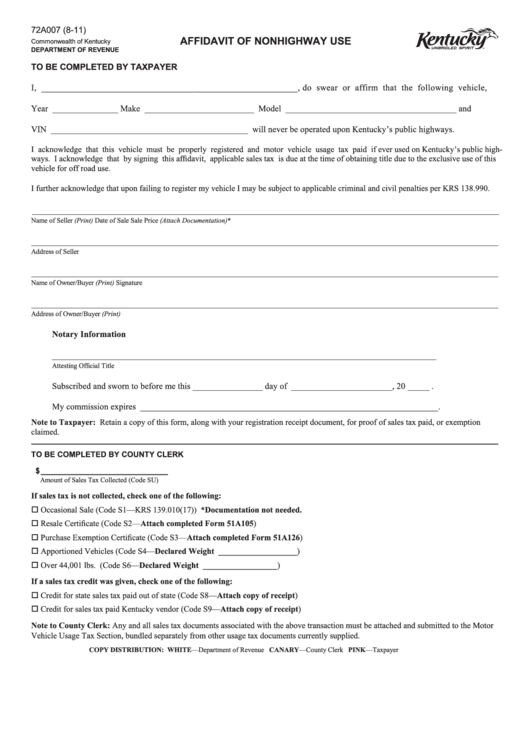

72A007 (8-11)

AFFIDAVIT OF NONHIGHWAY USE

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

TO BE COMPLETED BY TAXPAYER

I, ________________________________________________________, do swear or affirm that the following vehicle,

Year _______________ Make _________________________

Model _______________________________________ and

VIN _____________________________________________ will never be operated upon Kentucky’s public highways.

I acknowledge that this vehicle must be properly registered and motor vehicle usage tax paid if ever used on Kentucky’s public high-

ways. I acknowledge that by signing this affidavit, applicable sales tax is due at the time of obtaining title due to the exclusive use of this

vehicle for off road use.

I further acknowledge that upon failing to register my vehicle I may be subject to applicable criminal and civil penalties per KRS 138.990.

Name of Seller (Print)

Date of Sale

Sale Price (Attach Documentation)*

Address of Seller

Name of Owner/Buyer (Print)

Signature

Address of Owner/Buyer (Print)

Notary Information

Attesting Official

Title

Subscribed and sworn to before me this ________________ day of _______________________ , 20 _____ .

My commission expires ____________________________________________________________________.

Note to Taxpayer: Retain a copy of this form, along with your registration receipt document, for proof of sales tax paid, or exemption

claimed.

TO BE COMPLETED BY COUNTY CLERK

$ _____________________________

Amount of Sales Tax Collected (Code SU)

If sales tax is not collected, check one of the following:

Occasional Sale (Code S1—KRS 139.010(17)) *Documentation not needed.

Resale Certificate (Code S2—Attach completed Form 51A105)

Purchase Exemption Certificate (Code S3—Attach completed Form 51A126)

Apportioned Vehicles (Code S4—Declared Weight ___________________)

Over 44,001 lbs. (Code S6—Declared Weight __________________ )

If a sales tax credit was given, check one of the following:

Credit for state sales tax paid out of state (Code S8—Attach copy of receipt)

Credit for sales tax paid Kentucky vendor (Code S9—Attach copy of receipt)

Note to County Clerk: Any and all sales tax documents associated with the above transaction must be attached and submitted to the Motor

Vehicle Usage Tax Section, bundled separately from other usage tax documents currently supplied.

COPY DISTRIBUTION:

WHITE—Department of Revenue

CANARY—County Clerk

PINK—Taxpayer

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1