Resident Income Tax Return

ADVERTISEMENT

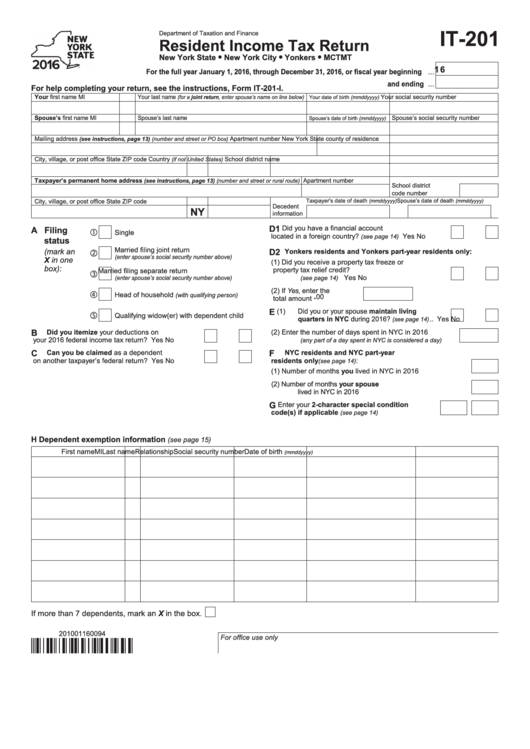

IT-201

Department of Taxation and Finance

Resident Income Tax Return

•

•

•

New York State

New York City

Yonkers

MCTMT

1 6

For the full year January 1, 2016, through December 31, 2016, or fiscal year beginning ...

and ending ...

For help completing your return, see the instructions, Form IT-201-I.

Your first name

MI

Your last name

(for a joint return, enter spouse’s name on line below)

Your social security number

Your date of birth (mmddyyyy)

Spouse’s first name

MI

Spouse’s last name

Spouse’s social security number

Spouse’s date of birth (mmddyyyy)

Mailing address

Apartment number

New York State county of residence

(see instructions, page 13) (number and street or PO box)

City, village, or post office

State

ZIP code

Country

School district name

(if not United States)

Taxpayer’s permanent home address

Apartment number

(see instructions, page 13) (number and street or rural route)

School district

code number ...............

Taxpayer’s date of death

Spouse’s date of death

City, village, or post office

State

ZIP code

(mmddyyyy)

(mmddyyyy)

Decedent

NY

information

D1

Did you have a financial account

A Filing

Single

located in a foreign country?

.......... Yes

No

(see page 14)

status

Married filing joint return

(mark an

D2

Yonkers residents and Yonkers part-year residents only:

(enter spouse’s social security number above)

X in one

(1) Did you receive a property tax freeze or

box):

property tax relief credit?

Married filing separate return

................................................. Yes

No

(enter spouse’s social security number above)

(see page 14)

(2) If Yes, enter the

Head of household

.

(with qualifying person)

00

total amount ...........

E

(1) Did you or your spouse maintain living

Qualifying widow(er) with dependent child

quarters in NYC during 2016?

.. Yes

No

(see page 14)

B

Did you itemize your deductions on

(2) Enter the number of days spent in NYC in 2016

your 2016 federal income tax return? ............ Yes

No

.........

(any part of a day spent in NYC is considered a day)

C

F

Can you be claimed as a dependent

NYC residents and NYC part-year

on another taxpayer’s federal return? ........... Yes

No

residents only

:

(see page 14)

(1) Number of months you lived in NYC in 2016 ................

(2) Number of months your spouse

lived in NYC in 2016 ........................................................

G

Enter your 2-character special condition

code(s) if applicable

......................

(see page 14)

H Dependent exemption information

(see page 15)

First name

MI

Last name

Relationship

Social security number

Date of birth

(mmddyyyy)

If more than 7 dependents, mark an X in the box.

201001160094

For office use only

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4