HOW TO REQUEST REIMBURSEMENT FROM YOUR DEPENDENT CARE ACCOUNT

This form is to be used to request reimbursement for dependent care expenses only. To view a detailed list of eligible dependent care

expenses, visit . In general, and subject to the rules of your employer’s plan, the following

rules apply to dependent care expenses:

• The individual receiving care must be either a qualifying child or a qualifying relative. (See below for IRS definition of dependent.)

• The individual must be under the age of 13 unless he or she is physically or mentally unable to care for himself or herself.

• The expenses must be incurred so that you and your spouse, if married, can work or your spouse can attend school on a

full-time basis.

• Child care or elder care centers must comply with all applicable state and local laws in order for dependent care expenses to

be reimbursed.

• The annual amount of dependent day care claims cannot exceed your annual deposit amount up to (a) $5,000, (b) $2,500 if

married and filing separate returns, or (c) your or your spouse’s annual salary, if less than $5,000.

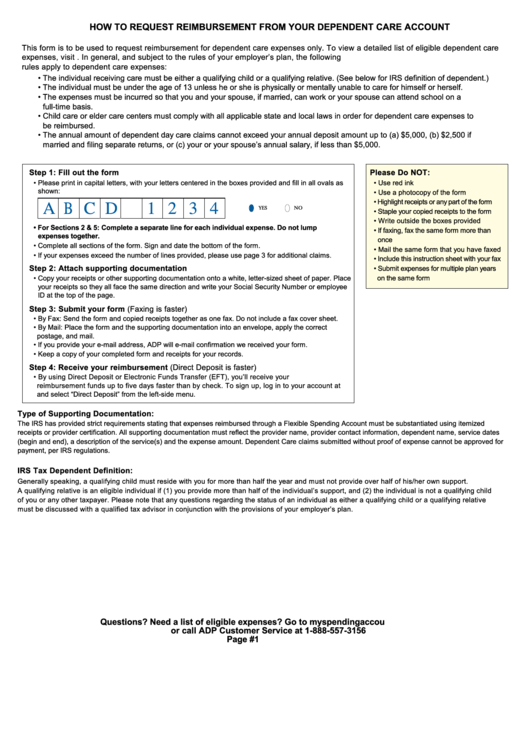

Step 1: Fill out the form

Please Do NOT:

• Please print in capital letters, with your letters centered in the boxes provided and fill in all ovals as

• Use red ink

shown:

• Use a photocopy of the form

• Highlight receipts or any part of the form

A B C D

1 2 3 4

YES

NO

• Staple your copied receipts to the form

• Write outside the boxes provided

• For Sections 2 & 5: Complete a separate line for each individual expense. Do not lump

• If faxing, fax the same form more than

expenses together.

once

• Complete all sections of the form. Sign and date the bottom of the form.

• Mail the same form that you have faxed

• If your expenses exceed the number of lines provided, please use page 3 for additional claims.

• Include this instruction sheet with your fax

Step 2: Attach supporting documentation

• Submit expenses for multiple plan years

• Copy your receipts or other supporting documentation onto a white, letter-sized sheet of paper. Place

on the same form

your receipts so they all face the same direction and write your Social Security Number or employee

ID at the top of the page.

Step 3: Submit your form (Faxing is faster)

• By Fax: Send the form and copied receipts together as one fax. Do not include a fax cover sheet.

• By Mail: Place the form and the supporting documentation into an envelope, apply the correct

postage, and mail.

• If you provide your e-mail address, ADP will e-mail confirmation we received your form.

• Keep a copy of your completed form and receipts for your records.

Step 4: Receive your reimbursement (Direct Deposit is faster)

• By using Direct Deposit or Electronic Funds Transfer (EFT), you’ll receive your

reimbursement funds up to five days faster than by check. To sign up, log in to your account at

and select “Direct Deposit” from the left-side menu.

Type of Supporting Documentation:

The IRS has provided strict requirements stating that expenses reimbursed through a Flexible Spending Account must be substantiated using itemized

receipts or provider certification. All supporting documentation must reflect the provider name, provider contact information, dependent name, service dates

(begin and end), a description of the service(s) and the expense amount. Dependent Care claims submitted without proof of expense cannot be approved for

payment, per IRS regulations.

IRS Tax Dependent Definition:

Generally speaking, a qualifying child must reside with you for more than half the year and must not provide over half of his/her own support.

A qualifying relative is an eligible individual if (1) you provide more than half of the individual’s support, and (2) the individual is not a qualifying child

of you or any other taxpayer. Please note that any questions regarding the status of an individual as either a qualifying child or a qualifying relative

must be discussed with a qualified tax advisor in conjunction with the provisions of your employer’s plan.

Questions? Need a list of eligible expenses? Go to

or call ADP Customer Service at 1-888-557-3156

Page #1

1

1 2

2 3

3