Wells Fargo Health Savings Account Payroll Deduction Form

ADVERTISEMENT

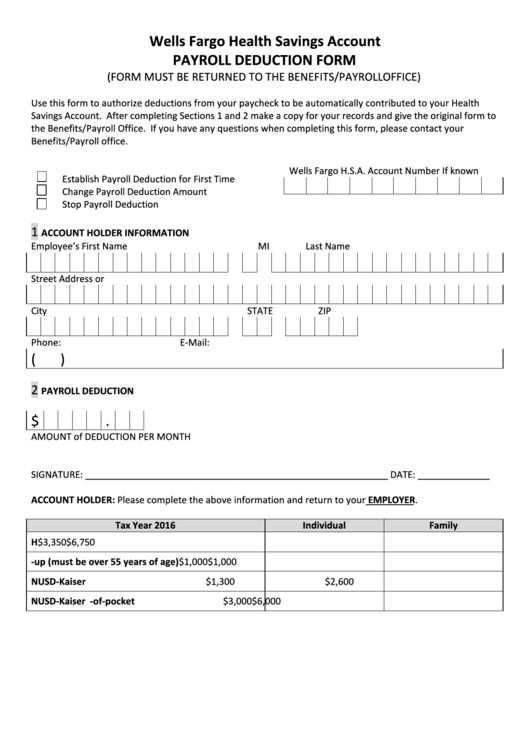

Wells Fargo Health Savings Account

PAYROLL DEDUCTION FORM

(FORM MUST BE RETURNED TO THE BENEFITS/PAYROLL OFFICE)

Use this form to authorize deductions from your paycheck to be automatically contributed to your Health

Savings Account. After completing Sections 1 and 2 make a copy for your records and give the original form to

the Benefits/Payroll Office. If you have any questions when completing this form, please contact your

Benefits/Payroll office.

Wells Fargo H.S.A. Account Number If known

Establish Payroll Deduction for First Time

Change Payroll Deduction Amount

Stop Payroll Deduction

1

ACCOUNT HOLDER INFORMATION

Employee’s First Name

MI

Last Name

Street Address or P.O.Box

City

STATE

ZIP

Phone:

E-Mail:

(

)

2

PAYROLL DEDUCTION

$

.

AMOUNT of DEDUCTION PER MONTH

SIGNATURE: ___________________________________________________________ DATE: ______________

ACCOUNT HOLDER: Please complete the above information and return to your EMPLOYER.

Tax Year 2016

Individual

Family

H.S.A. annual contribution limit

$3,350

$6,750

H.S.A. catch-up (must be over 55 years of age)

$1,000

$1,000

NUSD-Kaiser H.S.A. annual deductible

$1,300

$2,600

NUSD-Kaiser H.S.A. maximum out-of-pocket

$3,000

$6,000

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1