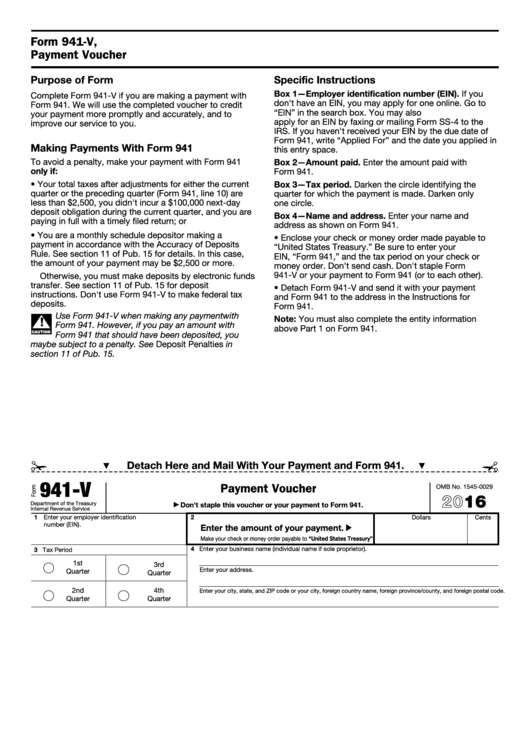

Form 941-V,

Payment Voucher

Purpose of Form

Specific Instructions

Box 1—Employer identification number (EIN). If you

Complete Form 941-V if you are making a payment with

don't have an EIN, you may apply for one online. Go to

Form 941. We will use the completed voucher to credit

IRS.gov and type “EIN” in the search box. You may also

your payment more promptly and accurately, and to

apply for an EIN by faxing or mailing Form SS-4 to the

improve our service to you.

IRS. If you haven't received your EIN by the due date of

Form 941, write “Applied For” and the date you applied in

Making Payments With Form 941

this entry space.

To avoid a penalty, make your payment with Form 941

Box 2—Amount paid. Enter the amount paid with

only if:

Form 941.

• Your total taxes after adjustments for either the current

Box 3—Tax period. Darken the circle identifying the

quarter or the preceding quarter (Form 941, line 10) are

quarter for which the payment is made. Darken only

less than $2,500, you didn't incur a $100,000 next-day

one circle.

deposit obligation during the current quarter, and you are

Box 4—Name and address. Enter your name and

paying in full with a timely filed return; or

address as shown on Form 941.

• You are a monthly schedule depositor making a

• Enclose your check or money order made payable to

payment in accordance with the Accuracy of Deposits

“United States Treasury.” Be sure to enter your

Rule. See section 11 of Pub. 15 for details. In this case,

EIN, “Form 941,” and the tax period on your check or

the amount of your payment may be $2,500 or more.

money order. Don't send cash. Don't staple Form

941-V or your payment to Form 941 (or to each other).

Otherwise, you must make deposits by electronic funds

transfer. See section 11 of Pub. 15 for deposit

• Detach Form 941-V and send it with your payment

instructions. Don't use Form 941-V to make federal tax

and Form 941 to the address in the Instructions for

deposits.

Form 941.

Use Form 941-V when making any payment with

▲

Note: You must also complete the entity information

!

Form 941. However, if you pay an amount with

above Part 1 on Form 941.

CAUTION

Form 941 that should have been deposited, you

may be subject to a penalty. See Deposit Penalties in

section 11 of Pub. 15.

✁

Detach Here and Mail With Your Payment and Form 941.

▼

▼

941-V

Payment Voucher

OMB No. 1545-0029

2016

Department of the Treasury

Don't staple this voucher or your payment to Form 941.

▶

Internal Revenue Service

1 Enter your employer identification

2

Dollars

Cents

number (EIN).

Enter the amount of your payment.

▶

Make your check or money order payable to “United States Treasury”

4 Enter your business name (individual name if sole proprietor).

3 Tax Period

1st

3rd

Enter your address.

Quarter

Quarter

2nd

4th

Enter your city, state, and ZIP code or your city, foreign country name, foreign province/county, and foreign postal code.

Quarter

Quarter

1

1