Clear Data

Help

Protected B

when completed

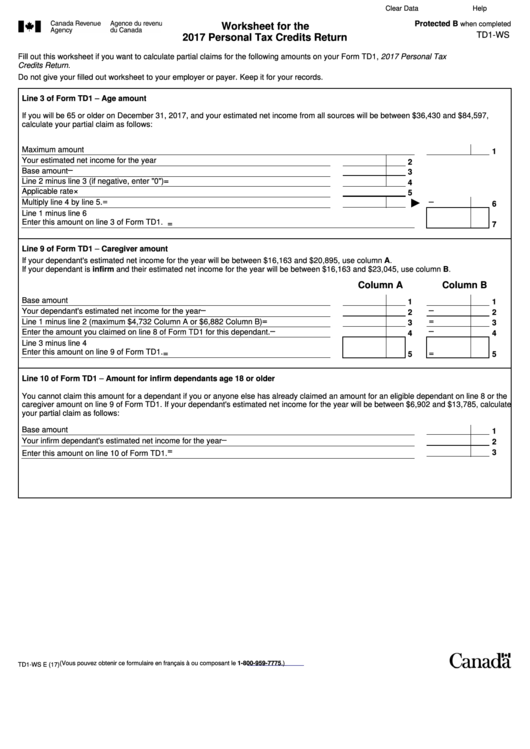

Worksheet for the

TD1-WS

2017 Personal Tax Credits Return

Fill out this worksheet if you want to calculate partial claims for the following amounts on your Form TD1, 2017 Personal Tax

Credits Return.

Do not give your filled out worksheet to your employer or payer. Keep it for your records.

Line 3 of Form TD1 – Age amount

If you will be 65 or older on December 31, 2017, and your estimated net income from all sources will be between $36,430 and $84,597,

calculate your partial claim as follows:

Maximum amount

1

Your estimated net income for the year

2

–

Base amount

3

=

Line 2 minus line 3 (if negative, enter "0")

4

×

Applicable rate

5

=

–

Multiply line 4 by line 5.

6

Line 1 minus line 6

Enter this amount on line 3 of Form TD1.

=

7

Line 9 of Form TD1 – Caregiver amount

If your dependant's estimated net income for the year will be between $16,163 and $20,895, use column A.

If your dependant is infirm and their estimated net income for the year will be between $16,163 and $23,045, use column B.

Column A

Column B

Base amount

1

1

–

–

Your dependant's estimated net income for the year

2

2

=

=

Line 1 minus line 2 (maximum $4,732 Column A or $6,882 Column B)

3

3

–

–

Enter the amount you claimed on line 8 of Form TD1 for this dependant.

4

4

Line 3 minus line 4

Enter this amount on line 9 of Form TD1.

=

=

5

5

Line 10 of Form TD1 – Amount for infirm dependants age 18 or older

You cannot claim this amount for a dependant if you or anyone else has already claimed an amount for an eligible dependant on line 8 or the

caregiver amount on line 9 of Form TD1. If your dependant's estimated net income for the year will be between $6,902 and $13,785, calculate

your partial claim as follows:

Base amount

1

–

Your infirm dependant's estimated net income for the year

2

=

3

Enter this amount on line 10 of Form TD1.

(Vous pouvez obtenir ce formulaire en français à

arc.gc.ca/formulaires

ou composant le 1-800-959-7775.)

TD1-WS E (17)

1

1