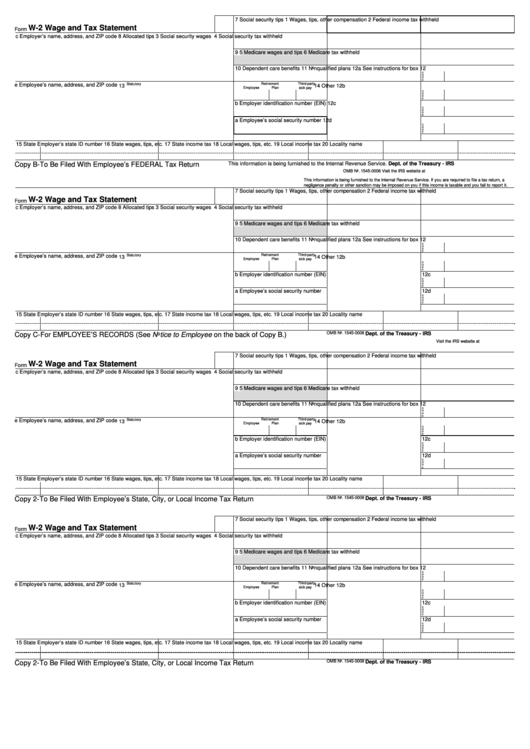

7 Social security tips

1 Wages, tips, other compensation

2 Federal income tax withheld

W-2 Wage and Tax Statement

Form

c Employer’s name, address, and ZIP code

8 Allocated tips

3 Social security wages

4 Social security tax withheld

9

5 Medicare wages and tips

6 Medicare tax withheld

10 Dependent care benefits

11 Nonqualified plans

12a See instructions for box 12

C

O

D

E

Statutory

Retirement

Third-party

e Employee’s name, address, and ZIP code

13

14 Other

12b

Employee

Plan

sick pay

C

O

D

E

b Employer identification number (EIN)

12c

C

O

D

E

a Employee’s social security number

12d

C

O

D

E

15 State

Employer’s state ID number

16 State wages, tips, etc.

17 State income tax

18 Local wages, tips, etc.

19 Local income tax

20 Locality name

Copy B-To Be Filed With Employee’s FEDERAL Tax Return

This information is being furnished to the Internal Revenue Service.

Dept. of the Treasury - IRS

OMB No. 1545-0008

Visit the IRS website at

This information is being furnished to the Internal Revenue Service. If you are required to file a tax return, a

negligence penalty or other sanction may be imposed on you if this income is taxable and you fail to report it.

7 Social security tips

1 Wages, tips, other compensation

2 Federal income tax withheld

W-2 Wage and Tax Statement

Form

c Employer’s name, address, and ZIP code

8 Allocated tips

3 Social security wages

4 Social security tax withheld

9

5 Medicare wages and tips

6 Medicare tax withheld

10 Dependent care benefits

11 Nonqualified plans

12a See instructions for box 12

C

O

D

E

Statutory

Retirement

Third-party

e Employee’s name, address, and ZIP code

13

14 Other

12b

Employee

Plan

sick pay

C

O

D

E

b Employer identification number (EIN)

12c

C

O

D

E

a Employee’s social security number

12d

C

O

D

E

15 State

Employer’s state ID number

16 State wages, tips, etc.

17 State income tax

18 Local wages, tips, etc.

19 Local income tax

20 Locality name

OMB No. 1545-0008

Dept. of the Treasury - IRS

Copy C-For EMPLOYEE’S RECORDS (See Notice to Employee on the back of Copy B.)

Visit the IRS website at

7 Social security tips

1 Wages, tips, other compensation

2 Federal income tax withheld

W-2 Wage and Tax Statement

Form

c Employer’s name, address, and ZIP code

8 Allocated tips

3 Social security wages

4 Social security tax withheld

9

5 Medicare wages and tips

6 Medicare tax withheld

10 Dependent care benefits

11 Nonqualified plans

12a See instructions for box 12

C

O

D

E

e Employee’s name, address, and ZIP code

Statutory

Retirement

Third-party

13

14 Other

12b

Employee

Plan

sick pay

C

O

D

E

b Employer identification number (EIN)

12c

C

O

D

E

a Employee’s social security number

12d

C

O

D

E

15 State

Employer’s state ID number

16 State wages, tips, etc.

17 State income tax

18 Local wages, tips, etc.

19 Local income tax

20 Locality name

OMB No. 1545-0008

Copy 2-To Be Filed With Employee’s State, City, or Local Income Tax Return

Dept. of the Treasury - IRS

7 Social security tips

1 Wages, tips, other compensation

2 Federal income tax withheld

W-2 Wage and Tax Statement

Form

c Employer’s name, address, and ZIP code

8 Allocated tips

3 Social security wages

4 Social security tax withheld

9

5 Medicare wages and tips

6 Medicare tax withheld

10 Dependent care benefits

11 Nonqualified plans

12a See instructions for box 12

C

O

D

E

Statutory

Retirement

Third-party

e Employee’s name, address, and ZIP code

13

14 Other

12b

Employee

Plan

sick pay

C

O

D

E

b Employer identification number (EIN)

12c

C

O

D

E

a Employee’s social security number

12d

C

O

D

E

15 State

Employer’s state ID number

16 State wages, tips, etc.

17 State income tax

18 Local wages, tips, etc.

19 Local income tax

20 Locality name

OMB No. 1545-0008

Dept. of the Treasury - IRS

Copy 2-To Be Filed With Employee’s State, City, or Local Income Tax Return

1

1 2

2